Jacie Tan

14th July 2020 - 3 min read

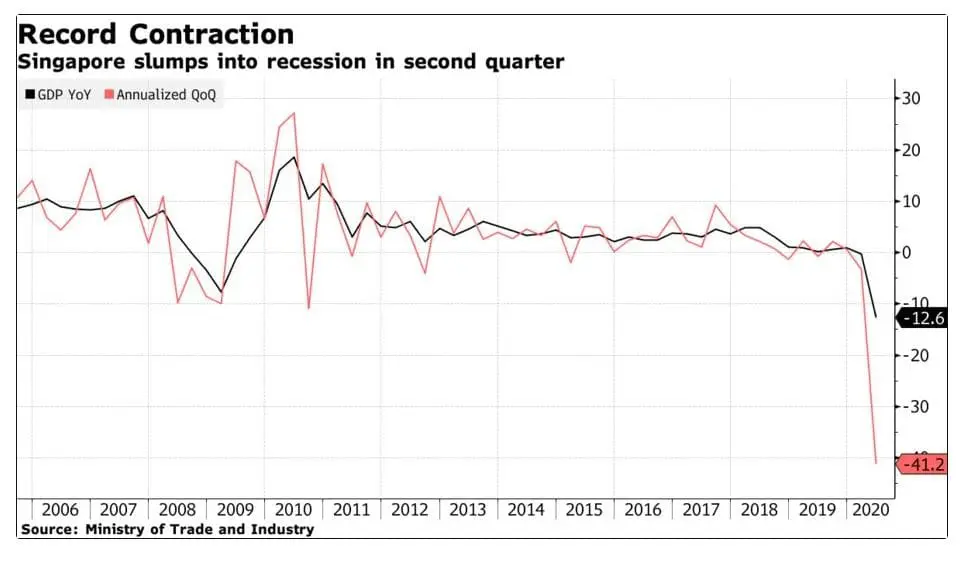

The Singaporean economy plunged into a recession in the second quarter of 2020, with a decline of 41.2% in gross domestic product (GDP) from the previous three months. The drop in GDP is the nation’s biggest quarterly contraction on record.

According to Bloomberg, the slump in Singapore’s growth figures indicate that the island nation is taking a bigger hit than many other Asian countries. At a decrease of 20% in GDP for Q2 2020 from the previous three months, Japan’s GDP decline rate is half of that of Singapore’s; it is also expected that China’s economy will return to growth when data figures are released this week.

Singapore’s huge drop in growth can be attributed to blows dealt by the Covid-19 pandemic on multiple fronts. The country’s export-reliant manufacturing industry was hit hard by the plunge in global trade due to Covid-19, plunging 23.1% compared with a growth of 45.5% in the previous three months. Meanwhile, Singaporean retailers were faced with a record dip in sales following the weeks-long partial lockdown measures in the last quarter. Services shrank 37.7% with airlines, hotels, and restaurants restricted during the “circuit breaker” measures implemented from 7 April to 1 June. The construction also took a massive hit, plummeting by 95.6% quarter-on-quarter.

The Singaporean government has already pledged about SGD $93 billion in stimulus packages to shore up troubled businesses and households. Trade and Industry Minster Chan Chun Sing stated, “We expect the recovery to be a slow and uneven journey, as external demand continues to be weak and countries battle the second and third waves of outbreaks by reinstating localised lockdowns or stricter safe-distancing measures.” The government’s current projection for the economy is a full-year contraction of 4-7%.

(Image: AFP)

Head of economics and strategy at Mizuho Bank Ltd said that the last quarter’s drop was likely to be the bottom of the cycle – “unless Singapore is forced to regress to the harsher iteration of circuit-breaker measures”. He added that the four fiscal packages given by the government would need time to permeate and cascade, although the possibility of additional stimulus is not ruled out.

Ho Meng Kit, head of the Singapore Business Federation, also predicted that the following two quarters would likely be better than Q2 with the economy having opened up since early June. However, with the tourism industry currently remaining on hold in Singapore, the economy is still not performing at previous levels due to the impact on demand, causing certain sectors to continue to be weak.

“Though there have been signs of a substantial pickup in activity in 3Q, we don’t expect a return to positive growth until 1Q 2021,” said Tamara Mast Henderson, an ASEAN economist with Bloomberg. “A full recovery for this transport hub will require the normalisation of global travel and trade.”

(Source: Bloomberg)

Comments (0)