Jasen Lee

1st April 2024 - 10 min read

This is an advertisement by Eastspring Investments Berhad

Investing on your own can often feel complicated. With so many choices like stocks, bonds, real estate, and more, it’s a lot of things to figure out on your own. You have to know what you’re investing in, keep an eye on how it’s performing, and make informed decisions to change your plan when needed. This can be both an overwhelming and time-consuming process, especially for those who have just started out and aren’t that well-versed.

In Malaysia, unit trust funds including variants like ASNB funds are the most popular types of investments among Malaysians, as revealed by the RinggitPlus Malaysian Financial Literacy Survey (RMFLS) since 2021. It should hardly be a surprise – unit trust funds inherently have various benefits that appeal to a majority of investors.

But before we discuss their benefits, what exactly is a unit trust fund? Unit trust funds are essentially an investment vehicle that bundles a pool of money from various investors and allocates that fund into diverse securities. Every unit trust fund has unique investment objectives, which drive the strategy and selection of investments within the fund.

Advantages Of Investing In Unit Trust Funds

1. Professional management:

The most notable advantage of unit trust funds is that your investments are managed by experienced fund managers. These professionals bring a wealth of knowledge and expertise to the table and are mandated to manage the pool of money in their respective funds according to the investment objectives and adhering to its risk profiles. This means that all investors in the fund are treated equally – regardless of the amount you invest.

2. Diversification:

You’ve likely heard of the old investment adage of not putting all your eggs in one basket. The rationale behind this is all about risk management – should this one investment perform poorly, your losses would significantly affect your ability to recover the initial capital invested. But if your capital is spread out across different investments covering various asset classes, industries, and markets, you not only reduce the risk of losing a substantial amount of your capital, but also potentially increase the returns of your investments over the long term.

With unit trust funds, you achieve diversification automatically – fund managers are mandated to strategically allocate the investment capital across diverse asset classes, including (but not limited to) stocks, bonds, commodities, real estate, digital assets, and possibly more.

3. Accessibility:

Another appealing aspect of unit trust funds are their accessibility. These days, you can not only invest in unit trust funds online, but you can also do so via various platforms and apps, unlocking your ability to invest without hassle. On top of that, many unit trust funds have a relatively low minimum investment amount – some may start from RM100, RM500, or RM1,000, and subsequent investments can be as low as RM100. This encourages individuals to start investing earlier, taking advantage of compounding and potentially leading to significant growth over time.

4. Variety:

There are literally hundreds and possibly thousands of unit trust funds in the market, offering options that match the various investment goals and risk tolerance of investors around the world. Whether you’re looking to capitalise on the potential of emerging markets, stable government bonds, long-term growth tech sectors, and more, there’s very likely a unit trust fund that meets any specific investment goals you may have.

5. Simplicity & convenience:

By investing in unit trust funds, everything is done for you – besides the initial and subsequent investments, you literally don’t need to do anything else. A portion of your investment is allocated to some fees and charges including the fund manager’s fee and sales charges, while you can also set up standing instructions to regularly allocate funds into the unit trust fund. The only thing you’ll need to do is to decide if the investment outcome meets your expectations and whether to continue investing or switch to a different fund or investment.

Investing In Unit Trust Funds With Eastspring Investments

If you’re thinking about exploring unit trust funds, there are plenty of options available from asset management firms, such as Eastspring Investments Berhad (“Eastspring”). As an established and trusted firm, Eastspring manages an impressive portfolio of 35 funds with assets under management totalling RM60.9 billion as of 30 September 2023.

Its two standout funds are the Eastspring Investments Islamic Small-cap Fund and the Eastspring Investments Global Equity Fund, offering investors the opportunity to tap into the local or the global markets, respectively.

