RinggitPlus

18th March 2024 - 8 min read

The freelance market in Malaysia has seen substantial growth over the past years, with many relying on technology and the boom of social media to help them earn income. Covid-19, too, has accelerated its growth as people sought out ways to cope with the salary cuts and retrenchment brought on by the pandemic.

In fact, the government has also shown its support for the gig economy by introducing incentives via various stimulus packages – such as the PENJANA economic recovery plan – and through collaborations with selected entities. It has even recently established the Gig Workers Commission to ensure that workers in this sector receive protection and enjoy the same benefits as formal workers as defined in the labour laws of Malaysia.

If you’ve been working as a freelancer over the past year – whether full-time or part-time – you may have some concerns about filing your taxes now that the tax season is here. For instance, do you need to file your taxes since you’re not “officially” employed by an employer? If yes, how different will the process be? What form should you use? Here’s a quick guide to help you through the process!

What is defined as a freelance work?

To begin, the World Bank defines self-employed individuals as someone whose income depends directly on the profits derived – which accurately describes freelancers and gig workers as well. This definition is also reflected in several government initiatives, where this group is accorded similar benefits as self-employed individuals (such as the Self-Employment Social Security Scheme). It includes gig economy workers, such as e-hailing drivers, delivery riders, and sellers on e-commerce platforms.

Do you need to file taxes as a freelancer?

Yes. All individuals are required to file their taxes if they already have a registered tax file, or if their annual income exceeds RM34,000 after deducting their EPF contributions. This is regardless of the source of their income. In other words, it does not matter whether you are employed by a company or freelancing; as long as you have reached the specified income threshold that can be taxed, then it is necessary for you to file your taxes.

Is the tax filing process different for an employed individual and a freelancer?

Overall, the tax filing process will not be tremendously different between an employed individual and freelancers. There are, however, certain extra steps that freelancers will need to take as they will be affected by the following:

EA Form

The EA form is document that is provided by employers to their employees, summarising details such as their annual earnings, as well as EPF and SOCSO contributions for the year. This document is immensely useful in the filing of your taxes as everything is already properly calculated on your behalf; all that remains is for you to key in the right number in the right place within the income tax form.

Meanwhile, freelancers will need to go through the extra step of tabulating their own profits by checking their invoices and expenses. This process can be pretty tedious, especially if you’ve been busy throughout the year, so it would be good idea for you to do your bookkeeping accurately as you conduct your business.

Monthly Tax Deduction (MTD)

Aside from that, the Monthly Tax Deduction (MTD, also known as PCB) programme also makes for a slightly different filing process between an employed individual and a freelancer. As an employee, you’ll notice that your employer will allocate a portion of your salary each month for this purpose.

Essentially, MTD payments are monthly deductions that serve as advanced tax payments. Introduced in 1995, it allows you to spread the financial heft of paying your annual tax across 12 months so that you do not need to struggle with a lump-sum tax payment at the end of the year. With the MTD in place, you will only need to pay a small amount (if your MTD amount is not enough to cover your actual tax amount), or may even receive a refund if you’ve overpaid for the year.

Freelancers, on the other hand, are not enrolled in the MTD programme. As such, they will need to pay the full sum at the end of every year, which can be quite a hefty amount, so be sure to allocate some money for this purpose throughout the year!

Which form should I use as a freelancer?

Depending on whether you’ve registered your freelance work as a business or not, you may be required to use different forms to file your taxes. If you’ve not registered your freelance work as a business, then you will still be using the BE form – which is intended for individuals who do not own a business. On the other hand, if you have registered your work as a business, then the right form to use is the B form instead.

How to fill in the form for part-time and full-time freelancers?

