Alex Cheong Pui Yin

21st September 2023 - 2 min read

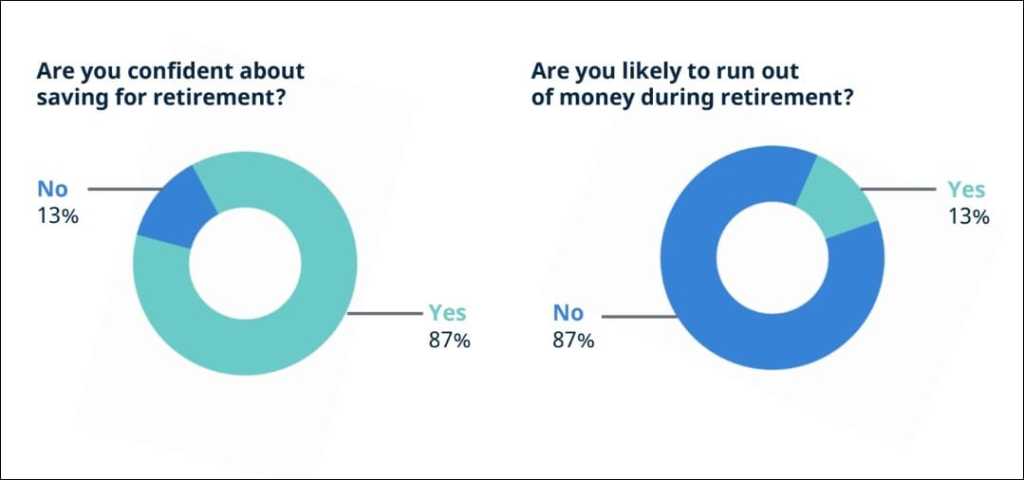

A recent survey by robo-advisor StashAway has indicated that although many of its M40 respondents are confident that they have sufficient savings to retire without worries, the reality is not so. Revealed in the M40 Malaysians’ Retirement Dreams vs Reality survey, it was found that an overwhelming 87% of participants believe they have enough to retire, but in actuality, 51% of them will use up their retirement savings in less than a year.

Even more distressing is the fact that 48% of the respondents anticipate being able to rely on their savings for up to 20 years, but only 7% of the survey participants have more than RM1 million worth of Employees Provident Fund (EPF) savings to retire worry-free. For context, the EPF had previously said that Malaysians who wish to retire in 20 to 30 years must have a minimum savings of RM1 million if they wish to have a dignified retirement.

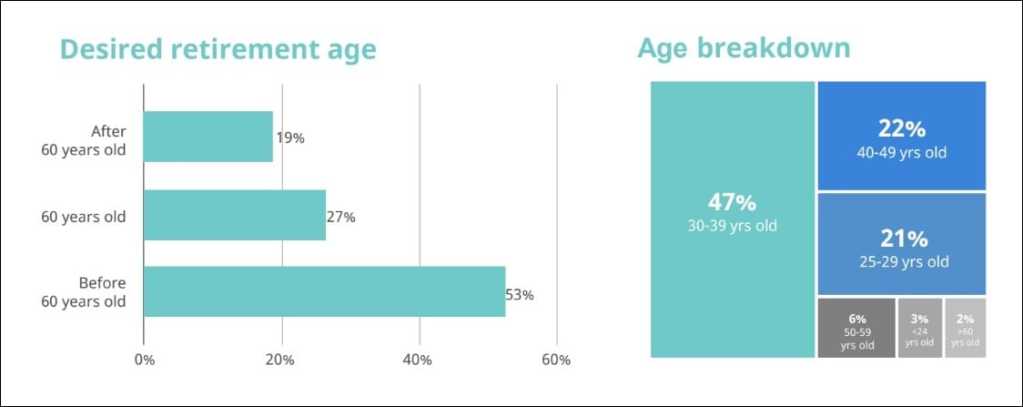

“The survey also found that 53% of participants wanted to retire before the age of 60 – even as their savings painted a different picture. With 69% of survey participants aged between 30 and 49 years old, many of them have about 20 years (or less) left,” StashAway shared in the survey report, noting as well that 45% of participants had less than RM100,000 set aside – not even meeting the basic retirement savings threshold of RM240,000 set by the EPF.

EPF’s basic savings threshold refers to the minimum amount of savings required by Malaysians to cover their basic retirement needs for 20 years (RM240,000), with the assumption that they need a minimum of RM1,000 monthly to live in retirement. This assumed figure is lower than Malaysia’s minimum wage of RM1,500.

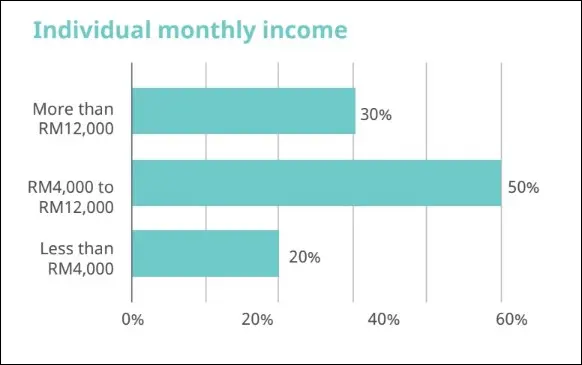

In terms of income earned, 30% of the respondents earned more than RM12,000, 50% earned between RM4,000 to RM12,000, and the remaining 20% earned less than RM4,000.

In light of these findings, StashAway said that it is crucial for Malaysians to begin “bridging the gap between aspiration and actuality” by reassessing their retirement strategies. For instance, they can consider investing as a viable solution, such as via the EPF’s Member Investment Scheme or other alternative avenues.

The M40 Malaysians’ Retirement Dreams vs Reality survey – which was conducted in collaboration with students from the Asia School of Business’ Action Learning Programme – had a total of 272 respondents.

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (1)

stupid survey.many retirees rely on stock dividen but the gov want to start CGT next year.Things getting worse in Malaysia.