Alex Cheong Pui Yin

26th January 2024 - 3 min read

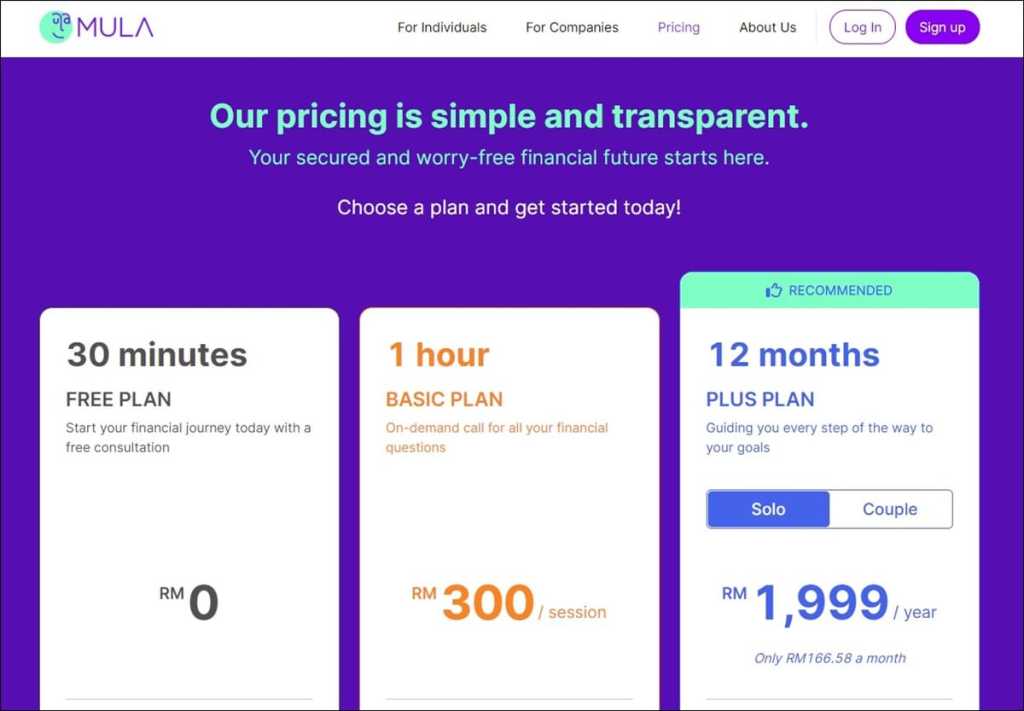

Digital financial planner MULA has refreshed its financial planning consultation packages, with updated features and pricing structures. Specifically, it now offers a free-trial plan, along with the Basic and Plus plans that are priced from RM300 to RM3,399 to meet the different preferences of its customers.

Depending on which plan you opt for, you will be able to gain unlimited access to your financial planning coach, thereby providing valuable and continuous support as you execute steps to improve your financial standing. Additionally, you may gain access to an exclusive stock investment community and market updates, enabling you to interact with other like-minded individuals.

Here’s the full list of benefits that you can enjoy under each plan offered by MULA:

| Free plan (one-off free trial) | Basic Plan (one-time plan) | Plus Plan (12-month plan) | |

| Pricing | Free (can only be claimed once per individual) | RM300 | – RM1,999 (for single individual) – RM3,399 (for couples/life partners) |

| Access to financial coach | 1 session (30 minutes) | 1 session (one hour) | Unlimited access to financial coach for a year, with a minimum of four consultation sessions: – Meet your financial coach – Build financial roadmap – Progress check-in – End of plan progress summary |

| Assessment level | Financial review on any preferred topics | Financial review on any preferred topics | Comprehensive evaluation across six categories: – Cash flow – Insurance – Investment – Goals – Tax planning – Estate planning |

| Action plans | Receive suggestions on what to do next | Receive suggestions on what to do next | Receive step-by-step action plan, tailored for your financial goals |

| Financial report/recap of consultation | Receive recap of consultation via email | Receive recap of consultation via email | Receive a detailed personal finance assessment and tailored action plan |

| Access to stock investment community & exclusive market updates | No | No | Yes |

For comparison, MULA previously did not have a free-trial plan, offering instead a Standard Plan that is priced at RM999 (individual) and RM1,499 (couples/life partners), as well as a 360 Plan that cost RM1,399 (individual) and RM2,099 (couples/life partners). These updated packages came about following feedback from MULA’s existing customers, who said that they sought more interaction and support from their coaches.

In addition to this, MULA now also has a referral programme that is exclusive only for onboarded customers, which allows them to earn 10% on the total subscription fee when their referees subscribe to MULA’s Plus Plan. Additionally, earn another 5% if your referees subsequently renew their Plus Plan subscription.

MULA is licensed by the Securities Commission Malaysia to provide financial services, and is the subsidiary of Malacca Securities Sdn Bhd. It also rolled out its very own app in October last year.

(Source: MULA)

Comments (0)