Alex Cheong Pui Yin

7th November 2022 - 4 min read

Several economists have commented that Bank Negara Malaysia (BNM) will likely continue to increase the overnight policy rate (OPR) next year, until it reaches a neutral rate of 3.25% to 5.00%. This is as the central bank maintains its calculated approach in battling inflation within the country.

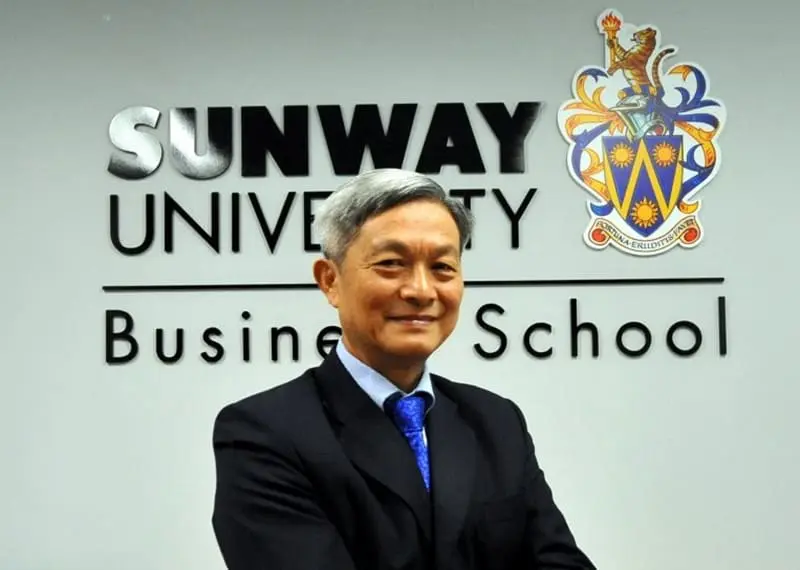

According to a professor of economics from Sunway University Business School, Dr Yeah Kim Leng, Malaysia can anticipate more policy rate increases in 2023, as the central bank attempts to reign in the core inflation rate that has shot up to 4% year-on-year at the end of September 2022. Core inflation is defined as the change in prices of goods and services, excluding those from the food and energy sectors (due to their more volatile fluctuation).

“The increase will help to moderate demand pressures, so that inflation expectations can be managed without resulting in higher inflation. However, given that the interest rate is still below the neutral rate, we expect the central bank to continue its normalisation given that the pre-pandemic interest rate ranged between 3.25% and 5%. We may see the central bank continue to push towards raising the interest rate to the neutral rate,” said Professor Yeah, adding that the pace and the amount of increase will be based on the prevailing inflation as well as growth momentum.

The professor also stressed that inflation is a global problem, and not just exclusive only to Malaysia. In fact, many central banks were caught by surprise at the magnitude of the surge in inflation rate. “Although the central bank does not have an inflation target, a comfortable inflation level whould be around 2.3% to 3.5%. But we also note that inflation will remain elevated in the post pandemic environment as well as supply chain disruption caused by the Russia-Ukraine war,” he said.

Similarly, MIDF Research also believes that BNM will continue hiking the OPR, and will, in fact, do so earlier next year as opposed to later. “With the rising core inflation trend and stronger-than-expected domestic demand, we expect the central bank to front-load its monetary bullets to pre-pandemic levels at 3% by January 2023,” it said in a statement.

The research house does also acknowledge, however, that BNM’s decision will be determined by the stability of Malaysia’s economic growth, the pace of price increases, and further improvement in macroeconomic conditions. It also said that this policy rate normalisation is necessary to avoid risks that could destabilise the country’s future economic outlook, including persistently high inflation and a further rise in household debt.

Meanwhile, the chief executive officer of Fortress Capital Asset Management, Thomas Yong compared Malaysia’s OPR with the United State’s interest rate, which has also been seeing consecutive increases over the past months, and at a far more aggressive rate. He highlighted the impact of the widening difference in both countries’ interest rates, noting that this could cause Malaysia’s currency to continue weakening against the greenback.

“Having said that, the strength or weakness of the ringgit is likely to move in line with regional currencies given the strong trade relations regionally. The US dollar strengthening has been universally observed against all currencies, rather than just the ringgit. At some point, concerns of a runaway US dollar exchange rate will subside and real transactional demand should then set the rate of exchange,” Yong elaborated.

Last week, the Monetary Policy Committee (MPC) of BNM had elected to bump the OPR up by yet another 25 basis points (bps), raising it from 2.5% to 2.75%. It is the fourth consecutive hike in 2022, with the first three hikes taking place in May, July, and September 2022. BNM noted in its statement then that the latest decision was driven by Malaysia’s improving economic activity in the third quarter (3Q22), which is expected to continue going forward.

(Source: The Edge Markets)

Comments (1)

We have a solution to tackle the inflation.