Alex Cheong Pui Yin

27th October 2022 - 3 min read

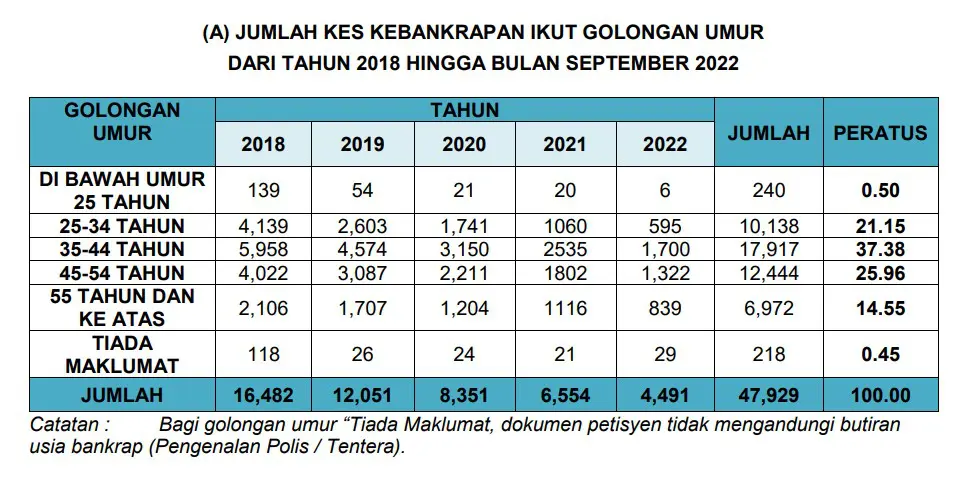

Latest data from the Malaysian Insolvency Department (MdI) indicated that the number of bankruptcies in the country has reduced significantly from a high of 16,482 in 2018 to 4,491 in 2022 (as of September). This achievement has been largely attributed to the initiatives of debt advisory agencies and financial planners, leading to an increase in financial literacy among young Malaysians.

Based on MdI’s data, 58% of individuals who were declared bankrupt from 2018 to September 2022 belonged to the age group of 25 to 44 years old, equivalent to 28,055 persons (2,295 persons in 2022, as of September). Meanwhile, bankrupt individuals under the age of 25 years old that were recorded from 2018 to September 2022 came up to only 0.5%, with only 6 individuals this year.

Looking at the data, licensed financial planner Marshall Wong said that although more than half of the bankruptcies were recorded among youths (25 to 44 years old), the number has been gradually declining between 2018 to 2022. This, in turn, indicates an effort on the part of young Malaysians to take charge of their financial well-being.

“We should give credit where it’s due. The bankruptcy rate is declining faster for those younger than 45 years old. I believe this is because youths are a lot smarter in managing their finances now than five years ago,” said Wong.

Wong also said that organisations like the Credit Counselling and Debt Management Agency (AKPK), the Financial Planning Association of Malaysia (FPAM), and the Malaysian Financial Planning Council (MFPC) can be credited for this increase in financial literacy. This is as they have been consistently promoting financial literacy through various events and campaigns, in addition to relevant content that is shared by other credible individuals on social media.

AKPK, in particular, has been instrumental in assisting Malaysians and businesses that faced debt repayment difficulties and other financial struggles following the Covid-19 pandemic and the end of loan moratoriums granted by banks. Its services include providing financial education, advisory, and debt management programmes – applicable to both bankrupt individuals and those who would like to seek advice before committing to any financial agreements.

Aside from that, Wong highlighted that personal loans continue to be the main cause of bankruptcies because borrowers often have reasons to apply for one, including medical expenses, house renovation costs, and children’s education expenses. According to MdI’s data, personal loans were cited as the reason for 42% of the total number of bankrupt cases, followed by vehicle purchases (14.5%) and business loans (13.8%).

“It is also worth noting that there is a drop in bankruptcies due to credit card loans from 10.99% in 2018 to 3.99% in 2022. I think this is quite significant and a good sign due to the high interest imposed on credit card (debt) compared with other loans,” said Wong.

Malaysia’s bankruptcy threshold is currently set at RM100,000, raised from RM50,000 back in 2020. The government had also subsequently remarked that it may once again review the country’s bankruptcy threshold in the future.

(Sources: MdI, The Sun Daily)

Comments (0)