Alex Cheong Pui Yin

4th January 2024 - 3 min read

Digital asset fund manager Halogen Capital has introduced its new Halogen Shariah Ethereum Fund in a soft launch today, said to be “the world’s first shariah-compliant cryptocurrency fund that provides institutional-quality exposure to physical spot and staked Ethereum”. It is the fund manager’s second digital asset fund, following the launch of its first Halogen Shariah Bitcoin Fund back in July last year.

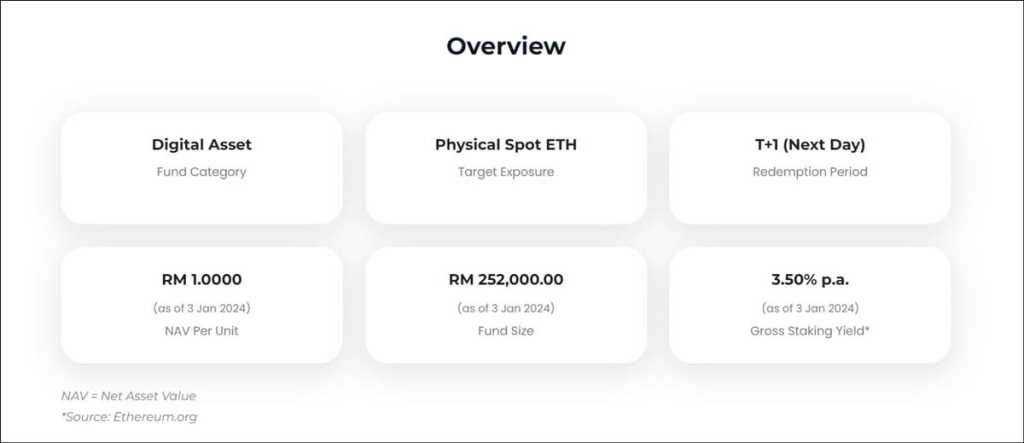

Aimed at investors with high risk tolerance and a long-term investment horizon, this growth fund will invest at least 70% of its net asset value (NAV) in Ethereum (ETH) traded on licensed digital asset exchanges that are approved by the Securities Commission Malaysia (SC). In addition, up to 70% of this investment may also be used for staking, the Ethereum network’s transaction validation process where you (referred to as a validator) deposit an amount of ETH to participate in the validation and securing of the ETH blockchain network, in return for some rewards distributed in ETH.

Additionally, the fund may also invest in Islamic collective investment schemes and derivatives as part of its hedging strategy, to protect the value of the asset during times of downturn or economic slumps.

As a validator staking ETH via this fund, Halogen Capital states that the potential annual percentage yield (APY) is currently between 3.50% to 4% p.a.. More importantly, though, there is no lock-in period for your investment, which means that you can redeem it at any time to receive your funds by the next day.

Halogen Capital also revealed that it is working with several partners for the Halogen Shariah Ethereum Fund, with its trustee being Universal Trustee (Malaysia) Berhad. Aside from that, the fund manager also appointed Amanie Advisors Sdn Bhd as its shariah advisor, and digital asset trust company BitGo as its custodian, which also provides staking as a service for its clients.

If you’re interested to invest in the Halogen Shariah Ethereum Fund, the minimum initial investment required is RM10,000, at an initial net asset value of RM1 per unit. The minimum additional investment, meanwhile, stands at RM1,000.

As for fees, there is a sales charge of up to 2% of the NAV per unit, along with an annual management fee of up to 1% p.a.. Additionally, there are also trustee fees up to 0.06% p.a. (subject to a minimum fee of RM30,000 per annum). No transfer, switching, redemption, and performance fees apply.

“We’re really proud today to announce the launch of the Halogen Shariah Ethereum Fund, the world’s first shariah-compliant cryptocurrency fund, which closely mirrors the performance of Ethereum. It will be a very unique fund that takes advantage of Ethereum’s proof-of-stake mechanism, and you’ll get – as a fund investor – native staking returns,” said the founder and chief executive officer of Halogen, Hann Liew, in a social media post announcing the launch of the new fund.

Halogen Capital itself commenced operations back in July 2023, and is Malaysia’s first SC-approved fund manager that specialises in digital assets. That said, aside from its digital asset funds (Bitcoin, and now Ethereum), Halogen Capital also offers a traditional asset fund, called the Halogen Shariah Ringgit Income Fund. This is on top of other services, such as private mandates.

(Sources: Halogen Capital [1, 2])

Comments (0)