Alex Cheong Pui Yin

17th May 2021 - 3 min read

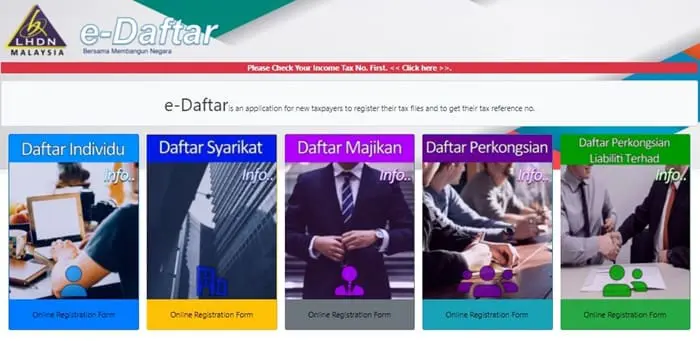

The Internal Revenue Board (LHDN) will be expanding the functions of e-Daftar so that more categories of taxpayers can register for their income tax numbers via the portal starting from 18 May 2021. On top of that, it will also be changing the existing income tax prefixes of individual taxpayers (SG and OG) to a new prefix (IG).

According to a statement by LHDN, new taxpayers in the following categories will be able to register and apply for their income tax numbers via e-Daftar starting from tomorrow:

- Cooperative Society (CS)

- Association (F)

- Trust Body (TA)

- Unit or Real Property Trust (TC)

- Business Trust (TN)

- Real Estate Investment Trust/Property Trust Fund (TR)

At present, registrations on the e-Daftar portal are only open to limited taxpayer categories, namely Individuals (SG and OG), Companies (C), Partnership (D), Employer (E), and Limited Liability Partnership (PT). LHDN said that this move to enable additional categories of taxpayers to register under e-Daftar is an effort by the board to improve its services for taxpayers. For context, e-Daftar is a portal that allows new taxpayers to register for their income tax files online instead of having to visit a physical LHDN branch.

Aside from that, LHDN also said that it will be implementing a new prefix for individual taxpayers, changing it from SG (individuals with non-business income source) and OG (individuals with business income source) to IG. “The process of setting the new prefix will involve two phases, namely phase one for new individual taxpayers registered through the LHDN system. Phase two will involve changing the prefix of existing individual taxpayers in stages from 18 May 2021,” said the board.

(Image: The Star)

LHDN further clarified that the changing of the prefixes will not alter taxpayers’ existing individual income tax number. Additionally, deadlines for the tax season will also remain the same; individuals who do not carry out business are still required to file their taxes by 30 April each year, whereas those who do must complete it by 30 June.

Finally, LHDN commented that the decision to change the prefixes for individual taxpayers is intended to better facilitate the management of taxpayers and to avoid confusion among individual taxpayers.

Taxpayers who have enquiries or feedback can contact LHDN through its HASiL Care Line at 03-8911 1000/603-8911 1100 (overseas). Alternatively, you can use the HASiL Live Chat or the feedback form on LHDN’s official portal.

(Sources: LHDN, The Edge Markets)

Comments (4)

My tax number code has been changed from SG to IG. What does that mean? No explanation was given by IRD.

My tax number code has been changed from SG to IG. What does that mean? No explanation was given by IRD.

same here

saya perlukan kesemua tax tax saya