Sasha Belani

10th February 2021 - 6 min read

Buying your first house is one of the most memorable milestones in a person’s life. There’s a giddy excitement that comes with visiting houses that are for sale, doing your research on developers, and browsing online for tips and recommendations before finally deciding on the property you intend to purchase.

However, once that “honeymoon” stage is over, the challenges of homeownership become more apparent. For some, low credit scores and other factors make it difficult to secure a housing loan, while for others, the high monthly commitment that comes with a housing loan is a difficult hurdle to overcome. And even then, there’s still the 10% downpayment — a sizable sum for most — to keep in mind. It’s not unheard of for home-buyers to postpone their plans because they’ve not considered the additional expense of stamping and legal fees which can almost double the initial downpayment cost.

Understanding these challenges, IOI Properties Group Berhad, one of Malaysia’s leading public-listed property developers, launched a unique financing scheme, IOIFinance. This scheme helps potential homeowners, such as yourself, realise their dream of buying a house by making it more affordable and easier to purchase a property in these 6 ways.

1. Improved Loan Credibility

With IOIFinance, you only need to secure a home loan from the bank from as low as 60% of the property value, while IOIFinance takes care of the remaining amount, financing up to 40% at zero interest. This is a far cry from the usual 90% home loan that needs to be secured from the bank. By borrowing a smaller amount from the bank (nearly 30% less than the usual amount), you put a lighter strain on your Debt Service Ratio, which means you are less likely to default on your repayments — thus, making you a more credible candidate for a home loan.

2. Reduced Interest Costs

This brings us to the next benefit; a lower borrowing amount from the bank also means lower interest costs. This can be very useful if you’re keen on amplifying your savings even as you purchase a property — and let’s be honest, who doesn’t want more savings?

Plus, don’t forget that IOIFinance will finance up to 40% of the remaining amount at zero interest. This means that not only is your interest payment on the bank loan lower, you’ll also save on interest fees on approximately 40% of the property value. Therefore, allowing homeowners to further reduce their interest costs.

3. Lower Monthly Commitments

Thirdly, as a natural succession to a smaller borrowing amount from the bank and reduced interest costs, with IOIFinance, you’ll also enjoy lower monthly repayments. These lower monthly repayments can be a boon to your monthly cash flow, especially if you’re purchasing a second home for your growing family. Not only will you have more disposable income to spend on other necessities, but you can also use the savings to start building a nest egg for the future.

4. Deferred Payment For 10 Years

Now, if you’re worried about how you’re going to juggle the monthly repayments to the bank and IOIFinance at the same time, you don’t have to be. With IOIFinance, you can defer the monthly repayments for the up to 40% financing received for up to 10 years! So, now you can take the time to build your income and simultaneously not put your home-buying plans on hold any longer.

Plus, the up to 40% includes the 10% downpayment you would otherwise have to fork out as a complete payment when you purchase your home. This essentially reduces the upfront payment needed to purchase a property by IOI Property, and you can use that money saved for other aspects of your home such as furnishings or renovations.

