Jacie Tan

25th June 2021 - 5 min read

Employees Provident Fund (EPF) CEO Datuk Seri Amir Hamzah Azizan offered up some interesting insights and commentary in an interview with The Edge – his first since assuming the post earlier this year.

During the interview, Amir Hamzah touched on various topics from the EPF fund size and performance to the consequences surrounding the i-Sinar and i-Lestari withdrawal programmes – the excerpts of which can be seen below.

On EPF dividends and fund size

When asked about what the EPF dividends might look like this year given a strong performance in Q1, Amir Hamzah said that it is a little early in the year to be talking about dividends, although the performance has been encouraging. “We enjoyed the nice ride up from the recovery in the world. I think the way that the pandemic is going, we see some light at the end of the tunnel. I think that’s what’s driving the equity market positive and it’s allowed us to be able to realise some profits,” he said.

“At the same time, I think my team has been very good. We’ve been able to ride on what we’ve invested in in the past. So as we rotate out of some stocks to others, we’ve been able to realise some returns. That’s helped us to shore up returns very well.”

The EPF’s fund size crossed RM1 trillion on 3 December last year prior to the i-Sinar withdrawals, and with contributions up again this year, Amir Hamzah shared that the EPF is optimistic that they will get there again.

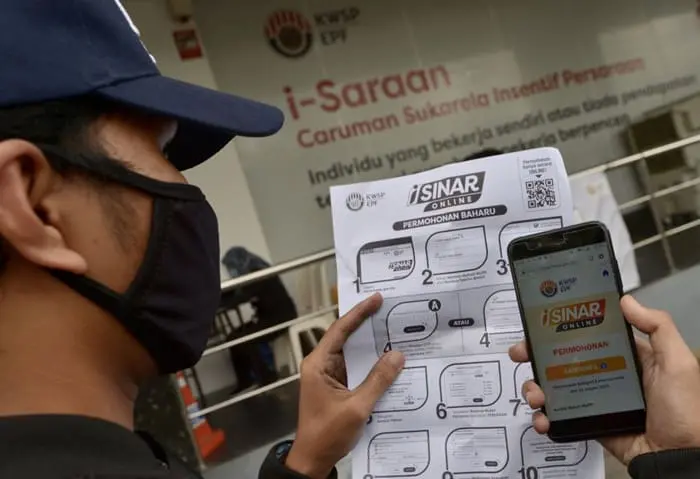

The i-Sinar and i-Lestari withdrawal programmes

Amir Hamzah shared that the EPF received i-Sinar applications from close to 6.49 million people who were predominantly in the B40 and M40 range. Of these applications, RM57.97 billion have been approved and RM50.93 billion paid out. Throughout the remaining of the year, the EPF will be paying out the remaining RM7 billion – although members can still apply for withdrawals before i-Sinar applications are set to close on 30 June.

In response to whether the i-Sinar applications deadline would be extended, Amir Hamzah said, “We’ve seen that since the applications without conditions were introduced at the end of February, we had a big rush of applications. Then it has been tapering off. I think our members have gotten to a point where they’re comfortable with what they’ve taken out, they’re also aware that it is important for them to leave a nest egg for when they retire. I think we will see it taper off.” However, the CEO added that the EPF would wait to how see matters were once the end of June rolled around.

According to Amir Hamzah, i-Sinar – which gave members access to EPF Account 1 – was a bigger challenge than i-Lestari, which allowed withdrawals from Account 2. “It became more problematic when access was given to Account 1 as opposed to Account 2. We had a dip when no conditions were imposed on Account 1 in February and people took out a big chunk in the beginning,” he said. However, he said that the EPF had been able to manage the withdrawals and that the liquidity challenge was not impossible to overcome.

“My worry now is not the challenge of i-Sinar and i-Lestari per se [to liquidity and portfolio returns] because I think the fact that we’ve been able to manage the withdrawals to date shows the strong base that we have built over the years. That’s not the challenge; if anything, it is short term.”

Bringing the focus back to retirement savings

Amir Hamzah said that quite a number of EPF members have now reduced the amount of savings in their accounts to levels that cannot guarantee their retirement. “It is much more important for us to look at how we can help our members to restore back their savings post pandemic. We understand that i-Sinar and i-Lestari were important during the period of the pandemic when people needed to supplement their shortfall in income but we’ve got to get them back to saving,” he explained.

“Just to give you an idea, about 6.3 million people have less than RM10,000 in their Account 1, which is meant to be retirement savings. We have a total member base of 15 million and we have 6.3 million with less than RM10,000. It’s worrying that 42% of the total membership has less than RM10,000 and if you look at Account 2, which is the amount set aside where members can access in certain instances, 9.3 million people have less than RM10,000. So they’ve used their emergency funds.

“From the EPF’s perspective, it is important to bring people back to focus on their retirement funds in the future. So the challenge was not how we can manage liquidity. We could manage liquidity but the challenge is to bring people back to think what they can do for their future. And if you look at EPF guidance in the past, EPF has guided that for you to have a basic amount of savings for retirement, you must have at least RM240,000 basic savings when you retire. But if 6.3 million have less than RM10,000 in Account 1 and RM9.3 million people have less than RM10,000 in Account 2, it is a far cry from being able to hit RM240,000.”

However, Amir Hamzah added: “For what people may say about i-Sinar and i-Lestari, yes, we recognise it was a challenge to the EPF and it shook us to the core when we were asked to look at Account 1 withdrawals, but we cannot ignore the fact that we did good for the guy who did not have funds to survive the down cycle. The fact that he could get access to funds to survive, we made a difference to that person’s life, right?”

Full excerpts of the interview can be found at The Edge Markets.

Comments (1)

Why not the government just take the list of 6.3mil less than rm10k and bank in into their account rather than makes lives of everyone so difficult?

Interview doesn’t make any sense. First say focus on savings retirement then say looking at plans to do account 1 withdrawal. What is the message of reporting here?