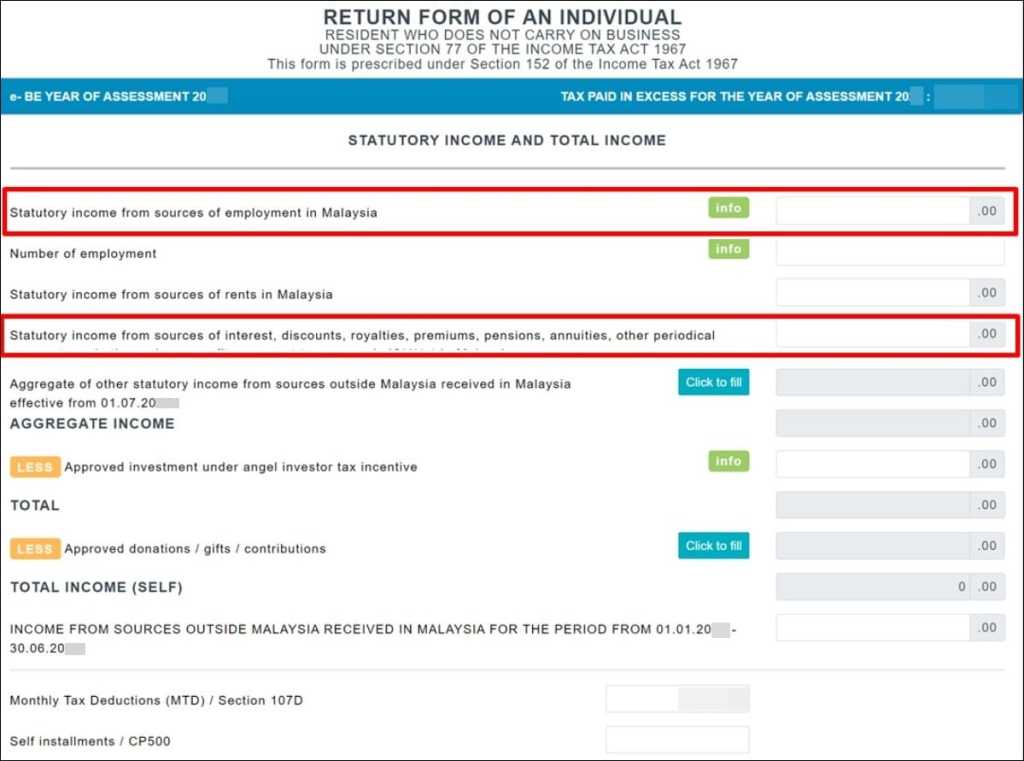

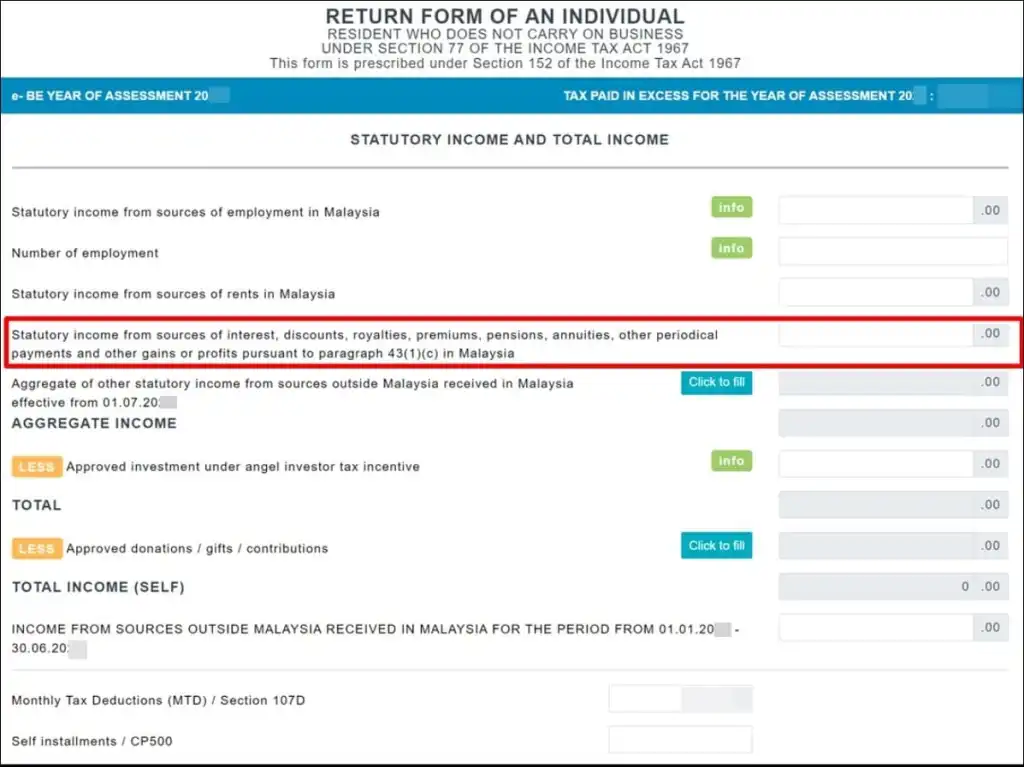

Assuming that you are using the BE form for your tax filing, part-time freelancers (defined as those who are still employed but are doing freelancing jobs on the side) and full-time freelancers will encounter a slight difference in the way you declare your income. For part-time freelancers, you will need to fill in the income that you earn from your day job under “Statutory income from employment”, and the income from your freelance work under “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits.”

Meanwhile, full-time freelancers will log all their earnings under “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits.”

Are there tax exemptions, deductions, or reliefs that you are entitled to as a freelancer?

Most of the earnings from your freelancing jobs will be taxable. However, there are some exemptions that you can tap into, including specific types of royalties:

- Exemption of up to RM10,000 for publication of artistic works, recording discs, or tapes

- Exemption of up to RM12,000 for the translation of books and literary works

- Exemption of up to RM20,000 for the publication of literary works, original paintings, or musical compositions

- 50% exemption of statutory income derived from research findings that have been commercialised

These are on top of other tax exemptions and tax incentives that you can tap into for your tax filing this year (YA2023).

Full-time freelancers can also consider tapping into the Self-Employment Social Security Scheme (SESSS) and the EPF Voluntary Contribution (i-Saraan) programme to reduce the amount of taxable income. Essentially, the SESSS and i-Saraan contributions are the equivalent of the Social Security Organisation (SOCSO) and Employees Provident Fund (EPF) contributions, but for self-employed individuals (including freelancers).

What about freelancing income from abroad?

Back in 2005 (YA 2004), the government had said that income earned from companies that are not based or registered in Malaysia is not subject to Malaysian income tax. Under Budget 2022, however, former Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz had proposed to begin taxing foreign-sourced income received in Malaysia. Following that, the government decided to continue exempting certain foreign-sourced income for certain categories of tax residents (under certain conditions) for another 5 years until December 2026; individuals who receive income from partnership businesses outside of Malaysia, for instance, are excluded from this exemption.

