Alex Cheong Pui Yin

24th November 2020 - 3 min read

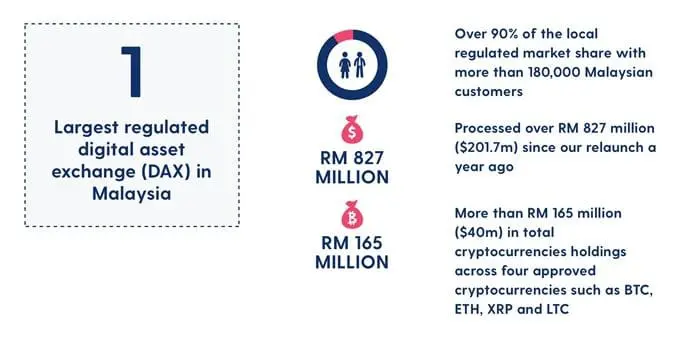

Digital asset exchange Luno revealed that it has processed over RM827 million worth of transactions since relaunching its operations within Malaysia in late 2019. With more than 180,000 users and over 90% of the local regulated digital asset exchange market share, this makes Luno the largest cryptocurrency exchange in the country.

Luno had actually been operating in Malaysia since 2015, but it was prevented from receiving new customers starting from January 2019 due to regulation issues. It was required to obtain a licence from the Securities Commission (SC), which was eventually granted in October 2019. This subsequently led to the relaunch of Luno’s operations as the first SC-approved cryptocurrency exchange in Malaysia.

Initially, Luno dealt exclusively in Bitcoin and Ethereum, but has now expanded to include Ripple and Litecoin as well. At present, Luno stores more than RM165 million on behalf of its customers across the four approved cryptocurrencies.

“It is very encouraging to receive such a great reception from Malaysian customers. Investment in cryptocurrency have been increasing steadily in Malaysia with many investors looking to cryptocurrencies as a good store or a start to their investing journey,” said the country manager of Luno Malaysia, Aaron Tang.

Tang also said that 68% of Luno users buy cryptocurrencies for investment purposes as they look for alternative investment vehicles to diversify their portfolios. Additionally, most of these users fall within the age bracket of 30 to 49 years old.

According to Tang, Luno has also introduced several new features in Luno to prioritise customer security and usability. One such feature is the ability to make deposits via FPX, allowing for instantaneous transactions and, consequently, an improved user experience. The cryptocurrency exchange also launched a Repeat Buy feature, enabling users to schedule automatic purchases.

On top of that, Luno has struck a partnership with blockchain intelligence company, IntoTheBlock, to provide users with better trading signals and data visualisation tools, intended for those who are into trading cryptocurrencies. It has also updated the trading view on its desktop application, as well as added market and stop-limit orders to its services. To briefly explain, market order is an order that is placed by specifying the amount that you wish to trade, which are then carried out immediately at the best available rate in the market. Meanwhile, stop-limit orders is a function where your orders to buy or sell an asset is activated only when your specified price for trade has been triggered.

Additionally, Luno has been collaborating with the SC to generate a collection of informational content aimed at educating Malaysians on the safety and risks of trading digital assets. “Over the last few years, the infrastructure that allows people to invest in cryptocurrencies have come a long way. Regulated cryptocurrency exchanges must meet stringent anti-money laundering laws and investor protection requirements. Luno has provided simple access users from all walks of life who are now able to directly access powerful online trading tools, which have historically been limited to professional investors,” said Tang.

Tang further hoped that the improved conditions brought about by regulated cryptocurrency exchanges, as well as continued governmental recognition will provide a conducive environment for users to purchase and trade digital assets safely.

Moving forward, Luno is looking to roll out various other new features, including new cryptocurrency offerings and deposit/withdrawal options. It also plans to introduce a service called the Savings Wallet, which is said to offer a targeted rate of 4% interest per annum (subject to market situation). That said, the Savings Wallet is currently still under review by local regulators, although it has already been made available in other markets.

Comments (0)