Alex Cheong Pui Yin

20th January 2022 - 3 min read

Robo-advisor StashAway has added two new portfolios to its existing investment offerings, namely the Responsible Investing Portfolio, as well as the Environment and Cleantech Thematic Portfolio. As the names suggest, both will allow Malaysians to generate long-term earnings by investing in companies that are geared towards social responsibility and sustainability.

Specifically, the Responsible Investing Portfolio is described as “an Environmental, Social, and Governance (ESG) adaptation of StashAway’s classic General Portfolio”; if you’re unaware, the General Portfolio is a globally diversified portfolio that invests in exchange-traded funds (ETFs) and encourages long-term investment. Accordingly, the Responsible Investing Portfolio also invests in similar instruments, except that it has heavy exposure to businesses with high ESG scores, or are concerned with positive social impact. This means that you can invest sustainably without compromising on investment returns.

Meanwhile, the Environment and Cleantech Thematic Portfolio is StashAway’s latest addition to its Thematic Portfolio feature, which was launched in September last year based upon the concept of thematic investing. It originally offered three themes to choose from: Technology Enablers, The Future of Consumer Tech, and Healthcare Innovation. With this newest Thematic Portfolio, you will now be able to invest in innovations that will mitigate the impact of climate change. Key sectors that you can expect to see under the Environment and Cleantech Thematic Portfolio include:

- Clean energy and water

- Energy storage and smart grids

- Green financing

- Waste management

StashAway also reassured investors that both the new portfolios will be managed by some of the world’s top fund managers. These include iShares, Amundi, ARK Invest, Global X, and VanEck.

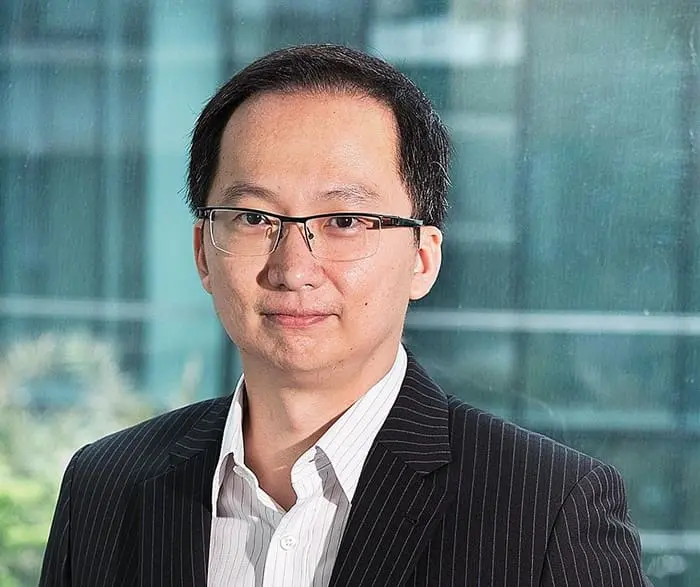

The co-founder and chief investment officer of StashAway, Freddy Lim said that investors these days have become more mindful about where their money is invested in, hence the move to introduce these two new portfolios. He also quoted data from Bloomberg saying that the global momentum for ESG investing has been immense, with assets slated to reach a third of global assets under management (AUM) come 2025.

“We’re introducing these two portfolios because we want clients to have the option to invest in a way that allows them to positively shape the future of our planets and society while also generating long-term returns,” said Lim.

To celebrate this launch and to encourage investors to get started, StashAway is waiving the management fees for new deposits into its Responsible Investing Portfolio, as well as Environment and Cleantech Thematic Portfolio – for up to a year. You are allowed to invest in either one portfolio or both. To tap into this benefit, you will need to make your investment before 20 February 2022.

(Sources: StashAway, PR Newswire)

Comments (0)