Alex Cheong Pui Yin

18th December 2023 - 3 min read

The Royal Malaysian Customs Department (RMCD) announced that the 10% sales tax for low-value goods (LVG) sold online will be charged starting from 1 January 2024. This comes following a few rounds of postponement since the tax was announced during the tabling of Budget 2022.

With this latest update, all imported goods that are sold online at a price of less than RM500 and are brought into Malaysia by land, sea, or air, will be subjected to this new 10% tax. Note, however, that LVG excludes selected items, namely cigarettes, tobacco products, liquors, electronic cigarettes, and preparation of a kind used for smoking.

RMCD further said that those who sell LVG on an online platform, or operate an online marketplace for the sale and purchase of LVG must register with the RMCD if the total sale value of LVG brought into Malaysia exceeds RM500,000 in 12 months.

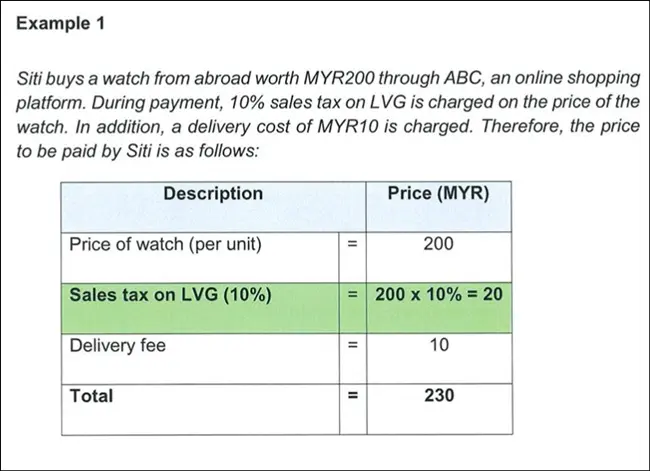

The department had also published a guide (dated 3 November 2023) and FAQ (dated 6 November 2023) on the LVG sales tax to provide further guidance for the public. Among other things, these documents clarified that the tax will be charged solely on the sale value of each LVG purchased – not including any tax, duty fees, or other charges (such as transportation, insurance, or other costs). Here’s a scenario shared by RMCD in its guide, where it showcased how the LVG tax will be applied:

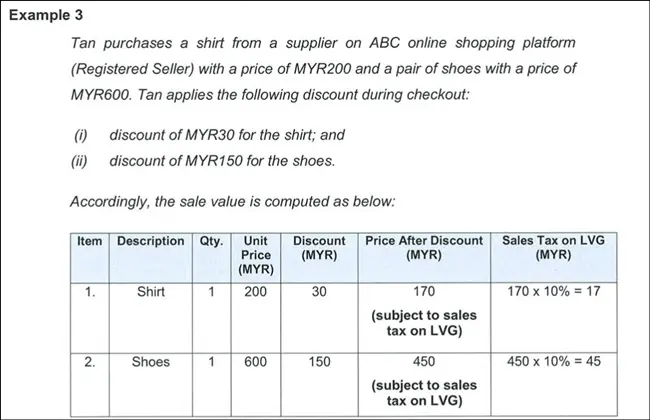

Additionally, RMCD also highlighted that if an item is sold at a discounted price instead of its original retail price, the LVG tax will be applied to the discounted price as the sale value:

RMCD had also clarified previously that items purchased before the implementation date will not be charged the LVG tax even if they are delivered and arrive later. So if you were to purchase any LVG before 1 January 2024, the tax will not be applied to them even if the items are delivered only after 1 January.

Meanwhile, Communications Minister Fahmi Fadzil said that the introduction of the LVG tax for imported goods is meant to enhance the competitiveness of local products. “It only applies to products imported from overseas that are sold online in Malaysia. Products produced in the country are not affected. So, I hope this will clear up misunderstandings among the public about the tax,” he said.

For context, the LVG tax was first mentioned during the tabling of Budget 2022, and was scheduled to be implemented on 1 January 2023. It was, however, eventually postponed to 1 April 2023, and later postponed again indefinitely – until this latest confirmation that it will begin on 1 January 2024. It should be highlighted, though, that although the actual implementation is set to start next year, the LVG tax legislation has actually come into force since 1 January 2023.

(Sources: Malay Mail [1, 2], RMCD)

Comments (5)

Hi, I just being charged the shipping cost inclusive tax, was that a mistake by custome dept?

To get clarity on this, I’d recommend reaching out to them directly and asking for an explanation. They should be able to provide you with more information about the charges.

If I were to buy directly from a seller in US valued less than rm 500, how do I pay the tax?

Go to the custom department ?

Pay online?

The confusing part is, what happen if one imports > RM500 of the LVG?

already clarified, imported goods below RM 500.