Jacie Tan

28th January 2020 - 2 min read

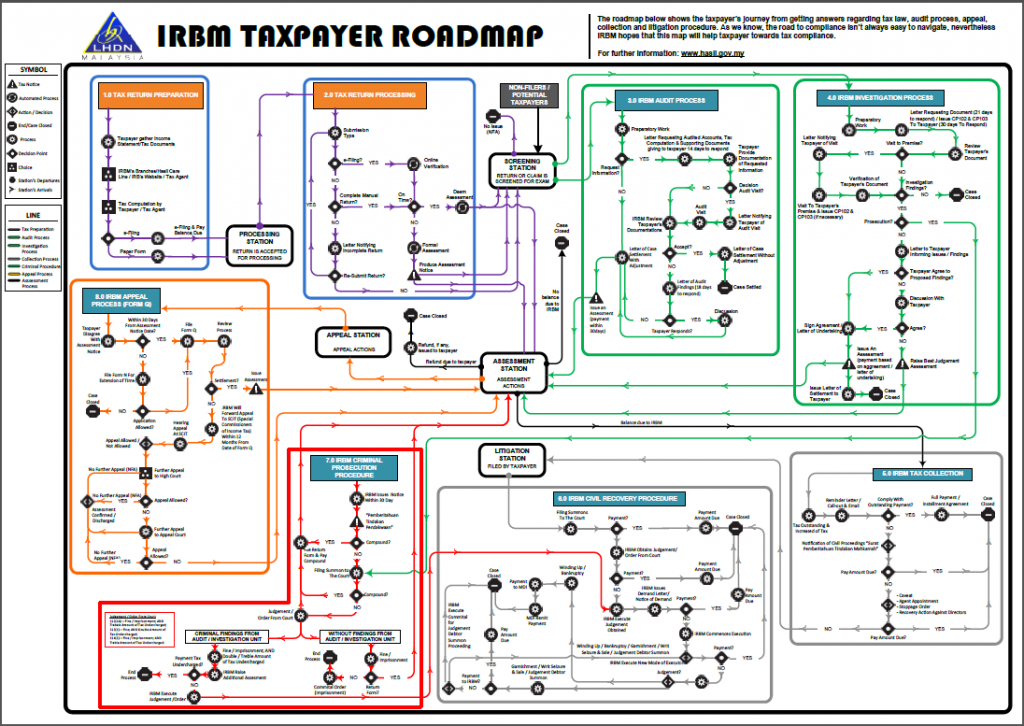

The Inland Revenue Board (IRB) has released a “Taxpayer Roadmap” for the benefit of the general public. The roadmap shows a taxpayer’s journey – from the basic processes like filing taxes to the more complicated procedures like appeals and litigation.

The Taxpayer Roadmap breaks down the income tax journey into eight steps. Most taxpayers are already familiar with the first two steps: tax return preparation and tax return processing. While not all taxpayers have cause to worry about the rest, the roadmap also details further income tax processes concerning audit, investigation, tax collection, civil recovery, criminal prosecution, and appeals.

“It was developed to assure and enhance the taxpayer’s confidence on the transparency of every action taken by the IRB,” said the Inland Revenue Board in a statement. “The IRB Taxpayer Roadmap also helps the IRB officers know the parameters and relationship of their duties with other officers, thus facilitating the monitoring of the status of their tasks and improving their service delivery.”

The Taxpayer Roadmap, which was launched by Finance Minister Lim Guan Eng, is available for download in both BM and English on the IRB portal. It will also be made available at IRB service counters.

(Source: Bernama)

Comments (0)