Diana Chai

25th September 2014 - 6 min read

Times are changing. Just as things were different 50 or even 20 years ago; they are changing today more rapidly than any of us can imagine. The rise of the single person household is an unmistakable phenomena with even more conservative Asian nations catching on. The Economist reported in 2011 that almost a quarter of Asians in their thirties to forties have never married and it doesn’t appear that the numbers look to decrease anytime soon.

We’re not here to debate on the reasons nor the merits of marriage versus singledom but if for your own good reasons you’ve chosen the route of ‘me my castle and I’; we are going to help you make the best decisions for retirement that you can.

Some Annoying Truths

Unfortunately, despite the pace of change within the make-up of households; it appears that few other areas of society has gotten the memo so admittedly; a single person will lose out on some benefits that married people still enjoy (and no we don’t mean childcare and the joy of wet towels on the bed).

- You won’t get as many tax breaks. Couples not only receive reliefs for themselves, they receive tax write-offs for children and each other.

- You can’t share costs. You pay full price for hotel rooms, internet, utilities, spa packages and other services which usually offer reduced priced packages for couples. Couples are obviously able to share rooms, homes and other costs halving their spending each.

- There isn’t the support of a second income. Just one income supporting a household can be tough. But not impossible.

Now those sound like some seriously trying odds but for many of those who have chosen the solitary life – the pay-off is getting to make your own decisions about your home, job, life and Astro subscription package without a heated debate. But the odds also mean a smaller, leaner retirement pot. After forking out some serious dough to just live well; singles don’t have the second income of a spouse to cushion a joint retirement fund. And this worries many but it doesn’t mean it’s the end of the world. Let us now tell you, single and fabulous people of the world, what you have going for you which will help you build that retirement pot sooner than you can say, “I do.”

Some Awesome Truths

Before you run out to the nearest matchmaking agency (or the biggest online one) in search of the person who’ll complete the financial ideal created by society; hear us out. You CAN save for retirement because here’s what you’ve got working for you.

- You can ‘follow the money’. It’s often true that single people usually have better careers and are paid more money. This isn’t due to discrimination but because a single person is more able to get up and take a job half way across the world if it pays better. Even in less drastic scenarios – a single person would be more able to move jobs without worrying about day care or considering their spouse’s job. You’ll also have more time to really dedicate to the job as opposed to a married couple with added familial responsibility.

- You can live small. You don’t need a huge family vehicle nor a big house. Whilst a smaller space and vehicle doesn’t exactly halve costs – it means you have more mobility, more choices and essentially more flexibility in terms of where you stay, work and play. New job out in the middle of bustling Hong Kong where I can quadruple my RM salary? No sweat; I can live in a breadbox for a bit whilst I grow the bank account.

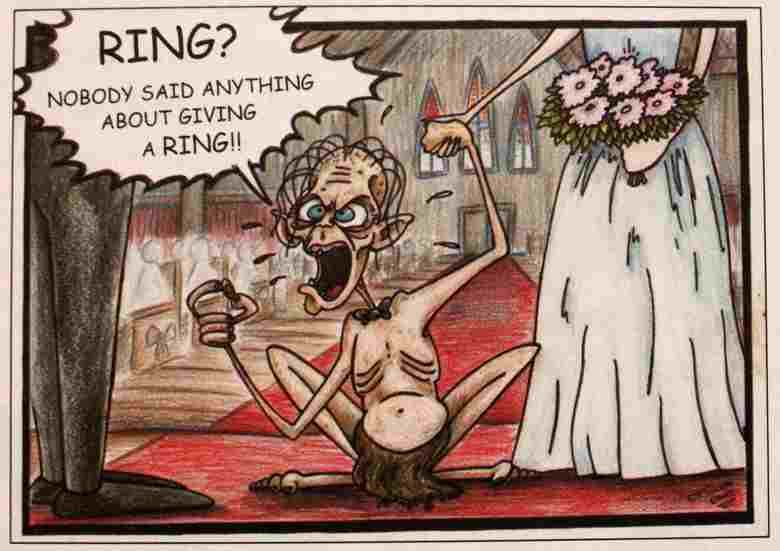

- You can make your own financial decisions. Whether it’s a risky stock you want to invest in or you want to buy rental property. Whatever you choose to do with your money is your decision alone. No council of Elrond required just because of the ring you accepted to carry.

- There are no children to support. Ringing up numbers may take days but the truth is – children are expensive. It’s not being cynical; it is a fact. Education costs are skyrocketing as we type. Have two or more kids and you’ve likely negated every financial benefit you’ve reaped from the bulleted list above.

Whilst this may seem like marriage bashing; it isn’t. We’re saying both statuses have financial strengths and weaknesses which you need to play to. But how does this help you build that retirement fund? We’re getting there…

Building a Solid Single Retirement Fund

So now you know what you have going for you and what you don’t. Acknowledging pros and cons is the first step to making better decisions. Let’s see how we can maximise this for building a solid retirement fund.

- Get a financial advisor (if you can afford it of course!). The financial advisor will be able to draw up a safe retirement plan for you and you only. Without the need to discuss this with a spouse or the need to factor their risk profiles into an already complicated calculation – the plan becomes much more straightfoward and easy to execute. This not only makes your decision making process easier; it also helps your advisor not fall into depression. Do this and you’ll have a gameplan based on what you feel comfortable with doing with your money.

- Follow the money. You can do this; you have a financial plan now if you’ve done step 1; so maximise the extra time and mobility you possess to build your wealth. This could be building a career; taking on consultancies or even just investing wisely.

- Get insured. Not having the second income back-up plan means any emergency medical bill or such thing will cause quite a rumble in your savings and deplete retirement funds. Insurance is important to everyone but even more so for singles. You’ll be glad to have a comprehensive policy that lovingly has your back. And you don’t have to make it coffee in the morning.

- Save as if you have children. Couples are often hounded by the nightmare that is a tertiary education fee and leaving an inheritance for their children. Get into the mindset of saving more like they do (because you’ll need it later on!) and put aside money into multiple saving accounts and secured investments (like fixed deposits and unit trusts) as if you have children to see to. You can always name them too. We found Trip to the Maldives for 3 months; Yacht Named Rosa; and Holiday Cabin in Switzerland very motivating names.

We’ve barely scratched the surface in terms of what singles can do to build their retirement fund. As society moves to eventually accept the dynamic nature of household makeup; hopefully there’ll be much more singles can do to enjoy as many financial benefits as couples. Until then; let’s work what we’ve got.

Comments (0)