Alex Cheong Pui Yin

20th September 2022 - 2 min read

Cybersecurity expert, Fong Choong Fook has cautioned the public that scammers now have upgraded tools that can help them to bypass banks’ security systems for online and mobile banking more effectively.

“New versions of software are now able to read one-time passwords (OTPs), and they can even delete the SMS sent by banks, leading (victims) to believe that they were not given any notification before fund transfers,” said Fong, who is also the chairman of local cybersecurity service provider LGMS Berhad. As such, he urged Malaysians to be even more diligent in avoiding any unverified mobile apps from unknown sources.

Fong further explained that the problem typically does not lie with banks’ cybersecurity infrastructure and online systems. He said that all banks are required to perform annual assessments on their systems – as mandated by Bank Negara Malaysia (BNM) – where they will run various checks to test its integrity. Based on these tests, the IT infrastructure and systems installed to identify cybersecurity risks are considered up to standard.

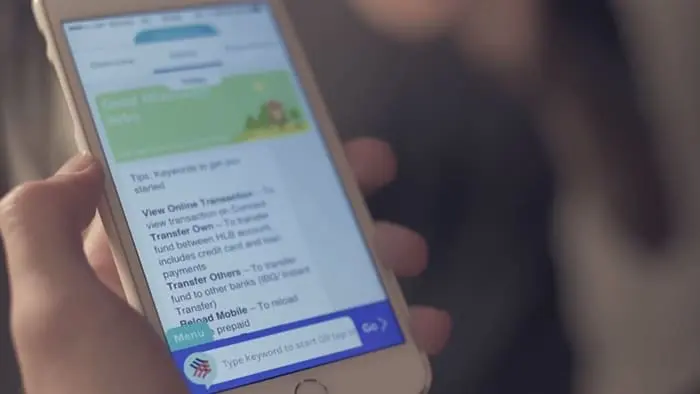

“From a cybersecurity perspective, scammers are unable to penetrate or change the online banking system. Instead, they find ways to attack (accountholders) through mobile apps. The problem is that Malaysians download unverified apps, which often become security threats that steal information stored on mobile phones. This is the root of the problem,” Fong stated.

Given the situation, Fong said that authorities will need to organise more awareness campaigns on online banking financial scams. Additionally, he suggested that the banking industry should collaborate to stop illegal transfers to mule accounts by identifying and blocking suspicious accounts at the early stage.

Finally, Fong stressed that scammers are constantly updating and improvising their technologies. Therefore, the public must always be vigilant with regard to the apps that they download into their phones.

Aside from Fong, other experts have also raised the alarm on the speed with which fraudsters are updating their tactics to swindle unsuspecting victims. An app developer, for instance, had previously demonstrated the dangers of downloading unverified apps. Maybank, too, warned its customers of malware scams involving malware-ridden apps that steal victims’ personal and banking details.

(Source: The Sun Daily)

Comments (0)