Alex Cheong Pui Yin

28th July 2020 - 2 min read

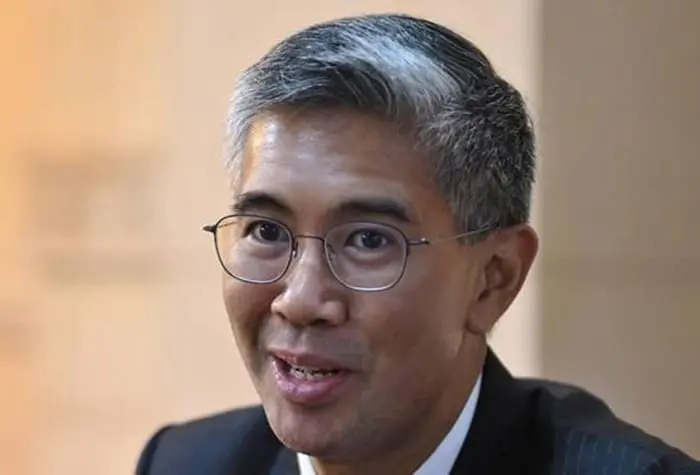

(Image: Focus Malaysia)

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz has said that the government will make an announcement soon regarding the extension of the ongoing six-month loan moratorium.

Tengku Zafrul also noted that the local banks have expressed their commitment to continue helping the Malaysian public in this challenging climate. He further said that the government is ready to aid borrowers who are truly in need of assistance by taking a targeted approach in restructuring their loans.

“With the opening of the economic sectors, some individuals and businesses have been able to continue paying their loans, but there are still those who are unable to do so either because they lost their jobs or because their economic sector is still heavily impacted. For the (latter) group, targeted approach assistance will be considered by the banking industry and these banks are currently contacting the borrowers,” said Tengku Zafrul during a parliamentary sitting.

At present, more than 93% and 95% of individuals and local businesses are benefitting from the moratorium, respectively.

During the same session, Tengku Zafrul also revealed that the banking industry will see an estimated total loss of RM6.4 billion from the six-month loan moratorium period. “The banking sector is estimated to suffer the Malaysian Financial Reporting Standards (MFRS) losses of RM1.06 billion for every month the moratorium is in place. In total, the loss will be about RM6.4 billion, equivalent to the reduced capacity for banks to provide new loans to borrowers,” he said.

(Image: The Star)

Earlier last week, Tengku Zafrul said that the government has yet to decide on whether the loan moratorium will be extended, and that it was still in the midst of discussion with local banks. The aid, which was introduced in April to ease the financial burden on the Malaysian public, is set to end on 30 September 2020. Various parties have called for an extension even as some banks – such as CIMB and AmBank – expressed their disinclination to offer a blanket extension to all customers.

(Source: New Straits Times)

Comments (0)