Alex Cheong Pui Yin

23rd September 2020 - 2 min read

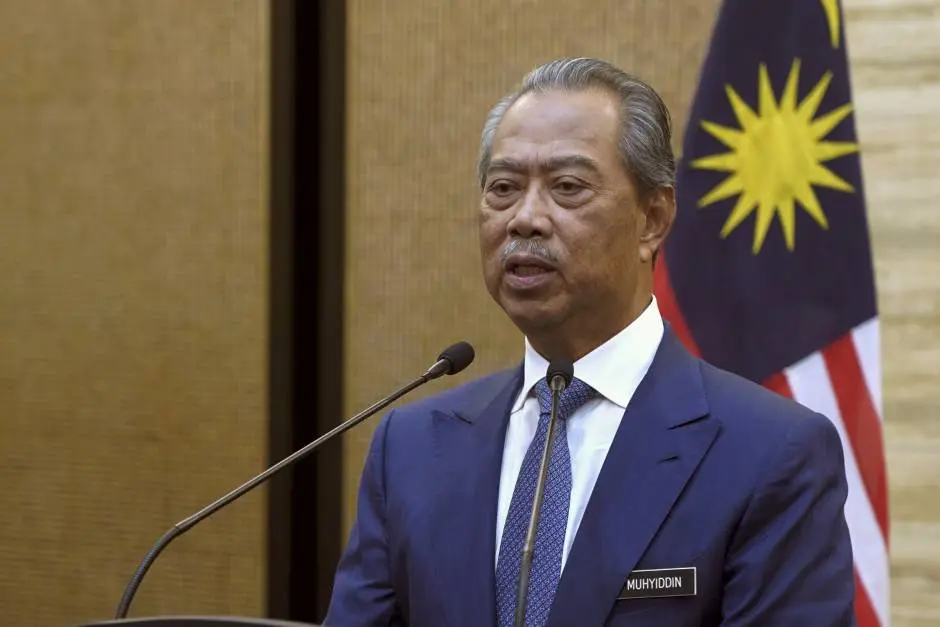

Prime Minister Tan Sri Muhyiddin Yassin has announced a follow-up to the current Wage Subsidy Programme, which is slated to end on 30 September 2020. Dubbed the Wage Subsidy Programme 2.0, this updated initiative – introduced as part of the new KITA PRIHATIN Package – shares the same objective as its predecessor: to prevent employees from being let go and lose their income.

Under this new programme, only companies that are still facing an income loss of 30% compared to the previous year since the start of the MCO can apply. This revised requirement differs from the ongoing Wage Subsidy Programme, which is open to employers who have suffered an income loss of more than 50% since 1 January 2020.

The prime minister further clarified that companies must also be registered with the Social Security Organisation (SOCSO) by 31 August 2020 in order to be eligible for the new programme.

The Wage Subsidy Programme 2.0 is set to run for three months, starting from 1 October until 31 December 2020, and will continue to offer a RM600 salary to eligible employees (up to a maximum of 200 workers per company). However, companies that have never received aid via the ongoing Wage Subsidy Programme will be eligible for salary subsidies of up to six months (an extra three months) through this new programme.

A total of RM2.4 billion has been allocated for this new initiative, and it is expected to benefit 1.3 million employees.

The ongoing Wage Subsidy Programme was first announced through the Prihatin Economic Stimulus Package back in March 2020, and was subsequently extended in early June through the PENJANA economic recovery plan. The programme was said to have saved 2.4 million jobs as of June 2020.

Comments (1)

is the wage subsidy received, subject to income tax?