Pang Tun Yau

27th February 2021 - 4 min read

The EPF has declared its dividend rates for 2020, with the Simpanan Konvensional earning 5.2% and Simpanan Shariah earning 4.9%. The rates have been touted as better than expected, given the challenging economic climate globally due to Covid-19.

Strong equities performance drives record-breaking investment income

Despite the Covid-19 pandemic and lower net contributions throughout the year (via hassle-free withdrawals from i-Lestari and i-Sinar), the EPF actually recorded its highest-ever gross investment income in 2020 with a total RM60.98 billion.

As part of the fund’s Strategic Asset Allocation (SAA), the fund’s exposure was well-managed and was key to delivering the solid returns. The fund took advantage of the equities market crash in March 2020, where leading stock indices lost as much as 40%, taking positions in fundamentally strong companies at attractive prices. This, and the subsequent recovery in global stock markets, contributed significantly to the EPF’s investment portfolios.

The EPF also rebalanced its investment portfolios based on thorough consideration on how the COVID-19 pandemic and global uncertainties had influenced capital markets worldwide, such as the US Presidential election in November 2020, the continuous US-China trade dispute, and the impact of the Brexit negotiations.

In total, the EPF’s equities investment in 2020 contributed RM28.71 billion in returns – 47.08% of the fund’s total income for the year.

Meanwhile, a further 42% (RM25.42 billion) of the fund’s income in 2020 was contributed by the Fixed Income Instruments, which comprises of Malaysian Government Securities & Equivalent and Loans & Bonds. Finally, a further RM5.66 billion came from the fund’s Real Estate & Infrastructure portfolio, which serves as a hedge against inflation but saw significant challenges last year with lockdowns and work-from-home measures.

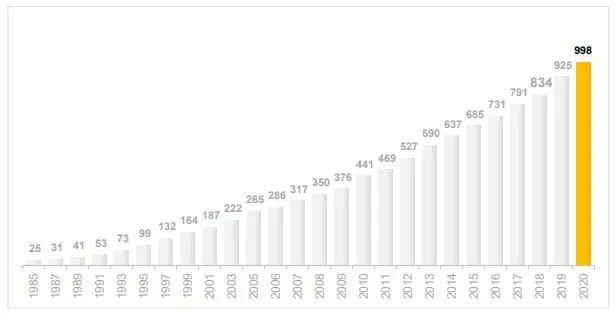

Nevertheless, the 2020 income represents quite a feat for the fund, which also broke the trillion-Ringgit investment asset mark just a few months ago in December. EPF Chairman Tan Sri Ahmad Badri Mohd Zahir said, “We managed to safeguard our members’ retirement savings well, while meeting their immediate needs to deal with the current challenges. It was not easy at times as we had to walk a tightrope in ensuring that our members survive the difficult times while balancing their future needs.”

“The quick spread of COVID-19 and its transmissibility made it a Black Swan event that many found challenging to manage. However, we were proactive in managing the pandemic and that helped us to ride through the challenges. Our focus on digitalisation enabled us to assist our members more efficiently and seamlessly while ensuring that we remain relevant to members who are more technology-savvy.

“The EPF’s speed of adaptability in its investment strategy and processes ensured that we were able to deliver optimum performance, and we further leveraged on the strength of our approximately 250-strong investment professionals who diligently managed the portfolios and took proactive measures. Solid teamwork and digital infrastructure ensured that we could adapt seamlessly to the new work norms,” Tan Sri Ahmad Badri added.

Assisting members through difficult times

Besides focusing on fund performance, the EPF also had to strike a balance between assisting its members through the pandemic who face drastic cash flow issues, while still safeguarding their retirement fund.

In fact, the EPF was one of the first retirement funds to provide assistance for its members with the introduction of the i-Lestari Account 2 Withdrawal Scheme, a hassle-free programme that lets members withdraw RM500 monthly from their Account 2 savings for 12 months. It also introduced the option of reducing members’ mandatory statutory contribution rates from 11% to 7% from April to December 2020.

Beyond that, the EPF also assisted SME employers through the Employer Covid-19 Assistance Programme (e-CAP). The programme allows eligible SMEs to apply for a deferment and restructuring of the employer’s share of EPF contributions to help manage their cash flow while still fulfilling their obligations of paying their portion of EPF contributions. The e-CAP programme benefitted 13,090 employers with a cumulative value of RM84.95 million.

2021 outlook

Moving into 2021, the EPF will further assist members to ease the continued economic slowdown caused by the pandemic.

With the worst seemingly over and Covid-19 vaccination drives in full force across the world, the EPF remains vigilant as new virus strains may put a dent on economic and market recovery. However, the fund remains committed to ensure members continue building their retirement savings.

In addition, the fund is also working on a new withdrawal scheme to allow members to purchase insurance or Takaful products as revealed in Budget 2021. The scheme is expected to be launched at the end of the year.

Comments (0)