Essentially, all this means that if you’ve been taking jobs from foreign companies, these earnings can be exempted, provided that you have paid tax in the country of origin (where the company is located). Be sure to keep proof that your income is attributed directly to business operations that are conducted outside of Malaysia, such as invoices and receipts. If you are unable to do so, your income will be deemed as Malaysian-derived income.

Make sure to also always check the taxation guidelines on e-commerce that is provided by the Inland Revenue Board (LHDN) to ensure that you are up to date with the latest standards adopted.

Registering as a business for more tax incentives

It may be a good idea to register your freelance work as a business with Suruhanjaya Syarikat Malaysia (SSM) – even if you are only freelancing as a side gig. This is because it opens up a number of tax deductions allocated specifically for businesses. For instance, you may be able to claim certain expenses as business operating costs – which you cannot do as a non-business taxpayer. To illustrate, freelance videographers can list the purchase of their camera gears and editing software as business cost.

If you’re interested, you can register as a sole proprietor business under a personal or trade name for your freelance work, between a period of one five years. Depending on whether you opt for a personal name or a trade name, the fee will come up to RM30 or RM60 (new registrations).

***

With this, we hope that freelancers will have a better idea as to how to file their taxes for the year. In some situations, though, it might be a good idea for you to hire a professional tax consultant for assistance – such as when you’ve earned a substantial income that could make the filing process complicated. They can also share pointers on how to prepare your taxes for your future reference.

If you need further step-by-step guidance on how to fill in your income tax form, do also check out our income tax guide for 2024 (YA2023) here. Alternatively, you can refer to our income tax content for other tax-related information, such as the new MyTax portal and how to file your taxes for the first time.

Comments (58)

Hi,

I only work 30 days last year, consisting of part-time and casual jobs. My total annual income is RM2,709. How should I declare this income?

Hi there!

If your total annual income is RM2,709, you are below the taxable income threshold, so you won’t need to pay any tax.

