Pang Tun Yau

4th May 2020 - 3 min read

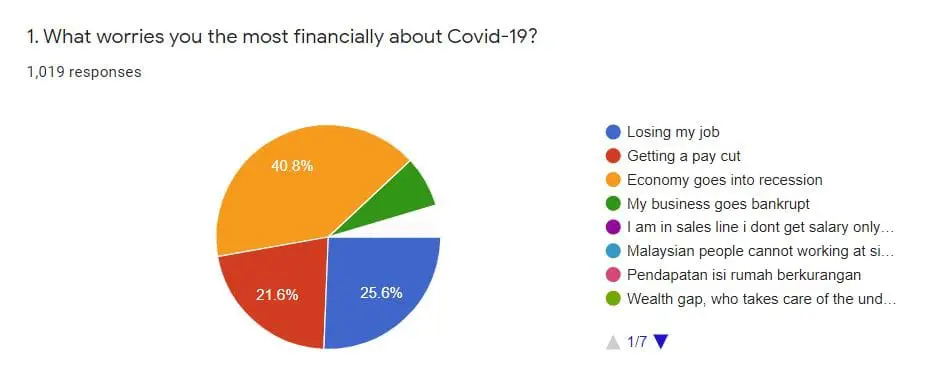

A survey recently conducted by RinggitPlus has revealed that a majority of Malaysians are not financially prepared in times of emergency. During this COVID-19 pandemic, most Malaysians are worried about their job and income security, with a majority not being able to survive more than two months with their savings.

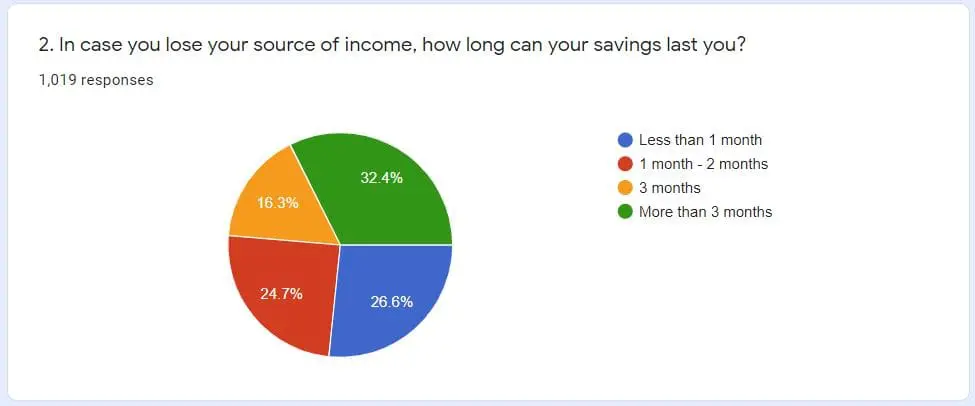

The RinggitPlus COVID-19 Financial Wellness Survey, involving 1,019 respondents from around Malaysia, found that 51% of respondents are not able to survive more than two months, echoing the findings of the Department of Statistics Malaysia. The respondents are also most worried about job and income security, which has become non-existent due to the sluggish economy.

One of the most interesting findings from this survey was the fact that despite the very real risk of running out of money in the near future, many Malaysians do not wish to tap into their EPF savings (directly or indirectly via the EPF’s i-Lestari platform or the reduced contribution rate). Among respondents who claim that they are not able to survive more than two months with their savings, 44.7% are not reducing their employee contribution rate to free up additional cash, while 42% are not taking up the i-Lestari withdrawal with the prime reason being that it is meant for their retirement.

In addition, the survey found that a staggering 47% of respondents have outstanding credit card debt, putting them in a very tough spot. With many local companies cutting costs by laying off staff, putting them on unpaid leave, or reducing salaries, this group will face the real risk of not being able to repay their debts and accrue more debt from sky-high credit card interest charges.

With COVID-19 shredding economies around the world, governments scrambled to put together packages to ensure the economy stays afloat. In Malaysia, the government introduced the RM250 billion PRIHATIN Economic Stimulus Package, and an additional Enhanced package specifically for SMEs and businesses affected by Covid-19.

However, the stimulus packages does not seem to be enough to alleviate the worries of the everyday Malaysian. Only 31.8% of respondents who are employees have stated they will withdraw RM500 per month from their EPF savings. On top of that, most salaried employees actually prefer that the Government reduce their income tax rate instead of cash handouts to targeted groups via Bantuan Sara Hidup (BSH).

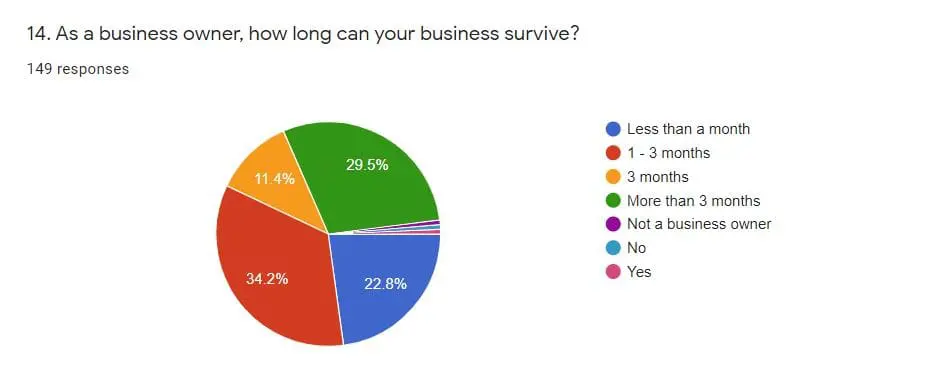

As for respondents who are business owners, 57% of them claim that their businesses cannot survive for more than 3 months despite cost-cutting measures, and require financial aid.

Overall, the findings of the RinggitPlus COVID-19 Financial Wellness Survey highlights the plight of the everyday Malaysian, who feel that the Government’s PRIHATIN stimulus packages do not seem to be enough to counter the financial impact of COVID-19 in Malaysia. It also highlights the need for basic financial literacy among Malaysians, as a majority do not have the proverbial umbrella ready for the rain.

The full report can be downloaded here: RinggitPlus COVID-19 Financial Wellness Survey Report

Comments (0)