Jacie Tan

19th February 2021 - 2 min read

The Employees Provident Fund (EPF) will open i-Sinar applications without eligibility conditions beginning 8 March 2021. From that date onwards, all i-Sinar applications submitted by EPF members below the age of 55 will be given automatic approval, subject to a minimum account balance of RM150.

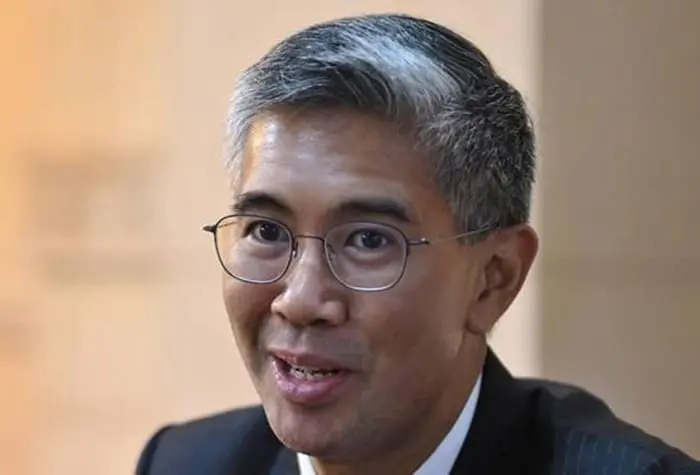

The move to remove eligibility conditions for the i-Sinar withdrawal facility was announced by Minister of Finance Datuk Seri Tengku Zafrul Aziz last week. With the change, EPF members will no longer need to prove a lack of contribution to the EPF for at least 2 months or a reduction in base or total income by at least 30% in order to qualify for i-Sinar.

(Image: Focus Malaysia)

According to the EPF, the removal of the i-Sinar eligibility criteria means that the interim payment of RM1,000 will be effectively stopped. However, the maximum withdrawal amount – of up to RM10,000 for members with an account balance of RM100,000 and below, and up to 10% of savings for those with more than RM100,000 – will remain in place, together with the six-month payment schedule.

The EPF also stated that members who have already applied for i-Sinar will be given their approval starting 8 March as well. As for those who have not made any application yet and intend to apply during this transition period, the EPF advised them to defer doing so until the revised i-Sinar facility comes online on 8 March. This will reduce processing time and speed up the crediting of their funds.

“The fund appreciates members’ patience and understanding while these changes are being implemented, as the amendments to the i-Sinar facility as announced on 11 February 2021 involves substantial changes to the system, process, and governance required for i-Sinar Online,” said the EPF.

To date, RM18.5 billion has been released under the i-Sinar facility since applications first opened in December 2020, benefiting 3.3 million members. For more information and enquiries, EPF members can contact the EPF Contact Management Centre at 03-8922 6000, the i-Sinar hotline at 03-8922 4848 or refer to the EPF website.

(Source: The Edge Markets)

Comments (4)

I hope akaun emas members can withdraw too, as they are also affected especially single parent….

Hai i already apply on 5th January 2021, the application shown still under process, What is the procedure to reapply isinar?

Kalau yg dah pernah mohon kategori 1 tempoh hari…tetapi tersilap drag ammount…. Boleh mohon semula tak?

I hope that my i sinar application will be approved lah. Because I plan to buy a new PS5 game console complete with all the latest games. The covid19 MCO has given me too much stress. I hope that with the i sinar, my epf moneyvand the new PS5 game console, will enchanted my living quality