However, if you already have a registered tax file with LHDN, it’s still a good idea to submit a tax return. You can declare the amount under “other income” in the BE form. This helps keep your tax records up to date and avoids issues in the future.

okay, thanks for information ☺️

Hello, since I’m currently working abroad, should I leave “Statutory income from employment” part empty since my income is from a foreign bank account? and only fill in “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits.”?

Thank you

Hi, thank you for your question. In general, whether income should be declared under “Statutory income from employment” depends on where the employment is exercised, not where the salary is paid or which bank account receives the funds. If you are physically working abroad and your employment duties are carried out outside Malaysia, the income is generally regarded as foreign-sourced employment income. For resident individuals, foreign-sourced income received in Malaysia is currently exempt from Malaysian income tax up to 31 December 2036, subject to conditions (for example, the income has been taxed in the country of origin). That said, exempt… Read more »

Hi there. I am a doctor who is both employed and working “freelance” (locum) in GP clinics. Do i use the BE form or B form when submitting my taxes?

Since you have both employment and freelance (locum) income, you should use Form BE.

Form B is for business income (sole proprietors or partnerships).

Form BE is for individuals with employment income and other sources of income (like freelance/consulting).

So in your case, report your salary + locum income in Form BE.

Good day to you and I hope that you see my comment:

If we JUST have freelance income only without full-time meployment?

Hi, yes — even if you only earn freelance income and have no full-time job, you are still required to file your taxes as long as your annual income exceeds RM34,000 after EPF deductions or you already have a tax file (still applicable in 2025).

If your freelance work is not registered with SSM, file using Form BE and declare your income under “other gains and profits.” Since freelancers don’t have MTD/PCB, any tax payable will be paid in a lump sum.

You can still claim personal tax reliefs, voluntary EPF (i-Saraan), and SESSS contributions.

Hope this helps.

Good day, I’m working with my parents as a farmer and receive my salary in cash and no payslip. When the time I filling tax, is Lhdn going to request my payslip as proof of income?

Thanks for sharing your question! 😊

If you earn cash and don’t have a payslip, LHDN may ask for other proof of income when you file your taxes. This can be bank statements, a simple letter from your employer (your parents in this case), or any record of your earnings.

It’s a good idea to keep clear records so you can show your income if needed.

Hello2 Ringgit Plus,

I’m a freelancer doing equipment rental and have my own rented office with no employee. Income is not every month though, usually its once in 2-3 months so I never bothered doing tax. I’ve been in business for 7 years and planning to start thinking about filing for tax.

How do I start? I called lhdn and they said do it yourself. not very convincing lol

Hi Riaz,

No worries! First, make sure you’re registered with LHDN. Then you can start filing your income tax, even if it’s irregular. You can use e-Filing or get an accountant to help for your first time. Use LHDN’s e-Filing portal.

Better to start now than leave it too long.

Hi, I’m based in Malaysia and working as a part-time lecturer with EPF/SOCSO. At the same time, I am also freelancing with a Singapore-based company on a monthly basis, with the salary credited directly to my Malaysian account. For the coming tax filing next year, how should I file the income tax? Do I also need to declare income tax in Singapore?

Hi! Since you’re a Malaysian tax resident, you should declare all your income, including freelance payments from Singapore, in your Malaysian tax filing. Usually, if you’re working from Malaysia, Singapore won’t tax it, but it’s best to double-check with their tax authority.

A person introduces a security project to a security company and he manages it by providing the guards and manages the site. He is not employed by the company. He earns an income (after the security company deducts its profit percentage) under CP58 declaration. Can the security company pay for his EPF and SOCO contributions even though he is not employed by the company ?

Hi Sam, great question!

Since the person is not officially employed by the company and earns income under CP58 (typically for agents or commission-based earners), the company is not obligated to contribute to EPF or SOCSO.

However, if both parties agree, the company can choose to contribute voluntarily to EPF under i-Saraan (for self-employed) or via a private agreement but this would be outside the usual employment framework.

Hope this info helps! Let me know if you need more details.

for Grab driver is to do e-filling by filling up form B?

but then it will prompt to message to fill in business name & Reg No…etc

which will shows error ..thus, I confuse with this part…wat need to fill in?

