Alex Cheong Pui Yin

23rd June 2023 - 3 min read

Several insurers have agreed to join the government’s Rahmah initiative and will begin offering affordable insurance and takaful packages to the people, with premiums starting from as low as RM3 per month. These include Etiqa General Insurance Bhd and Etiqa General Takaful Bhd, as well as Allianz General Insurance Bhd.

According to the Domestic Trade and Cost of Living (KPDN) Minister, Datuk Seri Salahuddin Ayub, Malaysians aged between 16 to 65 can apply for the Rahmah plans, which can be renewed until the age of 70. He also shared some details regarding the packages that will be made available to the public.

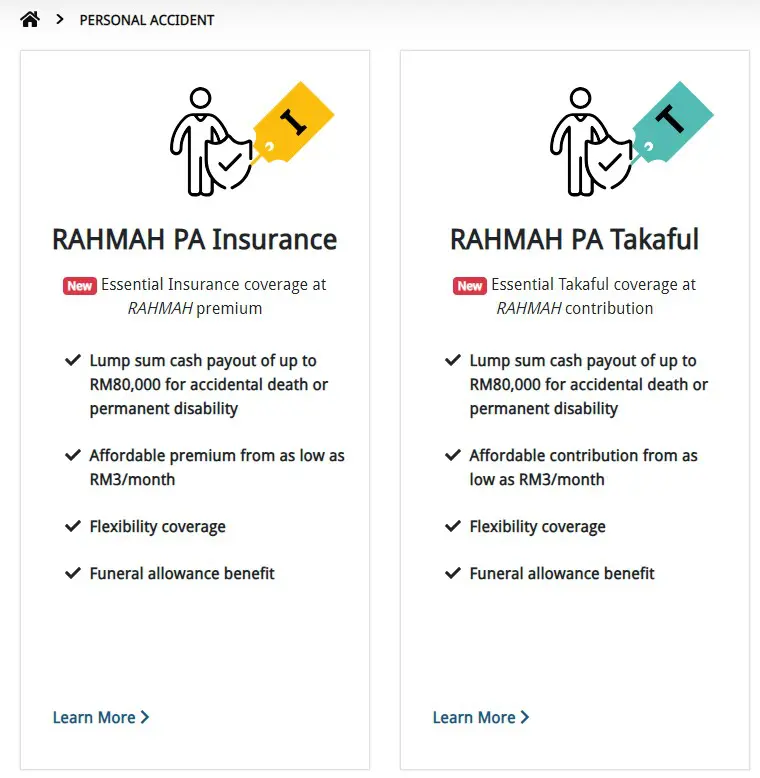

Etiqa General Insurance and Etiqa General Takaful, for instance, will provide RAHMAH PA coverage with a compensation of up to RM80,000 for those suffering permanent disability due to accident or disease, or death due to accidents. It also comes with funeral allowance in the event of accidental death. Premiums for these plans start from RM3 per month.

Meanwhile, Allianz General has put up its Allianz4All MyProtection insurance as part of its Rahmah offerings, with personal accident (PA) coverage of up to RM50,000 and a yearly premium of RM53 to RM79.50 (including sales tax). It also comes with additional benefits such as reimbursement of medical expenses at government hospitals and emergency relief payments of up to RM750 in the event of flood evacuation – at no extra cost.

On top of that, Allianz General is offering MotorcyclePlus insurance with a coverage of RM10,000 that protects both the rider and passenger in the event of death or permanent disability. This is in addition to hospital allowance through a policy based on the policyholder’s engine capacity, as well as complimentary flood relief benefits of up to RM1,000 without cost. If you opt for the Comprehensive policy, you’ll further enjoy some extra benefits, such as special perils coverage and roadside assistance of up to 50km.

“KPDN hopes that all plans offered through these two initiatives will help support more Malaysians, especially those in the B40, to own insurance or takaful coverage, next to applying the importance of owning insurance or takaful for the protection of one’s self and property,” said Datuk Seri Salahuddin.

These Rahmah insurance packages are provided under the government’s ongoing Payung Rahmah initiative, which was introduced at the start of this year as a short-term strategy to assist those in the B40 income group. Since its introduction, the Payung Rahmah initiative has grown to encompass a range of aids from various sectors, with programmes such as Menu Rahmah, Bakul Rahmah, and Jualan Rahmah having been rolled out. One of the most recent to have been launched is the Rahmah Eyeglass Package.

(Sources: Bernama, Malay Mail)

Comments (0)