Alex Cheong Pui Yin

15th June 2020 - 2 min read

A survey by Think City, a citymaking agency, has revealed that Malaysians with pay cuts or are self-employed struggle more than the unemployed to pay their rents and bills.

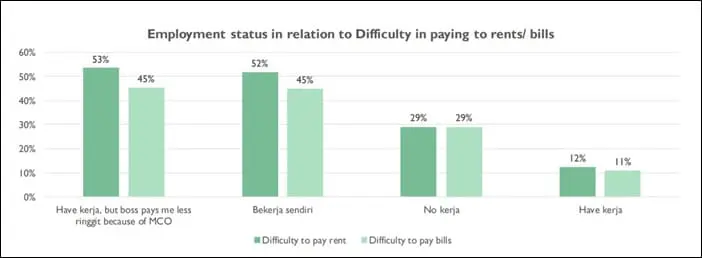

According to the findings of the survey, 53% of the respondents who received a pay cut said that they faced difficulty in paying rent, whereas 45% had trouble settling their bills. Those who are self-employed, too, shared very similar figures: 52% and 45% said that they had difficulty paying their rent and bills, respectively.

Meanwhile, only a surprising 29% of those who were unemployed said that they found it difficult to pay their rent, and another 29% voted that they struggled with their bills. Malaysians who retain their full pay, on the other hand, polled that 12% and 11% had trouble settling their rent and bills, respectively.

While the survey did not share an analysis to explain the finding, it is possible to speculate that this disparity could be caused by a change in lifestyle. Malaysians who received pay cuts may feel like they struggle with their rent and bills because they now have less disposable income to sustain their existing lifestyle. This, in turn, caused them to draw from budget meant for such priorities. Unemployed individuals, in contrast, are used to limiting themselves to minimal expenses and have fewer financial obligations.

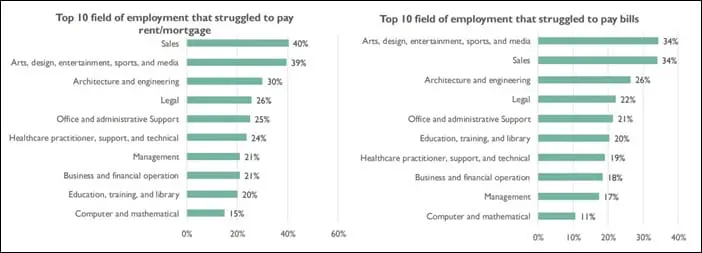

The survey also revealed that those working in the sales, arts and entertainment, as well as architecture and engineering industry struggled more than those in other fields of employment to pay their rent and bills. In comparison, those in highly specialised fields – such as healthcare, computers, and mathematics – have less trouble doing so.

The community survey, titled “You ok or not during MCO?”, ran between 15 to 23 May 2020 and saw a total of 2,240 respondents. Matt Benson, who created the survey and is also the programme director for Think City, said that it was meant to gather baseline data on how Malaysians fared during the lockdown period. Aside from researching the financial concerns of the respondents, the survey also sought to gauge other aspects of their wellbeing, such as their stress level and emotional condition.

“It is important that we understand how Malaysians are coping, whether they are in need of help, and if so, what kind of help. The results will be useful to us in innovating solutions that could potentially help reduce stress or deliver aid to Malaysians in need,” Benson added.

(Source: Malay Mail)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)