Lisa Ameera Azman

19th June 2023 - 3 min read

Preparing for retirement is not a topic that many are fond of discussing. Some believe that they can begin saving later or only start thinking about it when nearing middle age. According to a survey conducted by RinggitPlus in 2022, 82% of Malaysians believe that their EPF savings are insufficient for their retirement. At the same time, half of those surveyed have not begun planning or made any effort to supplement their EPF savings.

You can never be too young to start planning for your retirement, and your 20s could be the ideal time to grow your savings. During this period, you have a higher risk appetite as well as longer investment horizon, and thus there is bigger potential for you to reap the benefits that come with compounding interest.

What can you do to ensure your retirement fund will be sufficient to support your preferred post-retirement lifestyle? You can start by planning and taking action as early as possible! It is critical that you prioritise your retirement savings because once you can no longer earn a steady income, your retirement savings may be the only source of funds you have to keep you afloat throughout post-retirement life.

Having a nest egg for your golden age is critical. Not having a retirement fund that can sustain your post-retirement life may force you to return to the workforce or risk poverty.

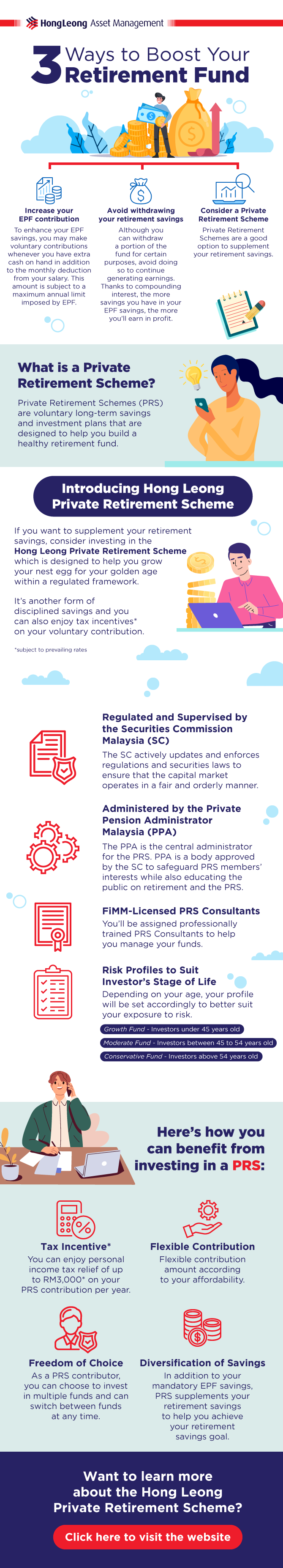

If you want to learn more about how you can encourage better growth for your retirement fund, continue reading Hong Leong Asset Management Bhd’s Infographic on 3 Ways to Boost Your Retirement Fund.

Disclaimer: This infographic article has not been reviewed by the Securities Commission Malaysia. Investors are advised to read and understand the contents of the Hong Leong Private Retirement Scheme – Conventional’s Disclosure Document dated 20 December 2022 and its 1st Supplemental Disclosure Document dated 30 August 2023 (known as the “DD”) and the Product Highlight Sheet (“PHS”) before investing. The DD has been registered and PHS lodged with the Securities Commission Malaysia, which takes no responsibility for the contents. A copy of the DD and PHS can be obtained from any of Hong Leong Asset Management Bhd (“HLAM”) offices, agents or authorised distributors. Investors are advised to consider the fees and charges involved before investing. Prices of units and distributions payable, if any, may go down or up and past performance is not a guarantee of future performance. Investors are advised to be aware of the risks associated with each fund before investing. The funds may not be suitable for all investors and where in doubt, investors are advised to seek independent advice.

Comments (3)

PRS is sampah … Give me negative return after 8 years. The only positive with PRS is their bosses all drive big cars

PRS, in not a saving which has good returns, just keep with EPF.

The only benefit is the tax benefit for the 3000 deposited.

Other wise it is loss making.

True. PRS is lost-making investment. Only good for tax rebate.