Jacie Tan

7th April 2022 - 2 min read

If you had booked a hotel or visited a tourist attraction in Malaysia during 2021, you could be eligible for an income tax relief of up to RM1,000 on the expenses. As you may recall, the special tourism tax relief that was announced under the Economic Stimulus Package 2020 – originally for March to August 2020 – had been extended up until December 2021 (and again until end of 2022).

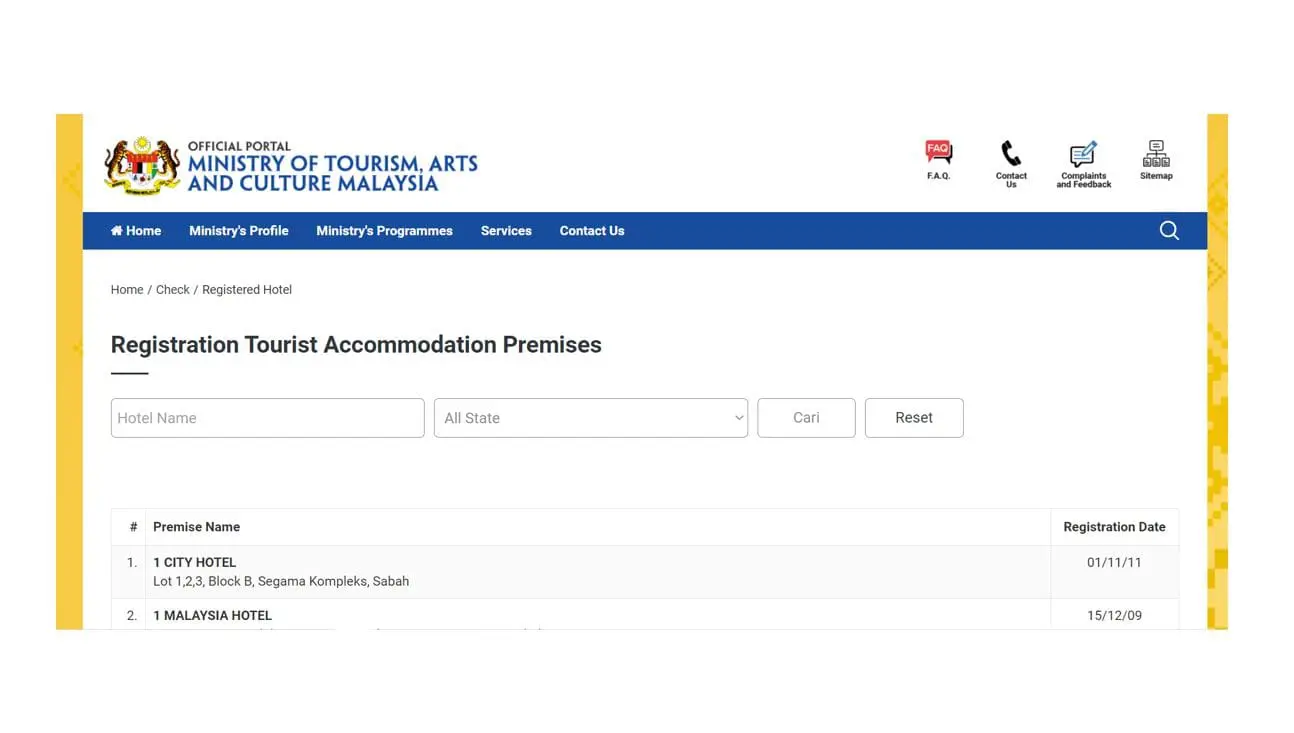

To qualify for the tax relief, your stay must be at one of the accommodation premises that is officially registered with the Commissioner of Tourism Malaysia. You can easily check this on the Ministry of Tourism, Arts and Culture Malaysia website, which has a searchable list of registered tourist accommodation premises. There are a total of 4,735 accommodation premises registered as of the time of writing.

This tax relief applies on payments made between 1 March 2020 and 31 December 2021 up to the amount expended, limited at RM1,000 for the assessment year. As is usual with tax relief claims, you will need to keep the relevant receipts and supporting documents for seven years, as it may be requested by LHDN as proof.

This tourism-related tax relief is one of several new tax measures introduced to help stimulate the economy as well as lighten the burden of Malaysians in the Covid-19 landscape.

Comments (17)

Can i claim this if i pay for the hotel but the invoice name is under other’s person name? I have bank transaction receipt as proof

How to check whether entrance fee to tourist attraction is eligible ?

can we claim if booking is made via klook app?

Yes as long as the hotel is registered under Tourist Accommodation Premises

If I paid for the accomodation in year 2021 but my staying period is 2022, am I eligible to claim it under YA2021?

No, it should follow the time you stayed and claim it for that assessment year.

does this rule of thumb applies to flight ticket too? bought this year but flying next year within Malaysia

Yup, it’s safest to interpret the relief as “time of stay” and not “time of purchase”

If the hotel registered commissioner of tourism Malaysia during year 2022, the accommodation is for the year 2021, can claim relied during year 2021??

Unlikely, since the requirement is that it must be registered with MOTAC at the time of your stay.

I think home stay/ air bnb is not eligible as they are not hotel

May I know I through Agoda is eligible?

in my opinion, if the platform is part of the tourism tax scope, we will be eligible to claim it under the relief:

FAQ – on tourism tax (search for agoda):

https://myttx.customs.gov.my/CTTAX/infopage/20%20Jan%20FAQ%20TTx_BI.pdf

Motac list : https://www.motac.gov.my/en/check/registered-hotel

Not all in Agoda is eligible so it still recommended to check thru the site given by Hasraf.

Thanks for the article. It’s so helpful.

Does stayed in AirBnB accommodation considered?

The premises where you stay has to be on the government list provided in the article above.