Kindly advice

Yes, as a Grab driver, you’ll need to do e-Filing using Form B.For the business name & registration number part:

If you don’t have a registered business (like SSM), just enter a name like “Grab Driver” or “Freelance Driver”.

For Registration Number, you can key in “N/A” or “-” , this usually works.

Make sure to declare your income under “Business income” section.

Hope that clears things up.

I’m working full time permanent as salary earner for a company. At the same time, i also have side income as freelancer and getting monthly accounting fees from few company with no EPF, Soco & EIS contribution(no file under CP8D). How should I file my tax filing? Should I use BE form or B Form?

p/s : FYI, i have file my income as an employment income in BE since i have the tax file.

Since you have both employment income and freelance income (which isn’t under CP8D), you’ll need to file using the B Form instead of the BE Form. The BE Form is just for salaried income with EPF/SOCSO, while the B Form covers any side income or freelance work too.

You can switch to the B Form in your e-Filing account before submitting. Hope that helps!

Hi, I’m a freelancer doing bookkeeping . I charge one of the office monthly, and one part time by hourly charge, and few more are yearly once. what is the number of employment i need to fill in?

Hey! Since you’re freelancing and not officially employed by any of them, you can just put zero for number of employments. Freelance clients don’t count as employers in this case.

Hope that clears it up!

Hi, I’m a contract worker in the Marketing field and have been paid monthly for a year for my services by the same company. This is my only source of income. There’s is no EPF and SOCSO provided by the company as this is a freelance contractual work. As a resident without business, do i submit my income as:

1. Income from sources of employment in Msia or

2. Income from sources (periodical payments, other gains or profits)

Appreciate any help out there as I’m not sure if i should submit under (2) for my freelance contractual employment. Thanks!

Since you’re a contract worker without EPF/SOCSO and not under a formal employment contract, your income is usually considered self-employment income. So you’d report it under:

Option 2: Income from sources – other gains or profits (specifically under “professional, vocational, or freelance services”).

Even if it’s your only income and you’re working with one company, it still counts as freelance unless there’s an employer-employee relationship with benefits like EPF.

Hope that clears it up!

Hai,

As a Cuckoo Agent, how to declare tax. Spending own money for buying free gifts to customers. Can we deduct from the earnings?

Yup, if you’re using your own money to buy gifts for customers, you can usually deduct that as a business expense. Just keep the receipts and best to double-check with LHDN or a tax agent to be safe!

if full time freelancer, then what to fill in for ‘Employer’s no. ‘ and also ‘Number of employment’ ??

If you’re a full-time freelancer, you can leave the ‘Employer’s No.’ field blank, as you don’t have an employer. For ‘Number of employment,’ you can put “1” to reflect your freelance work as your primary source of income.

Hello, I have a curiosity on how to submit the tax filling if i have permanent job but at the same time i have freelance job? How to fill in the form? Is it the same form or different form? Thanks

You can use the same form but declare your salary and freelance income separately. Freelance income goes under “Business Income.” Keep track of any related expenses, and consider consulting a tax pro for help.

I am a housewife. I took some part-time gig jobs last year. I have no formal job, and I have not filed taxes before. Do I need to file taxes on my current gig income? If necessary, should it be form b or form be?

Yup, if you earned some income from part-time gig jobs, you’ll need to file taxes, especially if it crosses LHDN’s chargeable income threshold.

Since it’s not from a formal job with EPF or SOCSO, you should use Form B, which is for self-employed or freelance income.

In other word, money earned in msia will subject to tax and money earn from outside msia not subject to tax? So gig workers like me doing grab same will file the tax and will be taxed if over then threshold. Correct me if i am wrong please? Tq

Yes, you’re mostly correct. Money earned in Malaysia is generally subject to tax, regardless of where it comes from. For gig workers like yourself doing Grab or similar services, you are required to file taxes if your income exceeds the threshold set by the Malaysian tax authorities. Money earned from outside of Malaysia may not be subject to tax in Malaysia, but this can depend on specific circumstances and whether it’s deemed to be from foreign sources. It’s always a good idea to double-check with the tax authorities or a tax professional to ensure you’re complying with the latest rules.

