Alex Cheong Pui Yin

26th April 2022 - 3 min read

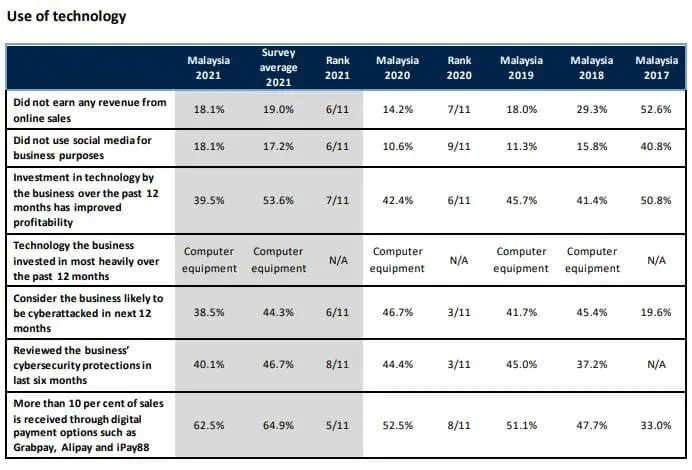

A regional survey conducted by CPA Australia has found that eight out of ten small businesses in Malaysia earned revenue from online sales in 2021. Revealed in the Asia-Pacific Small Business Survey (2021-2022), it also found that 62.5% of these businesses received more than 10% of their sales through digital payments, such as GrabPay, AliPay, and iPay88.

On top of that, many of the small businesses in Malaysia surveyed also showed awareness of the necessity of cybersecurity; 40.1% of local small businesses polled said that they had reviewed their cybersecurity measures in the past six months. Meanwhile, 38.5% of them expect some form of cyber attack on their business in 2022.

In a statement, CPA Australia noted that these findings – along with others in its official report – hinted at the tech-savvy nature of many Malaysian small businesses. It also pointed to their drive to harness technological innovations for long-term growth instead of just short-term survival.

“The findings are indicative of a new generation of entrepreneurs who are tech-savvy, innovative, and eager to promote what their business has to offer, both to the region and the world,” said the chairman of the Malaysian digital transformation committee for CPA Australia, Bryan Chung, adding that Malaysian respondents in the survey were typically younger, with 55.9% aged under 40 years old. This is in comparison with the survey average of 45.2%.

Furthermore, Chung said that the findings of Malaysia’s innovative culture are encouraging as compared to small businesses in several other Asia Pacific countries where the survey was also conducted. These include Singapore, Hong Kong, Taiwan, and Australia.

Aside from reporting on Malaysian businesses’ receptiveness towards technology, CPA Australia’s survey also obtained data on their financial health. For instance, close to 55% of Malaysian small businesses sought external finance in 2021 for business survival, and more than half of those who did seek external finance (in general) reported that they found it challenging to do so.

“Malaysia is also the only market where businesses found it more difficult than easy to pay their debts in 2021. These solvency problems are expected to continue this year with Malaysian small businesses again more likely to expect difficulty repaying debt than easy repayment conditions,” shared CPA Australia in its survey report. That said, many Malaysian businesses surveyed (66%) are confident that they will see growth in 2022, higher than the survey average of 61.9%.

The Asia-Pacific Small Business Survey (2021-2022) is CPA Australia’s 13th annual survey of small business issues and sentiments across 11 markets in Australia, New Zealand, and Asia. CPA Australia has been conducting this survey every year since 2009.

(Sources: CPA Australia, The Edge Markets)

Comments (0)