Samuel Chua

10th February 2025 - 2 min read

The Employees Provident Fund (EPF) is expected to declare a dividend of more than 5.8% for conventional savings for 2024, marking an increase from the 5.5% announced in 2023.

According to a Free Malaysia Today report, the dividend rate for shariah savings is also projected to be between 5.4% and 5.6%, according to a source familiar with the matter. Two years ago, the EPF disbursed a 5.4% dividend for shariah-compliant accounts.

The source described these figures as a ‘safe bet’ and indicated that the retirement fund would officially announce the final rates in early March.

The source added that the rates could be the highest in three years, surpassing last year’s payout, with the decade-long average standing at 6%.

In 2022, the total dividend payout for conventional accounts stood at RM50.33 billion, while RM7.48 billion was allocated to shariah savings.

The EPF currently has an estimated 16 million members, with over 8.5 million actively contributing to their retirement savings.

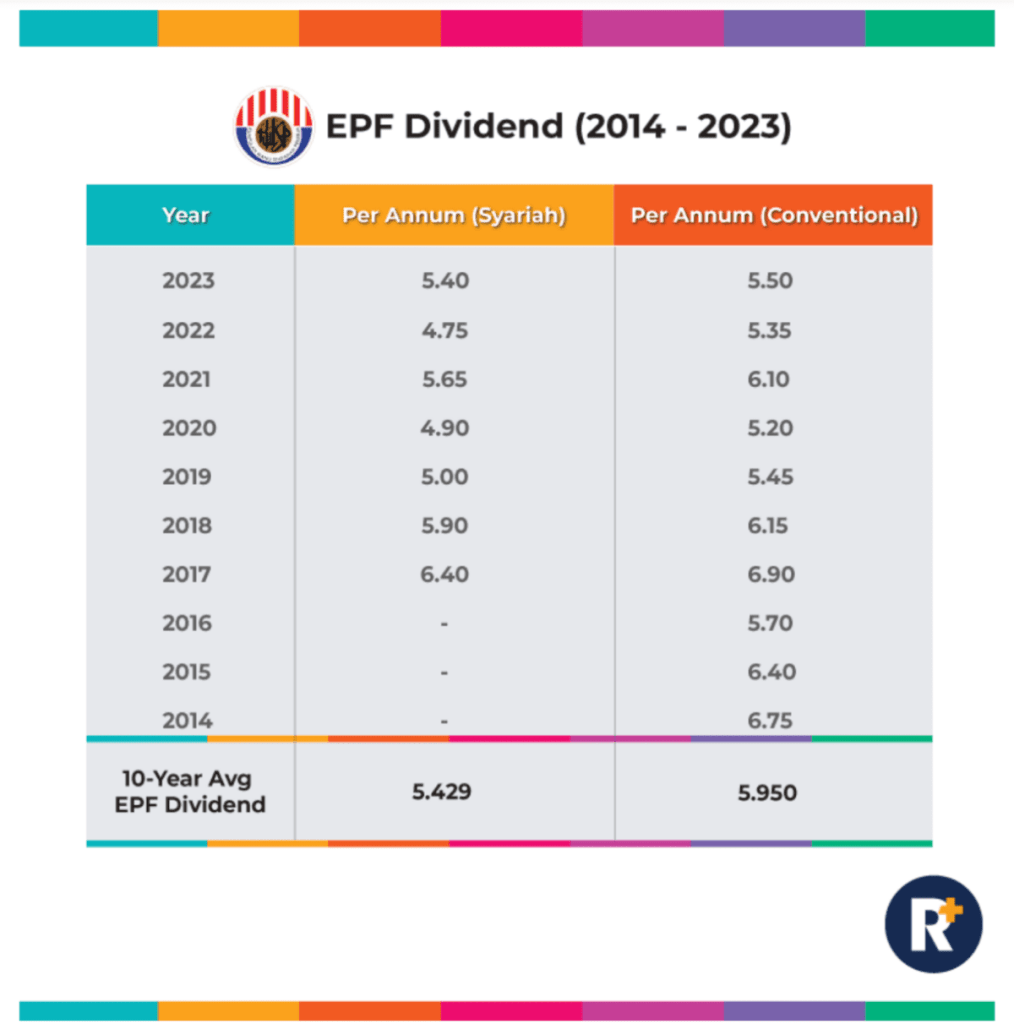

Over the past decade, EPF recorded an average dividend of 5.95% for its conventional scheme and 5.43% for the shariah scheme, which was introduced in 2017. The EPF’s highest dividend payout in the past decade was in 2017, with rates of 6.9% for the conventional scheme and 6.4% for the shariah scheme.

Comments (0)