Hayatun Razak

26th February 2019 - 2 min read

(Source: Mashable)

(Source: Mashable)

UOB has launched its first mobile-only bank in Thailand – and has plans to expand to other markets across the region. The mobile-only bank is called TMRW (pronounced “tomorrow”) and targets young, digitally-advanced millennials.

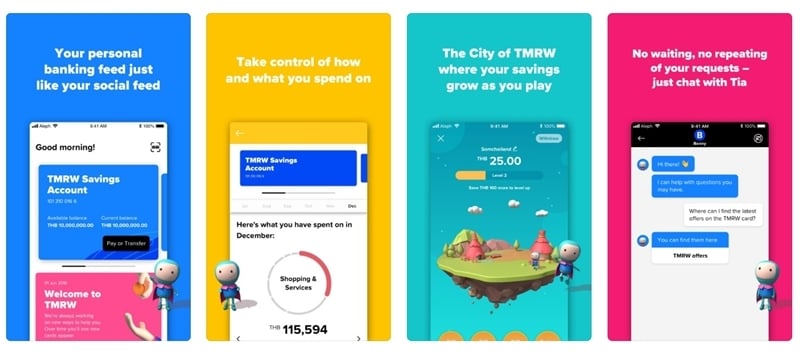

As a digital bank, UOB TMRW allows users to do their banking digitally through a mobile app, and is marketed as an alternative to traditional branch-based banking. UOB designed TMRW for millennials who possess a different approach to their banking habits, who have a different set of fundamental expectations in digital services such as preferring simplicity and an engaging user experience.

In addition, UOB TMRW has a distinctive gaming feature in its approach to money management, where customers build a virtual city that gets bigger as their savings increase. According to UOB, the game quickly became one of its customers’ favourite features because it helped them meet their savings goal whilst being fun and engaging.

Other useful features built into TMRW include transaction insights and travel summaries of users spending. It also gives out alert for unusual transactions or increased spending, while an AI-powered technology subtly tweaks the UI to surface frequently-used services. There is also a chatbot that mimics popular messaging apps and a call function to reach support staff with the ability to recall conversation history. Lastly, TMRW’s app eliminates the use of banking jargon for a simpler and more engaging experience – the result of an ethnographic research on millennials conducted by UOB before it launched TMRW.

(Source: Business Insider)

(Source: Business Insider)

The Head of Group Retail Digital, Dr Dennis Khoo, said that the bank partnered with two fintech firms, and learned from market leaders as well as millennial brands to explore the latest technological and behavioural insights to deepen customer engagement. Dr Khoo added that the group is looking to collaborate with more fintech to create a more engaging user-experience.

Before its official launch, UOB already conducted a pilot programme involving 1,500 customers in Thailand. Now that it is launched, UOB will be setting up 350 TMRW kiosks for complete self-service registration and soon it is planning to use biometric system for more ease of use. Despite its focus on millennials, there will be no age restrictions to use the service. Moving forward, TMRW is looking to expand to other countries across the region including Indonesia, Singapore, Malaysia and Vietnam by the end of this year.

(Source: Business Insider)

Comments (0)