Hayatun Razak

3rd June 2019 - 2 min read

(Image: The Star)

(Image: The Star)

PTPTN Public Affairs Department senior general manager Abdul Ghaffar Yusop has revealed that the corporation only received RM558 million in PTPTN repayment collections for the first quarter of this year. The body only received between RM150 million to RM180 million each month last quarter – well below the RM300 million per month it aims for. As a result, the cumulative outstanding loan amount stands at RM6.5 billion as of 30 April, with a total of about 350,000 defaulters.

At the current rate, PTPTN will only receive about RM2.2 billion in loan repayments by the end of the year – just slightly more than half of the RM4 billion per year it needs to continue providing loans for new and existing students. When asked if PTPTN still has enough funding to provide education loans, Ghaffar said “At the moment, we still have funds that were collected from last year. So we can utilise this.”

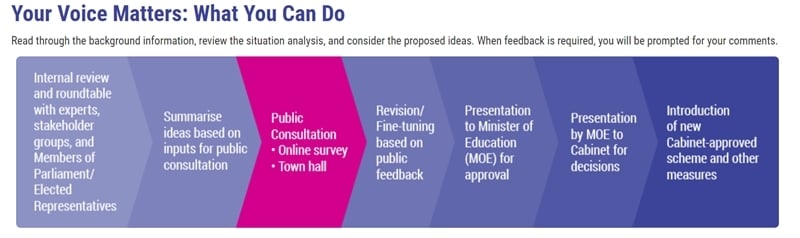

On 16 May, PTPTN began conducting a public consultation programme that aims to find a viable repayment scheme that will benefit both the corporation and the borrowers from the feedback and ideas received. Nearly 100,000 responses have been collected so far, and PTPTN expects the programme to be completed by mid-June. The body will then submit a report to the Cabinet for a new loan repayment policy to be drafted.

(Source: The Sun Daily)

Comments (0)