Alex Cheong Pui Yin

14th March 2023 - 2 min read

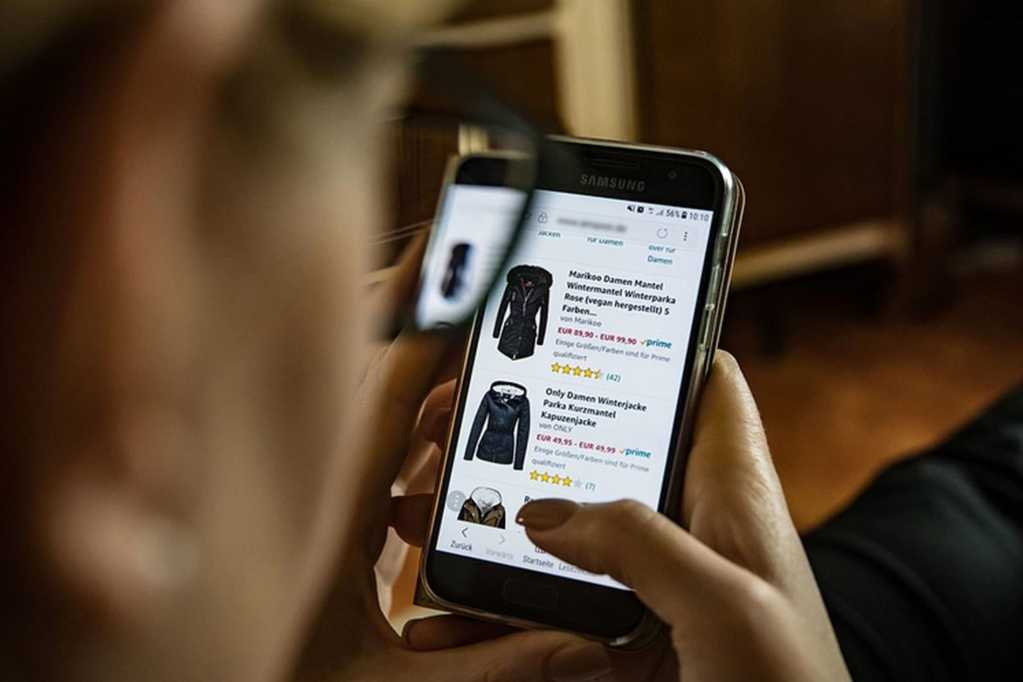

The Royal Malaysian Customs Department (RMCD) has updated that the implementation of the 10% sales tax on imported low-value goods (LVG) that are purchased online will be postponed to a later date. This tax was supposed to take effect starting from 1 April 2023.

Revealed in a short announcement on its website, the Customs department did not share a new date for the implementation, nor did it explain the reason for this delay. Instead, it merely said that the tax has been delayed until further notice.

The government had initially planned to impose a 10% tax on imported LVG that are bought online starting from 1 January 2023, proposed under Budget 2022. This refers to imported goods with a total value of less than RM500 per consignment, which are currently exempted from sales tax when they are brought in using courier services through selected international airports (excluding selected items, such as cigarettes, tobacco, and liquor).

The aim of this tax is primarily to ensure equal tax treatment for locally manufactured and imported goods, as local manufacturers are already subjected to a 5% or 10% sales tax, thereby putting them at a disadvantage. With the 10% flat tax rate also imposed on imported LVG, it is hoped that it will level the playing field for both domestic and imported goods, and that Malaysians will be encouraged to purchase locally made products.

The new LVG tax was subsequently deferred to 1 April 2023, with the RMCD clarifying a few other details on it as well. For instance, it was confirmed that the new tax will only be imposed on the base price of the goods, and not on the delivery charges or insurance costs for transporting the items into Malaysia as well. Products such as alcohol, tobacco products, and cigarettes, too, will be exempted.

At the same time, the RMCD also urged merchants who will be impacted by the implementation of the new tax to apply to be a registered seller. This is because the legislations related to the tax have already come into force since 1 January 2023, even though the actual implementation is delayed. Essentially, all sellers who sell LVG that are brought into Malaysia via land, sea, or air transport, as well as have an LVG annual sales value that exceeds RM500,000 in Malaysia must apply to be a registered seller.

(Source: RMCD)

Comments (0)