Alex Cheong Pui Yin

7th September 2021 - 2 min read

Prime Minister Datuk Seri Ismail Sabri Yaakob has urged for cash vouchers to be distributed without delay to Special Covid-19 Aid (BKC) recipients who do not have bank accounts. This is following the kick-off of the Phase One payments of the BKC initiative that began yesterday.

While the payments of the BKC will be credited into the accounts of 10 million recipients, Ismail Sabri also requested for the Finance Ministry to ensure a smooth payment process, especially to recipients who reside in rural areas, have less access to banks, or do not have a bank account. The government’s database indicated that there are 708,223 eligible BKC recipients who do not have a bank account.

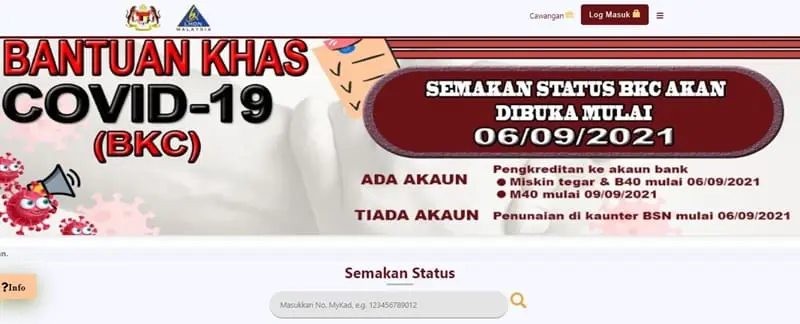

“As such, the prime minister wants the BKC cash vouchers prepared by the Finance Ministry to reach those recipients without any delay,” said the Prime Minister’s Office (PMO) via a statement. These cash vouchers for those without bank accounts will be distributed at Bank Simpanan Nasional (BSN) counters.

The BKC initiative is a cash assistance that is provided to households and individuals from various income categories, namely the hardcore poor, B40, and M40. The initiative’s eligibility criteria is determined based on the Bantuan Prihatin Rakyat (BPR 2021) recipient criteria. The full BKC payments – which will be paid out in three separate phases – range between RM1,300 to RM100, depending on the income class.

Under the Phase One payment, eligible recipients can expect to first receive between RM500 to RM100, and the crediting of the money will be carried out from 6 to 10 September 2021. Eligible recipients can check their status at the BKC website.

In observing the start of the Phase One payments of the BKC at several BSN branches yesterday, the PMO also said that Ismail Sabri hoped the cash aid will be a measure of help to those who are in need. “The prime minister hoped that the BKC will alleviate the burden of the Malaysian Family affected by the Covid-19 pandemic,” it commented.

(Source: The Edge Markets)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)