1. Eastspring Investments Islamic Small-cap Fund

The Eastspring Investments Islamic Small-cap Fund’s objective is to provide capital appreciation by investing in small market capitalisation Shariah-compliant securities of companies with growth potential.

https://www.eastspring.com/my/funds-and-solutions/fund-listing/fund-details?fundcode=E065

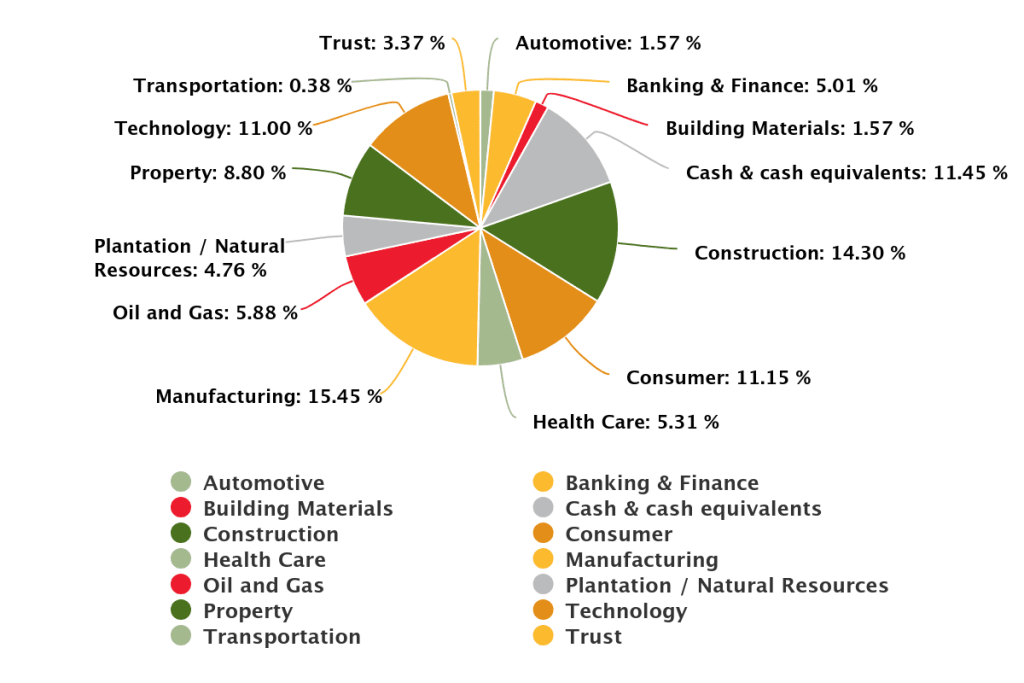

As shown in the diagram above, the fund’s asset allocation demonstrates a diverse portfolio covering various sectors and industries. The fund’s top holdings*, which include notable companies such as Hong Leong Industries Berhad, Syarikat Takaful Malaysia Keluarga Berhad, and Kerjaya Prospek Group Berhad, showcase its strategic investments in leading firms across diverse sectors.

The Eastspring Investments Islamic Small-Cap Fund is also quite accessible, where you can opt for a regular investment plan starting at RM100, or you can start with a minimum initial lump sum investment of RM1,000. Additional investments can also be made with as little as RM100 for both lump sum and regular contributions, allowing you to increase your investment at your own pace.

Find out more about the Eastspring Investments Islamic Small-cap Fund here.

*Data as of January 2024

2. Eastspring Investments Global Equity Fund

The Eastspring Investments Global Equity Fund aims to offer long-term capital growth by investing in a diversified portfolio of collective investment schemes across different geographical regions.

https://www.eastspring.com/my/funds-and-solutions/fund-listing/fund-details?fundcode=E77M

This fund, being a Fund-of-Funds primarily focuses on collective investment schemes and Exchange Traded Funds (ETFs). Among the fund’s top holdings are the Eastspring Investments Global Equity Navigator Fund Class D USD and the SPDR MSCI ACWI UCITS ETF**, reflecting a strategic and diversified investment approach as they include their own buckets of well-diversified investments.

Like the Eastspring Investments Islamic Small-cap Fund, the Eastspring Investments Global Equity Fund appeals to a wide range of investors looking to invest in the global markets. Whether you’re looking to begin with a lump sum of RM1,000 or prefer to ease into the market with a regular investment plan starting at RM100, this fund accommodates both approaches. Additional contributions can be made starting at RM100, making it straightforward to gradually build your investment in line with your financial capacity and goals.

You can learn more about the Eastspring Investments Global Equity Fund here.

**Data as of January 2024

Stand a chance to win Touch ‘n Go eWallet Reloads When You Invest As Little As RM100 With Eastspring’s “Labur Seratus” Campaign

To kickstart your unit trust fund investment journey with Eastspring, they are currently running the “Labur Seratus” campaign, where you’ll automatically receive a RM10 Touch ‘n Go eWallet reload PIN (limited to first 1,000 investors) and the chance to win an additional Touch ‘n Go eWallet reload PIN (up to RM1,000) when you invest with as little as RM100 through the myEastspring app.

