Alex Cheong Pui Yin

1st June 2020 - 3 min read

(Image: Amanz Media)

FICO, a global analytics software firm, has noted in a survey that Malaysians are rapidly becoming more comfortable with opening bank accounts digitally, with 78% of its participants saying that they would open some kind of financial account online.

The Consumer Digital Banking Survey found that out of these participants, 65% of them would consider doing so for an everyday transaction account, whereas 45% and 28% would apply online for a credit card and personal loan, respectively.

Interestingly, FICO’s survey also revealed that Malaysian consumers are more comfortable opening bank accounts on their smartphones than those in the US and Canada. It was noted that 23% of Malaysians prefer opening a bank account on their phones, whereas only 18% in the US and 16% in Canada are comfortable doing so.

FICO’s lead for fraud, security, and compliance in Asia Pacific, Subhashish Bose, commented that it is not surprising that Malaysians are digital natives. “It is demographically a young country, with 80% of the population under the age of 50,” he said.

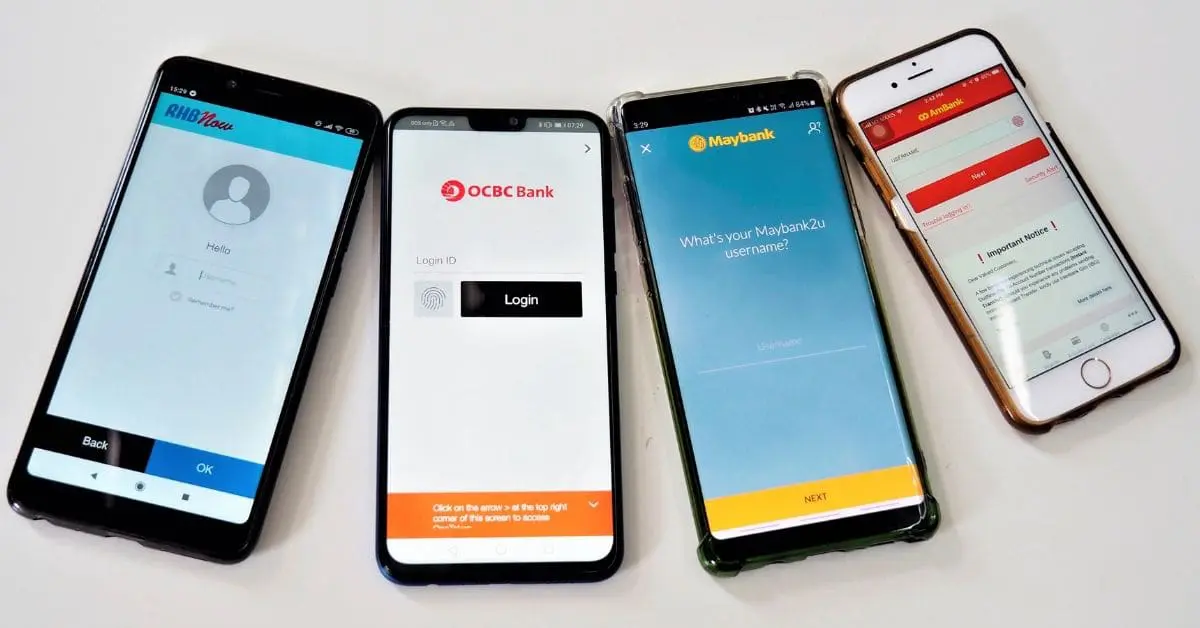

(Image: The Malaysian Reserve)

Bose’s observation is reflected in the survey numbers, with 76% of those between 25 to 34 years of age stating that they would open a bank account online. Conversely, only 49% of those who are 45 to 55 years of age said that they would do so. However, in a surprising turn of events, as many as 61% of those aged over 55 are also willing to open bank accounts online.

“Malaysian households are often multi-generational. So, this finding might be explained by younger generations helping their grandparents with their banking, especially if they are less mobile and can’t get to a branch,” explained Bose.

Additionally, FICO’s survey found that a large percentage of the Malaysian participants expect the process of opening bank accounts to be fully digital. In other words, they should be able to complete the full process of registration online or on their phones, including regular identity verifications. 78% of the participants believe that they should be able to prove their identity by providing scanned documents or selfies, whereas 46% expected to prove their address without moving offline. Yet another 40% opined that they should be able to use biometric measures when opening bank accounts online.

(Image: Vulcan Post)

Moreover, only 45% of the Malaysian participants said that they will carry out the necessary offline steps at the soonest if the full process of account opening cannot be completed in-session. 23%, in contrast, said they would abandon the process.

FICO’s survey further noted that without a fully digital account opening process, financial institutions could potentially stand to lose over 40% of their new businesses. “There is research to show that only 6 to 9% of applicants move through the funnel and complete the process,” said Bose.

Bose also attributed Malaysians’ ease with online banking facilities to the government. “The Malaysian government is actively encouraging development and investment in the digital economy, which makes up about a fifth of the country’s GDP. These factors have promoted a digital-first consumer base,” he commented.

FICO’s Consumer Digital Banking Survey involved 5,000 participants across 10 countries. Separately, KPMG has also carried out a survey that concurred with FICO’s findings. In KPMG’s survey, 77% of its respondents believe that digital banking is the next evolution in financial services.

(Source: The Edge Markets)

Comments (0)