Alex Cheong Pui Yin

1st November 2022 - 3 min read

Lazada has finally rolled out its very own buy-now-pay-later (BNPL) service, called LazPayLater, allowing eligible users to make their purchases now and pay at a later date. Currently, the service is only made available to selected pre-qualified users, who will also need to submit an application to use the service.

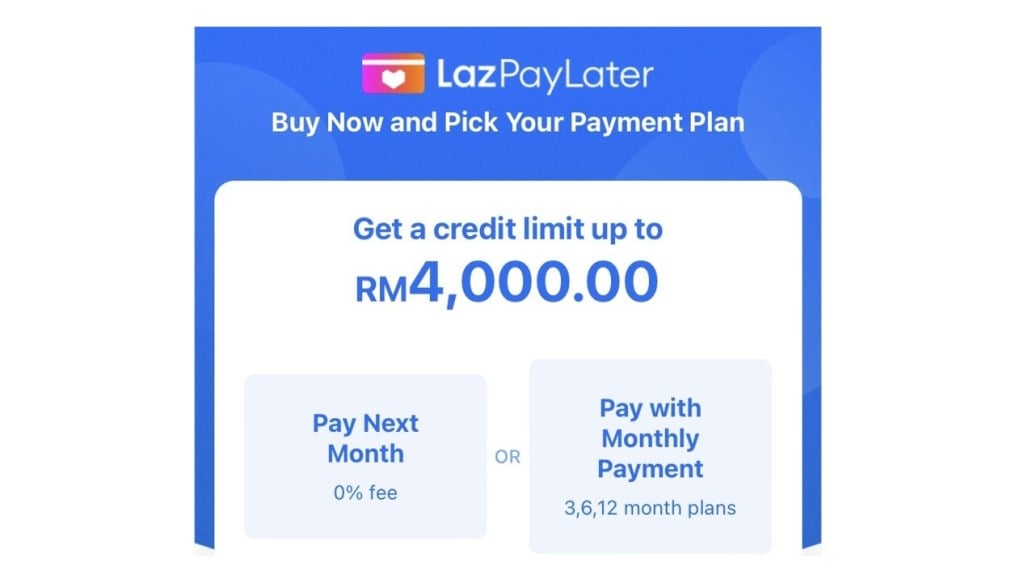

Those who tap into LazPayLater will have the option to delay the payment of their purchases up to 30 days later with zero interest, or opt for an instalment plan of 3, 6, or 12 months. As you can expect, opting for monthly instalments will incur a small fee, set at 1.5%.

You may also need to pay an overdue fee of RM30 if you fail to pay your instalments in time, as per your monthly statement bill. Note that the monthly statement cycle starts and ends on every 10th and 25th of the month, respectively (statement due date is currently fixed and cannot be modified).

Aside from that, do also be aware that each user will be entitled to a credit limit of up to RM4,000; the actual limit offered to you upon successful application will be calculated based on your personal information and a comprehensive evaluation of your profile. There is also currently no option for you to request for an increase in your LazPayLater credit limit, although Lazada did say that it will inform you through push notifications once you are eligible for an increase.

