Alex Cheong Pui Yin

23rd September 2022 - 3 min read

Chief strategy officer of the Employees Provident Fund (EPF), Nurhisham Hussein has said that individuals who are retiring in 20 to 30 years will need to have savings of at least RM900,000 to RM1 million. The amount is the “bare minimum” required, after factoring in variables such as inflation and medical bills – among others.

Meanwhile, Malaysians who are retiring in the next few years and staying in Kuala Lumpur will need about RM600,000 to have a “dignified” retirement. “When you look at the RM600,000 savings threshold, only about 4% of Malaysians could afford to retire. It’s a little lower outside of the Klang Valley,” Nurhisham further shared, adding that the amount will only cover ordinary outpatient medical needs or visits to general practitioners.

Nurhisham also stated that Alor Setar was found to be the most affordable place in country to lead a comfortable life upon retirement, but even that requires the retiree to have savings of at least RM480,000. This figure is twice the basic threshold for retirement savings of RM240,000.

For context, the basic threshold for retirement savings is a pre-determined amount in your EPF Akaun 1 that is set according to age, enabling members to achieve a minimum savings of RM240,000 when they reach the retirement age of 55. This is to ensure that members will have at least RM1,000 per month when they retire, in order to support their basic needs for 20 years (from 55 years old to 75 years old).

Despite these figures, Nurhisham said that at present, about 52% of EPF members have less than RM10,000 in their accounts, while 27% have less than RM1,000. Meanwhile, about 56% contributors, who are at the age of 54, only have less than RM50,000 in their EPF savings – an amount that can only sustain them for a little over four years, assuming that they only spend RM1,000 per month.

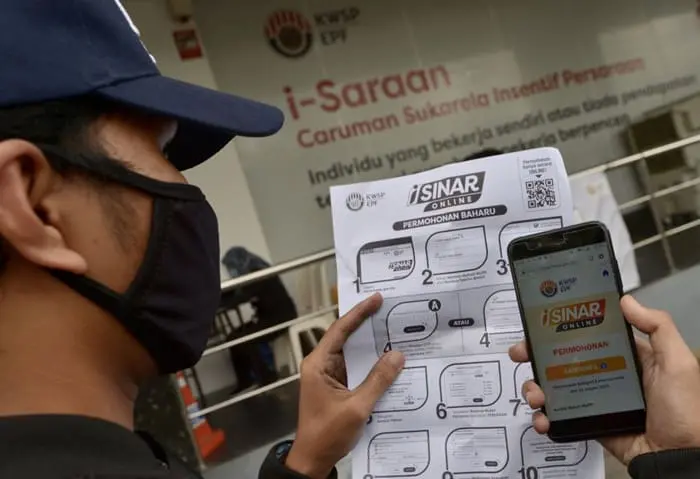

“That’s rather worrying. Obviously, I think the withdrawals have had a significant impact on retirement adequacy,” Nurhisham said, referring to the four Covid-related withdrawals that had been allowed thus far: i-Lestari, i-Sinar, i-Citra, and the RM10,000 special withdrawal facility.

It was also noted that prior to Covid-19, about 22% members met the basic threshold for retirement savings, but the number fell to 14% after these withdrawals. A total of RM145 billion was reported to have been withdrawn by members via the four withdrawal facilities.

Furthermore, Nurhisham said that one way for Malaysians to address this situation is to find multiple sources of savings and investments to complement their EPF savings. He also highlighted that the public can open an EPF account earlier on, instead of waiting to do so only upon formal employment.

Nurhisham is not the first individual to raise the alarm on this issue of insufficient retirement funds; several financial experts and planners have also expressed their concerns. Economist Dr Barjoyai Bardai, for instance, had previously claimed that Malaysians may need to work beyond the retirement age of 60 given the current condition of members’ EPF savings. Financial planner Azril Ikram also highlighted before in RinggitPlus financial planning workshops that Malaysians need savings of approximately RM1 million in order to retire comfortably.

(Source: The Star)

Comments (0)