Chee Jo-Ey

3rd March 2023 - 4 min read

There are many reasons to apply for a credit card such as to pay for larger purchases, earn rewards, or build your credit score. With so many credit cards out there, it’s important to ensure that you choose one that lets you enjoy benefits that align with your lifestyle.

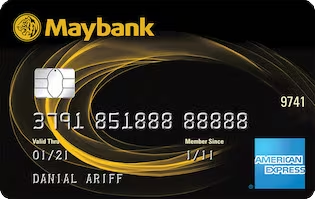

If you want to make the most out of your credit card, you may consider the Maybank 2 American Express® Gold Card. To apply, you need to have a minimum annual income of RM30,000.

Read on to find out what other benefits await.

Enjoy Up To RM50 Cashback A Month And More When You Spend

One of the reasons why people sign up for a credit card is to earn rewards points or cashback on their spendings. Using a credit card to earn rewards can be a smart financial strategy, as long as you pay off your balances in full and on time each month. If you need to make purchases anyways, why not use a credit card to gain some points or get cashback to offset your spending?

Maybank 2 American Express® Gold Cardholders will receive 5% cashback when they charge their expenses to the card on weekends, with a cap of RM50 per month. Earn cashback at your favourite merchants, F&B outlets, retail stores, e-commerce sites, petrol stations and more as shown below.

Retail stores:

H&M, Uniqlo, Cotton On, Zara, COS, Vans, Timberland, Marks & Spencer, Ikea, Sogo, Isetan, Parksons, Aeon, Harvey Norman, Sen Heng, and Machines.

Groceries/Pharmacies/Convenience stores:

Ben’s Independent Grocer, Village Grocer, Jaya Grocer, Aeon, Lotuss, Cold Storage, Giant, Aeon Wellness, Carings Pharmacy, Guardian, Big Pharmacy, My News, and Family Mart.

F&B outlets:

McDonalds, KFC, Pizza Hut, Dominos, Carl’s Jr, Texas Chicken, A&W, 4 Fingers, Starbucks, San Francisco Coffee, TGIFridays, Chilis, Madam Kwans, Baskin Robbins, Sushi Zanmai, Sushi Tei, Putien, Grand Dynasty, Hai Di Lao, KyoChon, Kayu Nasi Kandar, and Pelita Nasi Kandar.

E-Commerce sites:

Shopee, Lazada, Zalora, Presto Mall, and Valiram 247.

Petrol:

Shell, Petron, BHP, Petronas, and Caltex.

With the Maybank 2 American Express® Gold Card, you enjoy 5x TreatsPoints for your spending on weekdays, exclusive to the card only. You can easily redeem the points via mytreats.maybank.com/my to get gadgets, home appliances, and even air miles in return.

Lifetime Annual Fee Waiver And Online Application

If you’re a credit cardholder, you would know that there are several common fees that you might need to pay such as annual fees. Maybank 2 American Express® Gold Cardholders can rejoice knowing that they enjoy a lifetime waiver of annual fees for both principal and supplementary cards. This means you get to save even more.

Applying for the Maybank 2 American Express® Gold Card is also very straightforward. You can apply for the Maybank 2 American Express® Gold Card online and be rewarded when you spend with your newly approved cards.

All you need is a copy of your Identification Card (NRIC) or passport, latest 3 months’ salary slips, and latest 6 months’ savings account activity or current account statements.

Pay Easily With Contactless Transactions

Last but not least, you might also be glad to know that Maybank credit cards are compatible with Apple Pay. You can add your Maybank 2 American Express® Gold Card to your Apple Wallet on your Apple devices including iPhone, Apple Watch, iPad, and Mac to make contactless payments, which means no more bulky wallets and faster cashless transactions.

***

As we progress through different stages of our life, our priorities change and the benefits we seek also differ. To ensure that you’re maximising the benefits available, it’s important to select a credit card that aligns and rewards you for your lifestyle.

There are always special promotions going around for Maybank 2 American Express® Gold Cardholders. Apply online now and enjoy the Marshall Minor III Earbuds worth RM599 and RM 100 cashback. There are many more promotions which you can enjoy with Maybank’s dining, travel, and entertainment partners.

So, if you want to learn more, click here.

Comments (1)

Does it have air miles?