Alex Cheong Pui Yin

22nd August 2023 - 2 min read

Bank Negara Malaysia (BNM) announced that the government is looking to enhance the iTEKAD financial programme so that it can better assist microentrepreneurs as well as small and medium enterprises (MSMEs) that are in need, particularly those from the B40 group. Specifically, the programme will receive an additional funding of RM6 million to carry out its initiatives.

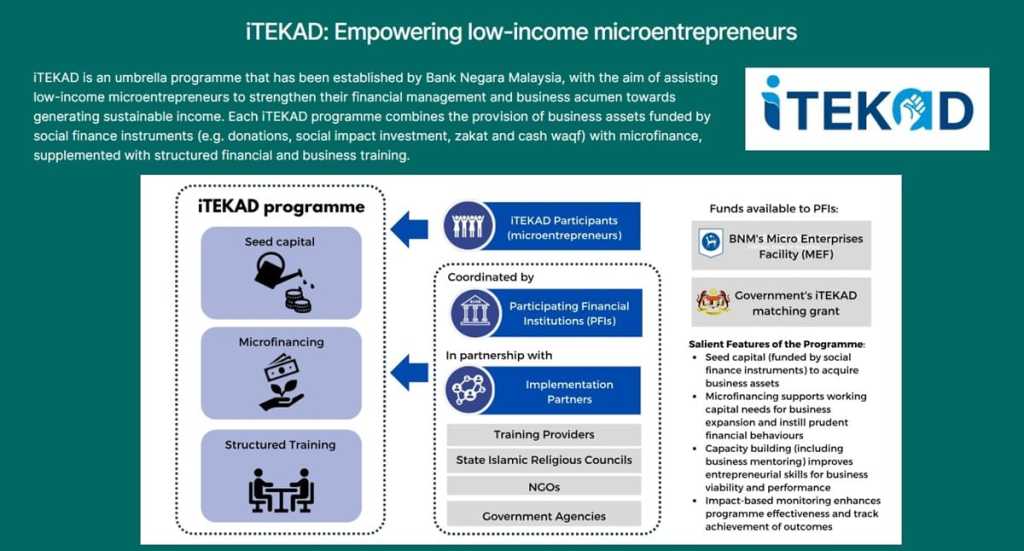

The iTEKAD programme – which had an allocation of RM4 million under Budget 2023 – was first introduced during Covid-19 to assist low-income microentrepreneurs in their financial and business management so that they can generate sustainable income. Among other things, it provided structured training, seed capital, and microfinancing for these individuals – and is in line with the Financial Sector Blueprint (2022-2026) to elevate the financial wellbeing of households and businesses.

In turn, these MSMEs may eventually contribute back to the society by providing job and economic opportunities within their respective communities. This ultimately helps to bridge the gap between the poor and the rich, with the final aim of eradicating national poverty.

In terms of participants, BNM has seen over 3,000 microentrepreneurs tap into the solutions provided via iTEKAD as of May 2023. It also currently has 11 participating financial institutions and over 50 implementation partners to implement iTEKAD’s solutions, including Bank Islam, CIMB Islamic, Bank Muamalat, Agrobank, and Bank Simpanan Nasional (BSN).

Moving forward, BNM hopes to grow the number of iTEKAD participants to over 4,000 individuals. It also aims to bring more financial institutions and implementation partners onboard – an aspiration that is echoed by Prime Minister Datuk Seri Anwar Ibrahim as well.

“I hope that in the next few months, the figure will reach 20 banking institutions [for iTEKAD]. If not, I will request to see the list of those that have not joined and expand it further in the private sector,” said Datuk Seri Anwar during the Majlis Jalinan Kerjasama iTEKAD organised by BNM today. He further stressed that the involvement of banks is crucial to the success of programmes like iTEKAD as it means better efficiency in the management of the programmes.

Finally, BNM urged corporates from both the public and private sector to reach out to any participating financial institutions if they wish to be part of the iTEKAD initiative.

(Source: Malay Mail)

Comments (0)