Alex Cheong Pui Yin

26th April 2022 - 2 min read

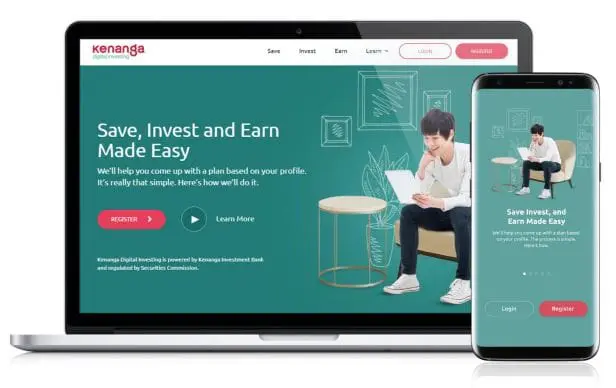

Kenanga Investment Bank revealed that its AI-driven digital investment management platform, Kenanga Digital Investing (KDI) has crossed RM100 million in asset under management (AUM), with an overwhelming 6,500 successful signups. This achievement came just two months after its launch back in mid-February 2022.

“We are extremely pleased with the response from the public on KDI. Crossing RM100 million in AUM within such a short time is a significant milestone for us. More importantly, the public’s confidence and trust in Kenanga has brought us another step closer in our vision to revolutionise the way Malaysians save and grow their money,” said the group chief digital officer of Kenanga Investment Bank, Ian Lloyd.

Lloyd also stressed that KDI’s goal is to make investment both simple and accessible for Malaysians, and the strong performance recorded thus far is a good indicator that KDI is exactly what the market needs.

KDI is licensed by the Securities Commission Malaysia (SC), seeking to make the investing process more seamless via a less complicated sign-up process and easy-to-understand products that investors can track anytime, anywhere. It has two key features on its platform, namely KDI Save and KDI Invest.

As per its name, KDI Save is a cash management fund that allows users to earn daily returns with no lock-in period and zero management fees. Meanwhile, KDI Invest provides customers with access to global investment opportunities through US-listed exchange traded funds (ETFs) at a competitive fee.

Comments (0)