5. More Savings!

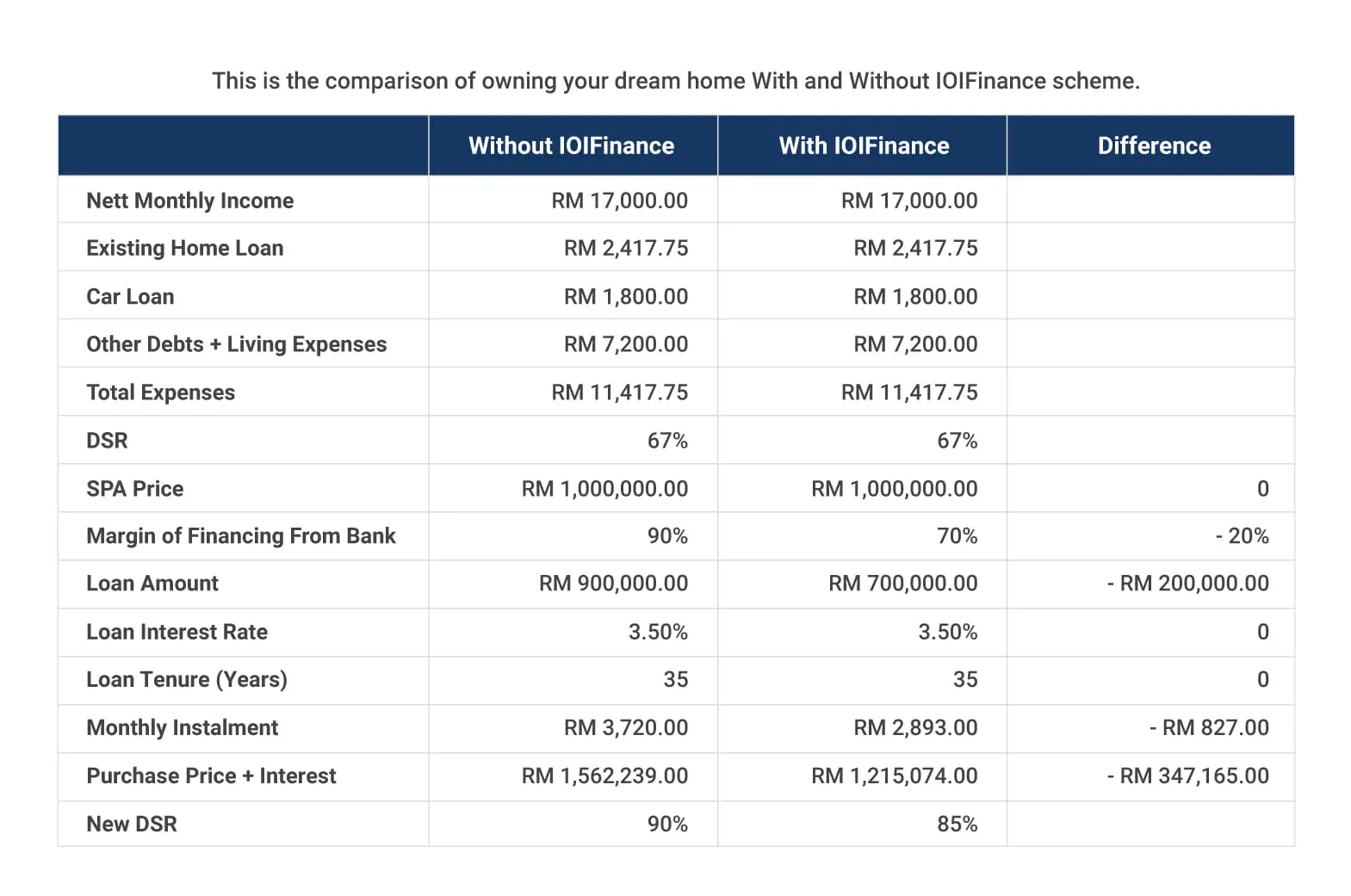

All the above benefits that come from IOIFinance can be narrowed down to a single ultimate benefit, which is quite simply more savings. For example, take a look at the comparison table below to get a birds-eye view of how IOIFinance’s unique financing scheme can reduce your overall DSR, give you lower monthly repayments, and give you more savings for a property with 35 years’ loan tenure.

As you can see in the “Difference” column, assuming that you have secured 70% financing from the bank (instead of 90%) with the remaining 30% financing from IOIFinance, you can save around RM347,000 over the 35-year loan tenure on the Sales and Purchase Agreement (SPA) price of a property valued at RM1,000,000. Additionally, if you have debts such as an existing home loan and car loan, you’ll also benefit from a reduced overall new DSR, as seen in the table above.

What’s more, your immediate monthly savings from the lower monthly instalments range around RM827 per month — that’s disposable income you can use for necessities elsewhere.

In addition to the myriad of benefits offered by IOIFinance, you can also gain more savings with the now extended government-initiated Home Ownership Campaign (HOC). Under the HOC which runs until May 2021, you can take advantage of financial incentives such as exemptions on Stamp Duty and instruments on securing loans, thus giving you a better value on your purchased properties.

6. Extra Financing For Government Employees

What’s more, IOIFinance is offering an additional up to 3% financing margin exclusively for government employees. Just be sure to bring along your government staff ID to be entitled to the additional up to 3% financing.

Find Your Dream Home From IOIFinance Participating Projects

For a limited time only, IOIFinance is only available for a few projects by IOI Properties in Klang Valley and Johor. From condominiums, apartments, and landed properties to commercial properties, take a peek at some of their exclusive projects below:

|

Properties in Klang Valley | ||

| PALMYRA RESIDENCE

Bandar Puteri Bangi | SKY CONDOMINIUM

Bandar Puteri Puchong & Puchong Jaya | LA THEA RESIDENCES

16 Sierra, Puchong South |

| ENIGMA SQUARE

Bandar Puteri Bangi | CONEZIÓN RESIDENCES

IOI Resort City, Putrajaya | PAR 3 CONDO & CONDO VILLA

IOI Resort City, Putrajaya |

| STELLAR SUITES

Bandar Puteri Puchong & Puchong Jaya | N’DIRA TOWNHOUSE

16 Sierra, Puchong South | EVIRA

Warisan Puteri, Sepang |

|

Properties in Johor | ||

| THE PLATINO SERVICED APARTMENT

The Platino | MARINA COVE – WAVE SERVICED APT

Marina Cove | OLEANDER

Taman Kempas Utama |

| CELESTE

Bandar Putra Kulai, Johor | ALPINIA

Bandar Putra Kulai, Johor | VERANA

Bandar Putra Kulai, Johor |

| EMPIRE – 3 & 4 STOREY SHOP OFFICE

Bandar Putra Kulai, Johor | EMINENCE – 3 STOREY

Bandar Putra Kulai, Johor | D’SUMMIT

Taman Kempas Utama |

Register Your Interest Today!

So, if these benefits by IOIFinance have piqued your interest during your search for a dream home, why not take a closer look at IOI Properties? With the savings that IOIFinance can offer, it might be worth your time to talk to a representative and find out further how IOIFinance can help you own your dream home at a more affordable price.

Check out IOIFinance participating projects today!

Comments (0)