Alex Cheong Pui Yin

26th October 2022 - 2 min read

A data report by Bursa Malaysia’s research portal, Bursa Digital Research has revealed Permodalan Nasional Bhd (PNB) to be the top institutional seller on the local bourse in the second quarter of 2022 (2Q22). Its outflow is reported to have increased quarter-on-quarter, from US$230.6 million (about RM1.09 billion) in the previous quarter (1Q22) to US$605.9 million (approximately RM2.87 billion) in 2Q22.

“The top three institutional sellers on Bursa Malaysia were PNB at US$605.9 million, Principal Islamic Asset Management Sdn Bhd at US$43.2 million, and Candriam Belgium S A at US$34.5 million,” said the digital platform in a note.

Meanwhile, the Employees Provident Fund (EPF) was named as the top buyer on Bursa Malaysia, with purchases of US$373.9 million (approximately RM1.77 billion). It is followed by BlackRock Fund Advisors from the United States at US$62.7 million (approximately RM296.6 million) and the Vanguard Group at US$56.9 million (approximately RM269.1 million).

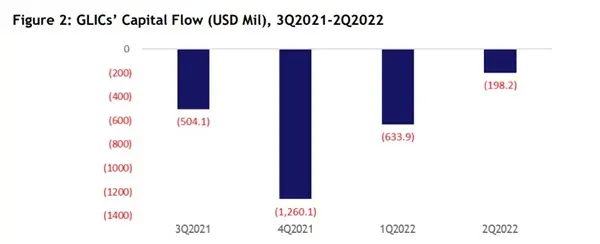

The portal also highlighted that cumulative capital outflows – defined as the total movement of assets out of a country – from nine government-linked investment companies (GLICs) in the domestic market had tapered off significantly from US$633.9 million in 1Q22 to US$198.2 million in 2Q22. This is as the EPF and Retirement Fund Inc (KWAP) have turned net buyers; the remaining seven GLICs are PNB, Amanahraya Investment Management Sdn Bhd, Khazanah Nasional Bhd, Lembaga Tabung Angkatan Tentera, Lembaga Tabung Haji, Pertubuhan Keselamatan Sosial, and PMB Investment Bhd.

Aside from these details, Bursa Digital Research’s report also revealed the trend of capital flow by industries – including the consumer goods and financial industries – and by companies. It tracked the capital flow from institutional investors (ex GLICs) as well, noting that while this segment continues to record an inflow instead of outflow in 2Q22, it slowed from US$132.57 million to US$98.88 million. This is as Principal Islamic Asset Management Sdn Bhd had turned net seller.

Bursa Digital Research is a “multi-faceted research portal” that was launched by Bursa Malaysia at the end of 2021. It is intended as an additional resource for investors to gain market insights and keep abreast of the latest developments in the stock market, and complements the Bursa Broadcast platform to enrich investors’ capital market understanding.

(Source: Bursa Digital Research)

Comments (0)