Samuel Chua

9th July 2025 - 4 min read

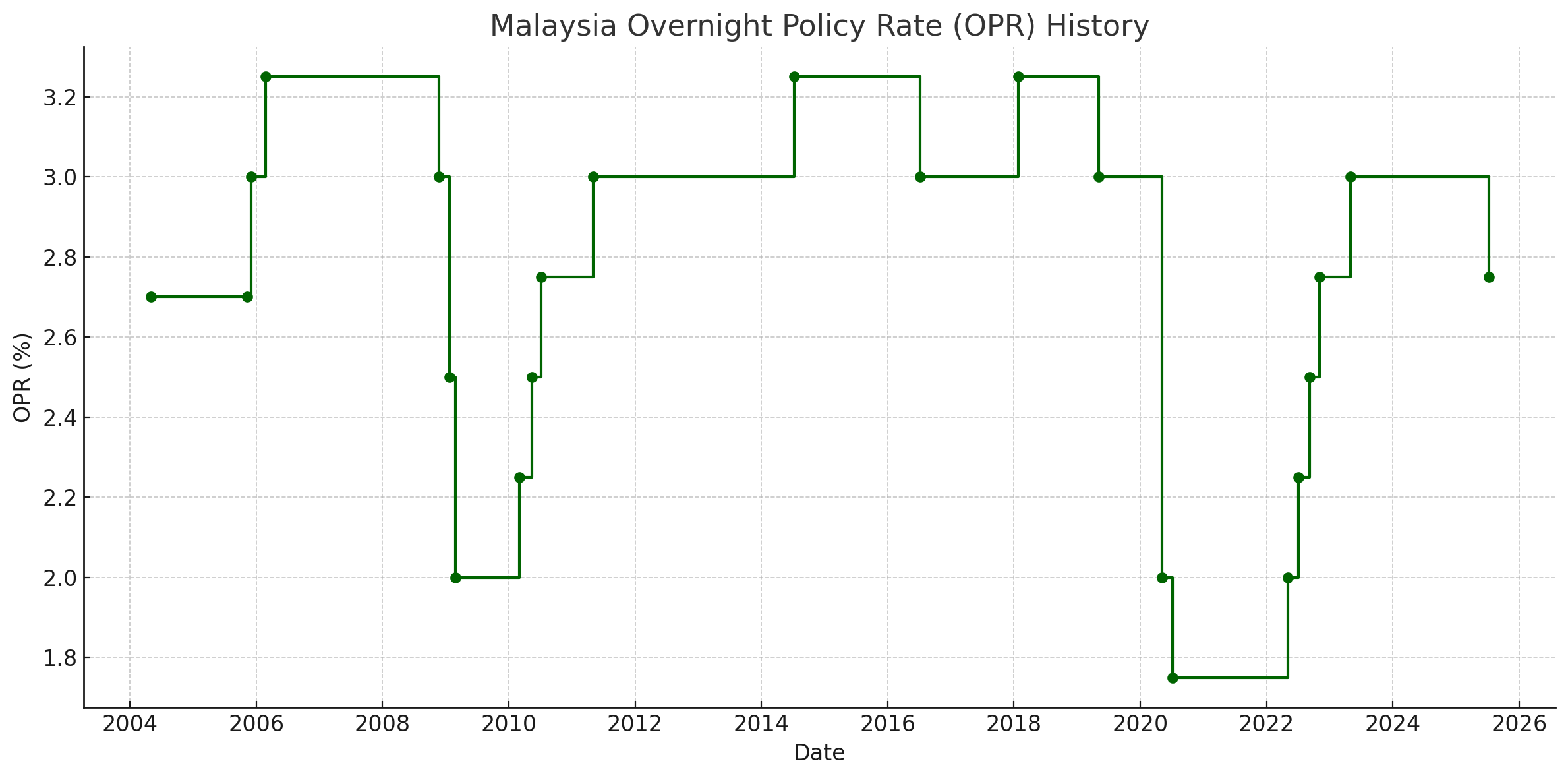

Bank Negara Malaysia (BNM) has officially lowered the Overnight Policy Rate (OPR) by 0.25%, bringing it to a new level of 2.75%. As the benchmark for our entire banking system, this key interest rate and its adjustment will have a direct effect on your personal finances.

The change impacts the cost of borrowing and the returns on savings. For Malaysian consumers, it’s important to understand what this means for your budget. Here is a clear guide to the immediate consequences of the new OPR.

Monthly Loan Repayments Will Decrease

For anyone with a variable-rate loan, especially a home loan, this rate cut is good news. When the OPR is reduced, banks lower their own base rates in response. As a result, the interest charged on your existing loan will decrease.

Most home loans in Malaysia are variable-rate, meaning the interest you pay is tied to your bank’s Base Rate (BR), which in turn follows the OPR. In addition to mortgages, many personal loans and small business term loans are also structured with variable rates. Car loans, however, are typically fixed-rate and may not be affected.

The change translates into tangible savings. On a RM500,000 home loan with a 30-year tenure, for example, a 0.25% rate cut can reduce your monthly instalment by approximately RM70 to RM75, which provides extra cash flow for households to manage other expenses or increase savings.

Alternatively, you could choose to maintain your current monthly payment. By doing so, more of your money goes towards reducing the principal loan amount, allowing you to pay off your loan faster and save on total interest costs in the long run.

After any OPR cut, it’s also a good idea to check your next loan statement or contact your bank to confirm that your interest rate has been revised downward as expected.

Savings Returns Will Drop

While borrowers benefit, the environment for savers will become more challenging. A lower OPR means banks will also reduce the interest rates offered on Fixed Deposits and other savings accounts.

Those who rely on the steady income from these accounts, particularly retirees, will see their returns diminish. The interest earned on your savings will be lower, making it more critical to review your financial plan and ensure your money is still working effectively towards your goals.

Fixed-price unit trust funds such as Amanah Saham Bumiputera (ASB) and Amanah Saham Malaysia (ASM) benchmark their performance against the Maybank 12-month Fixed Deposit rate. According to Permodalan Nasional Berhad (PNB), ASB delivered a competitive spread over this benchmark, which averaged 2.64% in 2024.

For more information on current Fixed Deposit rates and strategies to maximize your savings, refer to RinggitPlus’ site on the best fixed deposit accounts in Malaysia.

The Economic Reasoning Behind the Cut

BNM’s decision is a strategic move to support the national economy. By making it cheaper to borrow money, the central bank aims for its monetary policy [PDF] to stimulate spending and investment among both consumers and businesses.

With growing concerns over a weaker global outlook and slowing domestic demand, this preemptive cut is designed to encourage economic activity. Cheaper loans can motivate businesses to expand and individuals to make major purchases, helping to sustain growth during uncertain times.

Aligning with Regional Trends

The rate cut also brings Malaysia in line with other countries in the region. Central banks across Southeast Asia have already been lowering their interest rates this year in a coordinated effort to counter global economic headwinds.

For Malaysians, the move to a 2.75% OPR marks a clear shift in the financial landscape. Borrowers may feel some relief on their monthly repayments, but savers will need to rethink their strategy. It’s a good time to review your finances, understand how the lower rate affects you, and make changes to stay ahead in this new environment.

Comments (1)

Wah! So hard to save now