Iman Aminuddin

20th August 2024 - 4 min read

Securing credit or a home loan is a common challenge for many Malaysians, with 54% experiencing difficulties in obtaining a home loan due to poor credit history. The frustration of repeated rejections can be overwhelming, especially for those who believe they have clean financial records. These obstacles often highlight a critical gap in understanding one’s credit health, suggesting that a closer examination and improvement of one’s credit report might be the key to overcoming these barriers.

The Importance Of Comprehending Your Credit Report And Score

Credit applications are frequently rejected due to gaps in financial health assessments. A poor credit score or lack of credit history often contributes to these denials. Many potential borrowers misunderstand what constitutes creditworthiness, mistakenly thinking that a few missed payments or limited credit activity won’t significantly impact their chances.

Therefore, having a clear understanding of your credit report and score is vital. Being informed about your credit health helps you identify areas for improvement and make better financial decisions. By closely monitoring your credit report, you can take steps to enhance your financial stability and creditworthiness, ultimately paving the way for more successful credit applications.

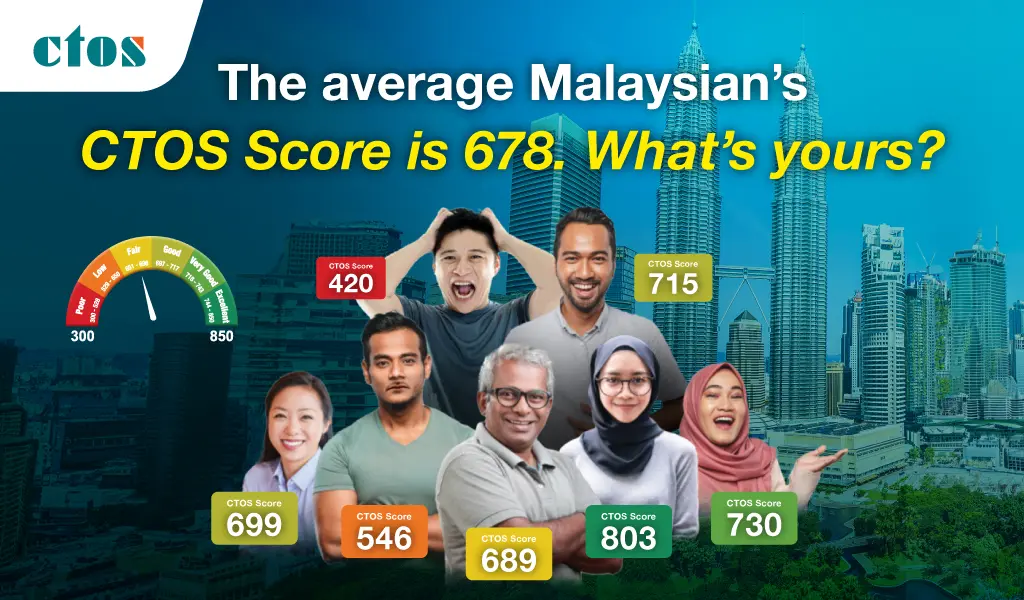

Introducing CTOS, Your Credit Health Partner

CTOS is a leading credit reporting agency in Malaysia, dedicated to providing valuable insights into your credit health. By collecting and reporting on credit information, CTOS helps individuals understand their credit standing and make informed financial decisions. A CTOS credit report is a powerful tool for those looking to improve their creditworthiness and increase their chances of loan approval.

Understanding Your CTOS Credit Report

A CTOS credit report provides a comprehensive overview of your credit profile, offering key insights into your financial health. It includes several components that lenders consider when assessing your creditworthiness:

- Payment History: Timely payments on existing credit accounts can positively impact your score.

- Amounts Owed: The total amount of debt you owe and your credit utilisation ratio affect your score.

- Types of Credit: A mix of credit types, such as revolving and instalment credit, can benefit your score.

- Length of Credit History: A longer credit history is generally favourable.

- Credit Applications: Frequent applications for new credit can negatively impact your score.

Your CTOS Score is dynamic and changes with updates to your credit report, reflecting your current credit health.

How To Improve Your CTOS Score Over Time

Improving your CTOS score requires consistent effort and financial discipline. Start by ensuring you pay all your bills on time, which helps maintain a positive payment history and boosts your score. It’s also important to keep your credit card balances low relative to your credit limit, maintaining a low credit utilisation ratio.

While working on improving your score, it’s wise to avoid unnecessary credit applications, refraining from applying for new credit cards and loans until your score is healthier. Additionally, regularly monitor your credit report to check for unauthorised entries, which could indicate potential identity theft. By taking these proactive steps, you can steadily improve your CTOS score and enhance your overall credit health.

How A CTOS Credit Report Helps You

A CTOS credit report is more than just a reflection of your financial history. It’s a tool that empowers you to enhance your credit health and improve your credit approval chances. By understanding your credit profile and taking proactive steps to improve it, you can position yourself as a more attractive borrower to lenders.

Take Control Of Your Credit Health Today

Ready to take control of your financial future? Purchase your first CTOS Report and receive 20% off using the promo code NEWCTOS24. This offer is valid until 1 September 2024. For more information on how to start your journey towards better credit health, click here.

Comments (0)