Hi i am an expat, I already pay MTD and filed BE form this year, but I am going to start freelance work I will get income paid from abroad by an Aussie client just 1-3k rm a month. So this amount which will fluctuate, will be reported as freelance income and is still exempted until 2026 Dec I see.

So nothing to worry till 2026? But how do i mention on be form i earned freelance from abroad do i need to??

Hi! Your freelance income from abroad is usually exempt until December 2026. You should still mention it on your BE form as foreign freelance income; under “Other Income” or “Non-Employment Income” and provide a brief description. Keep documentation for your records. For detailed guidance, check with a tax advisor.

I checked that the income is subject to the tax in the country of origin but I am not paying any tax in Australia, but the client is a tax payer.

If your income is subject to tax in the country of origin but you’re not paying tax in Australia, it might be a good idea to consult with a tax advisor just to make sure everything’s squared away. Since your client is a taxpayer, there could be some implications depending on the tax laws.

What if my client is just sending me money in form of remittance or using a website like freelancer or fiverr to pay me then the earnings from that i am not supposed to pay in malaysia right?

Thanks any affordable tax advisors you could advise me to check with?

Hi,

If i’m doing contract work for overseas company (paid into my Malaysian foreign currency account) – is this also freelancing income? and which form should i be using? Thanks.

Contract work payments from overseas count as freelance income. You typically report it on Form B for Malaysian tax purposes.

Without e-commerce business model, do i just fill in ‘Statutory Income From Sources Outside Malaysia received in Malaysia’?

if i haven’t been in Malaysia for more than 182 days, will i still be allowed deductions?

Thanks.

I’m working full time permanent as salary earner for a company. At the same time, i also have side income as freelancer and getting monthly allowance from my small business (partnership) registered with SSM. How should I file my tax filing? Should I use BE form or B Form?

Considering your employment and additional income sources, you may need to use both the BE and B forms for tax filing. I recommend seeking advice from a tax professional for more guidance.

i have a full time job and i work as part time property agent as well, my part time income will put under “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits.”

what is the number of employment i need to fill in? is it 1 or 2?

Thanks

You should fill in “1” for the number of employments, as your part-time work as a property agent doesn’t constitute separate employment but is considered additional income.

thank you very much. this is a very helpful article. Regards

My question:- A retiree ( with no job & income) has been helping his friend as a freelance casual worker and have been paid RM2150 only for year 2023 via cheques and online payment. Does the retiree need to declare this RM2150 as income in his efiling? Tq

Graphic Design &written

I’m rather new to tax filing and sole proprietorship,

wanted to ask if I worked my day job from Jan – Jun, then quit and started a sole proprietorship July – dec.

Would I need to fill in both BE(for day job) and B(for sole proprietorship)?

How would I fill in during the transition

Yes, you need to fill out both BE (for employment income) and B (for sole proprietorship income). During the transition, report your employment income under BE and sole proprietorship income under B. Contact LHDN for more information.

Hi, i will soon convert my position in the company to “sub-con” or “free-lancer” due to age and slowly stepping down before retirement at 60. I am 58 this year. The company propose no EPF to be given to me, but i still liable to file my tax every year since i started not to punch in 9-5 in office as daily worker. Pls adv are they going to issue me EA form every year, and pls adv the possible PCB rate which they will deduct from my so called monthly “sub-con” fee (in fact is monthly income). What is… Read more »

Your best option would be to clear this matter with your employer (especially regarding PCB and EA. You should also consider engaging a tax consultant who would be able to assist you and offer expert advice tailored to your situation.

If my income is categorized as freelancing income from abroad, do I still need to do e-filing by filling up form BE? If yes, which field should I input my income? I’m hoping to go through this process so that I can get a document to apply for credit card..

I think they already answer here. Note that under Budget 2022, the government had proposed to remove this tax exemption for foreign-sourced income, but the decision was subsequently reversed. With this, affected individuals can continue to enjoy the exemption from 1 January 2022 to 31 December 2026. This is with the exception of those who carry out partnership businesses in Malaysia; they will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022.

which mean freelancing income from abroad no need to filling Up form BE even convert to MYR is 200k?

Hi I’m interested to know what does it mean by freelancing income from abroad , does that mean that we get paid in a different currency like google ad sense or such?