Jacie Tan

29th July 2020 - 3 min read

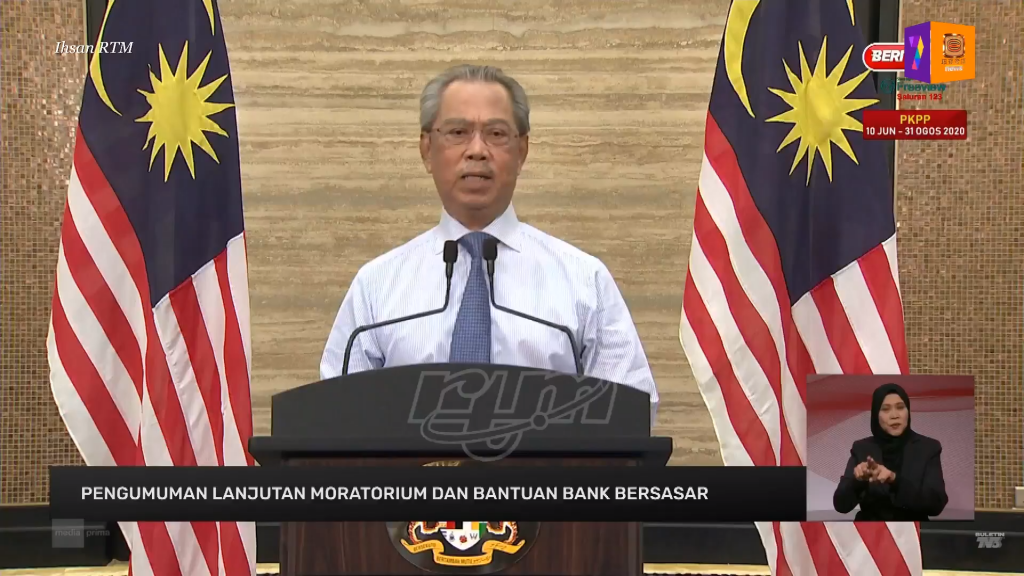

Prime Minister Tan Sri Muhyiddin Yassin has officially revealed the details of the moratorium extension and targeted bank assistance that will take place once the current six-month blanket moratorium ends on 30 September 2020.

According to the Prime Minister, the easing of movement controls has displayed encouraging signs of economic recovery, with more people returning to work. In line with this, some 270,000 borrowers who initially opted for the moratorium have resumed repaying their loans between May to July 2020.

Nonetheless, the income and cashflow challenges remain for others, which was why the Government has opted for a targeted assistance instead of a blanket extension of the moratorium.

Extended moratorium for the unemployed

Individuals who have lost their jobs this year and still have not procured new employment are eligible for an extended targeted moratorium for a period of three months. After these three months, the moratorium may be further extended by the banks depending on the circumstances of each individual at hand.

Reduced instalments for those suffering from salary cuts

Meanwhile, individuals who are still employed but are suffering paycuts due to Covid-19 can have their monthly instalments lowered in line with their reduced salaries. For housing or personal loans, the monthly instalment will be reduced at a rate that is in equal proportion to their salary cut rate. This assistance will be given for at least six months and further extensions may be possible based on the individual’s salary situation at that point in time.

Revised instalment schedules for hire purchase agreements

For hire-purchase loans, the banks will offer the option of rescheduling your monthly instalments as necessary, subject to the Hire Purchase Act. For example, you have the option of extending the repayment tenure of your loan and pay a lower monthly instalment.

Additional repayment flexibility for individuals and SMEs

Tan Sri Muhyiddin also stated that the banks are committed to assisting all individuals and SMEs affected by Covid-19, offering assistance such as:

- allowing borrowers to only pay the interest portion of the loan for a specified period of time

- lengthening the overall period of the loan as a means to reduce monthly instalments

- providing “other forms of flexibility” until the borrower is in a more stable position to resume repayments in full.

In a statement, Bank Negara Malaysia (BNM) urged borrowers who have the means to resume repayments to do so as it will reduce their overall debt and borrowing cost.

Applications for extended moratorium to open from 7 August

According to the prime minister, borrowers who are eligible for these financial aids should contact their respective banks to make the relevant applications starting 7 August 2020.

Comments (0)