Eloise Lau

27th January 2026 - 3 min read

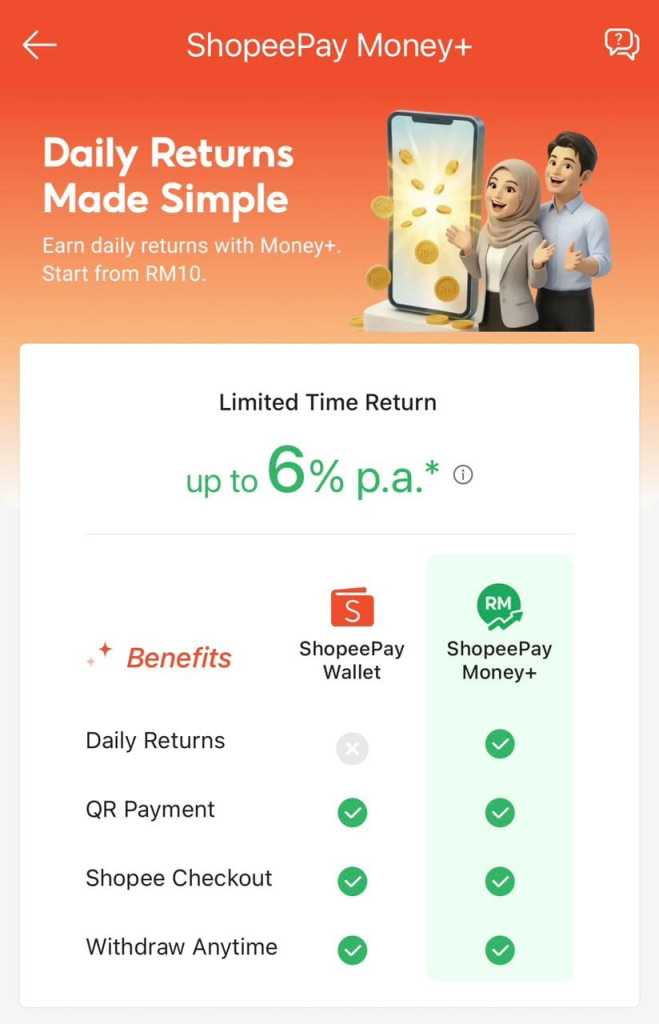

ShopeePay has launched Money+, a new cash management and investment feature that allows users to earn daily returns on funds stored in their ShopeePay e-wallet, with a limited-time promotional return of up to 6% p.a.

The feature is developed in partnership with iFAST Capital Sdn Bhd and Eastspring Investments Berhad, and is positioned as a low-barrier entry point for users looking to grow idle cash. Users can start investing with as little as RM10.

Money+ is accessible directly through the Shopee or ShopeePay app. Funds placed into Money+ are invested in the Eastspring Investments Islamic E-Duit Fund, a Shariah-compliant money market fund managed by Eastspring Investments Berhad.

Users can use their Money+ balance for payments at physical and online merchants via DuitNow QR, or withdraw funds when needed, without a fixed lock-in period.

According to ShopeePay CEO Alain Yee, the feature is designed to simplify access to investing and lower entry barriers for everyday users. Dennis Tan, CEO of iFAST Malaysia, added that the collaboration bridges digital payments and capital markets to support long-term financial resilience among Malaysians.

How The 6% p.a. Promotional Return Works

To mark the launch, ShopeePay is offering a limited-time “bonus top up” that increases potential returns to up to 6% p.a., credited daily.

To qualify for the promotional rate, users must meet the following conditions:

- Campaign period: 27 January 2026 to 27 April 2026

- Minimum balance: RM150 in Money+

- Balance cap: Promotional bonus applies to the first RM1,000 only

The advertised 6% p.a. return combines the underlying fund’s base return with an additional bonus provided by ShopeePay. Any balance above RM1,000, or funds held after the campaign ends, will earn the standard return of the money market fund.

What Users Should Know Before Using Money+

While Money+ offers convenience and daily returns, it is an investment product, not a savings account.

Funds placed in Money+ are not protected by Perbadanan Insurans Deposit Malaysia (PIDM), which typically insures bank deposits of up to RM250,000. Returns are also not guaranteed, as earnings depend on the performance of the underlying money market fund.

Although money market funds are generally considered low risk, their returns can still fluctuate based on market conditions. Users may want to assess their risk tolerance before placing emergency savings or significant cash balances into the feature.

Users interested in the Money+ feature can access it through the ShopeePay app, available on the Apple App Store and Google Play Store.

Follow us on our official WhatsApp channel for the latest money tips and updates.

As a creative content writer, Eloise has covered finance, business, lifestyle topics, and even moonlights as a singer-songwriter outside of RinggitPlus. Her current interests are learning the best ways to optimise spending and credit card hacks to gain more airline miles.

Comments (0)