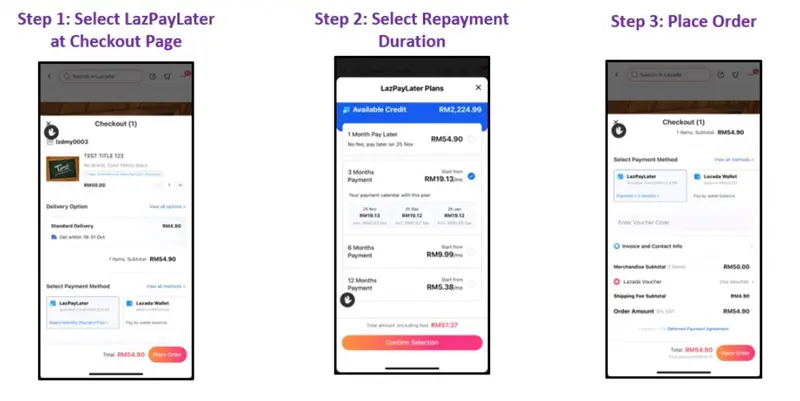

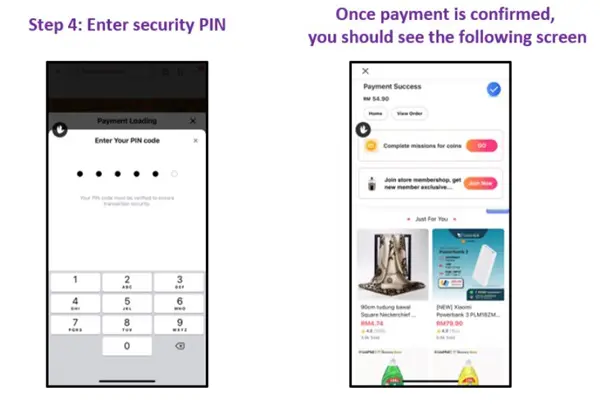

While LazPayLater can be used for the purchase of most products on the e-commerce platform, it is not applicable for the purchase of certain products under the digital goods category (such as e-vouchers and gift cards) and the fine jewellery category. As such, make sure to double check beforehand! Here’s a quick guide from Lazada on how to use LazPayLater as your payment option:

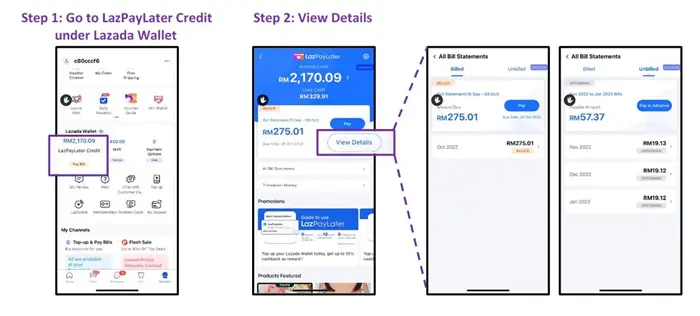

As for repaying your LazPayLater bills, payments can be made via a variety of channels, including Lazada Wallet, online banking, credit and debit cards, as well as the Touch ‘n Go (TNG) eWallet and Boost e-wallet. You can view your billed and unbilled LazPayLater statements by tapping on the “View Details” button found in your LazPayLater account.

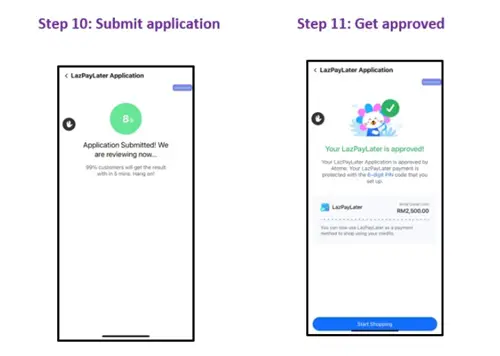

If you’ve been chosen as a pre-qualified user and would like to give LazPayLater a try, you can apply for the service by heading over to the Lazada Wallet section in your My Account page and following this concise guide by Lazada:

You can check the status of your application on your Lazada Wallet page, but do note that the verification process may take up to 24 hours.

To note, the chief executive officer of Lazada Malaysia, Alan Chan, had hinted earlier in September 2022 that the e-commerce platform is set to launch its BNPL service “very soon”. Back then, Chan also said that Lazada had taken some time to roll out the service because it wanted to “bring the best breed of partners to provide financial services into our platform”.

(Source: Lazada)

Comments (1)

What is the interest computation for purchases thru lazpaylater beyond 30 days? Is it 1.5% straight? Need disclosure and clarification with this issue since it will help customers in their decision