Jacie Tan

29th June 2021 - 3 min read

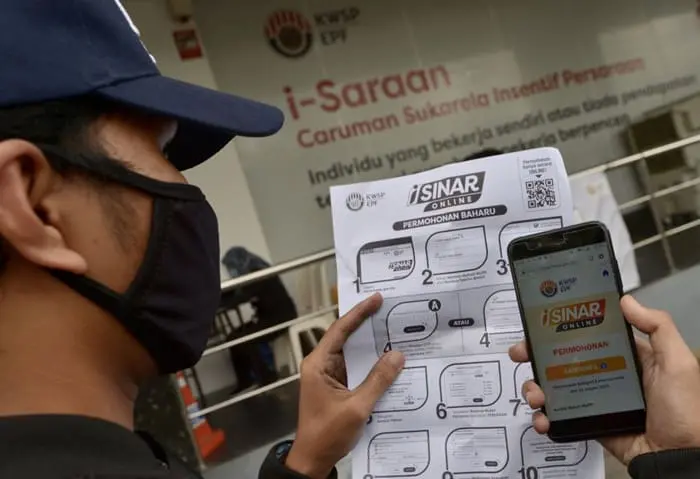

On 28 June 2021, Prime Minister Tan Sri Muhyiddin Yassin announced that Employees Provident Fund (EPF) members would once more be allowed to make withdrawals from their EPF funds as the ongoing movement control order continues. The new i-Citra programme was revealed as part of the PEMULIH stimulus package and will allow EPF members to withdraw up to RM5,000 worth of funds from their account.

Here is more information on the new EPF i-Citra withdrawal facility based on the FAQ that has been released by EPF.

What is i-Citra?

i-Citra is the name of the facility that allows members of the EPF to withdraw up to RM5,000 worth of funds from their EPF account. Neither the prime minister nor the EPF’s FAQ page made reference to which account the funds would be withdrawn from. However, when asked, an EPF customer service representative stated that the i-Citra amount would be withdrawn from Account 2 first; if the funds in Account 2 are not sufficient, the balance will be withdrawn from Account 1.

Who can apply for i-Citra?

EPF members who are aged 55 years and below (including non-citizens and permanent residents) who have at least RM150 in balance in their EPF account upon application are eligible for i-Citra.

Are there any conditions for i-Citra?

There are no further conditions or requirements to prove financial difficulties imposed under the i-Citra programme. As long as you fulfil the eligibility criteria above, you can apply for a withdrawal via i-Citra.

How much can you withdraw through i-Citra?

You may withdraw up to a maximum of RM5,000 under the i-Citra programme – as long as you leave a balance of at least RM100 in your Account 1. The amount you can withdraw is based on your total funds on the date that your application is processed, minus any pending i-Sinar payments.

How will the i-Citra payments be made?

Payments will be made monthly for up to five months. The payment amount is set at RM1,000 a month or depending on your account balance. The minimum payment amount is RM50.

When do i-Citra applications open?

Applications start on 15 July 2021 and will remain open until 30 September 2021.

How can I apply for i-Citra?

i-Citra applications will be done wholly online through the icitra.kwsp.gov.my portal. You will be able to access this portal when applications open on 15 July.

Will I be able to apply for i-Citra if I have made i-Lestari and i-Sinar withdrawals?

Yes, subject to the i-Citra eligibility criteria mentioned above.

When will the i-Citra withdrawals be paid out?

Payments for applications made in July are expected to be paid out starting in August 2021.

Can funds in my Akaun Emas be withdrawn via i-Citra?

No. Funds in Akaun Emas consist of contributions made by those who continue working after the age of 55, to be withdrawn at age 60. Only those aged 55 and below can use i-Citra.

How can I get further information or make enquiries?

You can visit the EPF website and make use of the chat system ELYA, get in touch via the EPF’s official social media channels, or call the i-Citra hotline at 03-8922 4848.

Comments (0)