Just use the promo code “LABUR100” when you make your investment, from now to 30 April 2024 only!

***

Investing in Eastspring Investments’ funds has been made user-friendly with the latest updates to the myEastspring app. Its new features are designed to streamline your investment journey, offering a secure and intuitive platform for easy fund management. With real-time portfolio performance insights and simplified transaction processes, the app ensures efficient and seamless buying, selling, or even swapping of fund units, enhancing the overall experience.

If you’re ready to invest in unit trust funds with Eastspring Investments, do remember to use the code “LABUR100” for a chance to win Touch ‘n Go Reload PIN (up to RM1,000) or take home a RM10 Touch ‘n Go Reload PIN (limited to first 1,000 investors) when you invest as little as RM100 with them! Click here to explore more about the campaign, ending on 30 April 2024.

Download the myEastspring app today:

***

Disclaimer: The contents of this advertorial are intended for general information only. Investors should carefully consider their investment objectives as well as the risks and costs associated with fund investing prior to making any investment decisions.

Investors are advised to read and understand the contents of the Eastspring Investments Islamic Small-cap Fund Prospectus dated 25 May 2017, the Eastspring Investments Islamic Small-cap Fund First Supplementary Prospectus dated 31 October 2018, the Eastspring Investments Islamic Small-cap Fund Second Supplementary Prospectus dated 2 January 2019, the Eastspring Investments Islamic Small-cap Fund Third Supplementary Prospectus dated 1 August 2019, the Eastspring Investments Islamic Small-cap Fund Fourth Supplementary Prospectus dated 30 September 2022, the Eastspring Investments Islamic Small-cap Fund Fifth Supplementary Prospectus dated 1 February 2023, the Eastspring Investments Islamic Small-cap Fund Sixth Supplementary Prospectus dated 2 February 2024, the Eastspring Investments Global Equity Fund Prospectus dated 25 November 2021, the Eastspring Investments Global Equity Fund First Supplementary Prospectus dated 15 July 2022, the Eastspring Investments Global Equity Fund Second Supplementary Prospectus dated 2 February 2024 (collectively, the “Prospectuses”), as well as the fund’s Product Highlights Sheet (“PHS”) before investing. The Prospectuses and PHS are available at offices of Eastspring Investments Berhad or its authorised distributors and investors have the right to request for a copy of the Prospectuses and PHS.

This advertisement has not been reviewed by the Securities Commission Malaysia (“SC”). The Prospectuses have been registered with the SC who takes no responsibility for its contents. The registration of Prospectuses with the SC does not amount to nor indicate that the SC has recommended or endorsed the product. Units will only be issued upon receipt of the application form accompanying the Prospectuses. Past performance of the Manager/fund is not an indication of the Manager’s/fund’s future performance. Unit prices and distributions payable, if any, may go down as well as up. Where a unit split/distribution is declared, investors are advised that following the issue of additional units/distribution, the Net Asset Value (“NAV”) per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV. Where a unit split is declared, investors are advised that the value of their investment in Malaysian Ringgit will remain unchanged after the issue of the additional units.

Investments in the fund are exposed to the risks as tabulated below. Investors are advised to consider these risks and other general risks as elaborated in the Prospectuses, as well as the fees, charges and expenses involved before investing. Investors may also wish to seek advice from a professional adviser before making a commitment to invest in units of any of our funds.

| Fund Name | Principal Risks |

| Eastspring Investments Islamic Small-cap Fund | Equity risk and Shariah status reclassification risk. |

| Eastspring Investments Global Equity Fund | Collective investment scheme (“CIS”) risk, country risk, currency risk, income distribution risk, related party transaction risk, financial derivative risk instruments and fund management of CIS risk. |

Eastspring Investments is an ultimately wholly owned subsidiary of Prudential plc. Prudential plc, is incorporated and registered in England and Wales. Registered office: 1 Angel Court, London EC2R 7AG. Registered number 1397169. Prudential plc is a holding company, some of whose subsidiaries are authorised and regulated, as applicable, by the Hong Kong Insurance Authority and other regulatory authorities. Prudential plc is not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc. A company incorporated in the United Kingdom.

Comments (0)