Alex Cheong Pui Yin

9th June 2022 - 2 min read

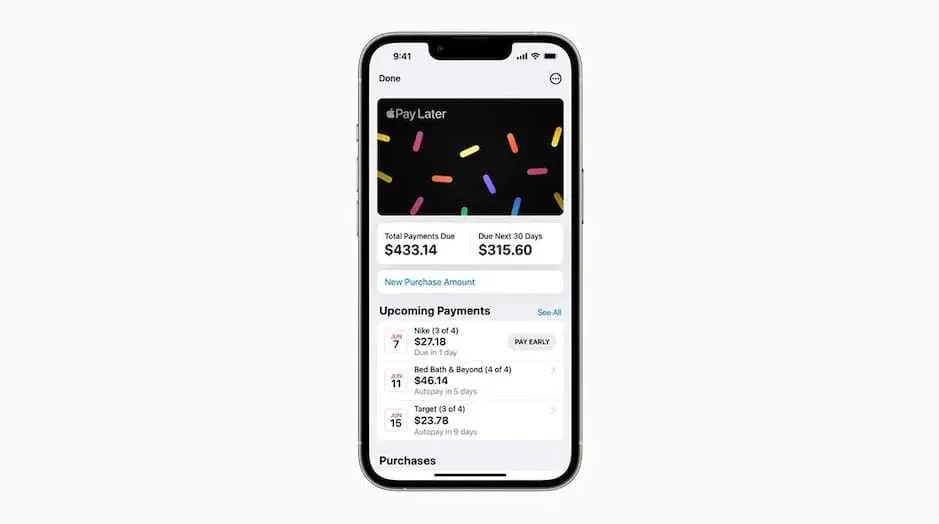

Apple has revealed that it will be rolling out a new buy-now-pay-later (BNPL) service, dubbed Apple Pay Later. Announced during its WWDC developers’ conference, it is set to be one of several upgrades made to the existing Apple Wallet.

Users who tap into Apple Pay Later will be allowed to split the payment of their purchases into four equal instalments, to be paid over six weeks. Payments can be managed through the Apple Wallet app. Additionally, Apple Pay Later will be interest free, with no fees applicable either.

The tech giant also shared that it will conduct credit checks on applicants to determine if they qualify for the service. This includes drawing on data such as their purchase and payment history with Apple (in both its stores and online services, including the App Store).

Apple Pay Later will be made available at any payment points where Apple Pay is accepted – both online and offline stores. It also shed some light on other technicalities, noting that payments made to merchants will be conducted over the Mastercard network, while payment credentials will be issued by Goldman Sachs (as the official banking identification number (BIN) sponsor).

Apple also clarified that it plans to use its corporate balance sheet to fund the loans for its upcoming Apple Pay Later service, which was revealed just earlier this week. Although Apple did mention that the funding sources for Apple Pay Later may change over time, its current reported finances has been noted to be resilient enough to support the move. For instance, its most recent quarterly results indicated that it had a net cash of US$73 billion at the end of March 2022, and as of 2021, Apple reported a revenue of US$378.55 billion.

The tech giant highlighted as well that its treasury department will be responsible for determining the mechanism that should be adopted for the Apple Pay Later service. Meanwhile, Apple Financing LLC – a wholly owned subsidiary – is in charge of other decisions regarding loans and creditworthiness.

As with many of Apple’s products, Apple Pay Later will be launched first in the US, and is expected to arrive in September 2022 with the drop of the latest iOS 16. Other financial products that Apple has also launched thus far include its Apple Card, which was introduced back in 2019.

Comments (1)

More importantly, when is Apple Pay coming to M’sia?