Eloise Lau

21st August 2024 - 8 min read

You may have heard of P2P financing before – but what exactly does it mean? Essentially, peer-to-peer (P2P) financing is an approach that directly connects individuals with borrowers (often small and medium enterprises (SMEs)) looking for alternative financing solutions. This approach pools the funds from a group of individuals (also known as investors) at an agreed rate and tenure, bypassing traditional financial institutions such as banks.

Over the past decade, this model has gained popularity as a mutually beneficial one for both investors and borrowers. For investors, P2P financing is an avenue to earn potentially higher returns and diversification to their portfolios.

Intrigued? Read on to find out more about how it works as well as the benefits and risks of investing in this model:

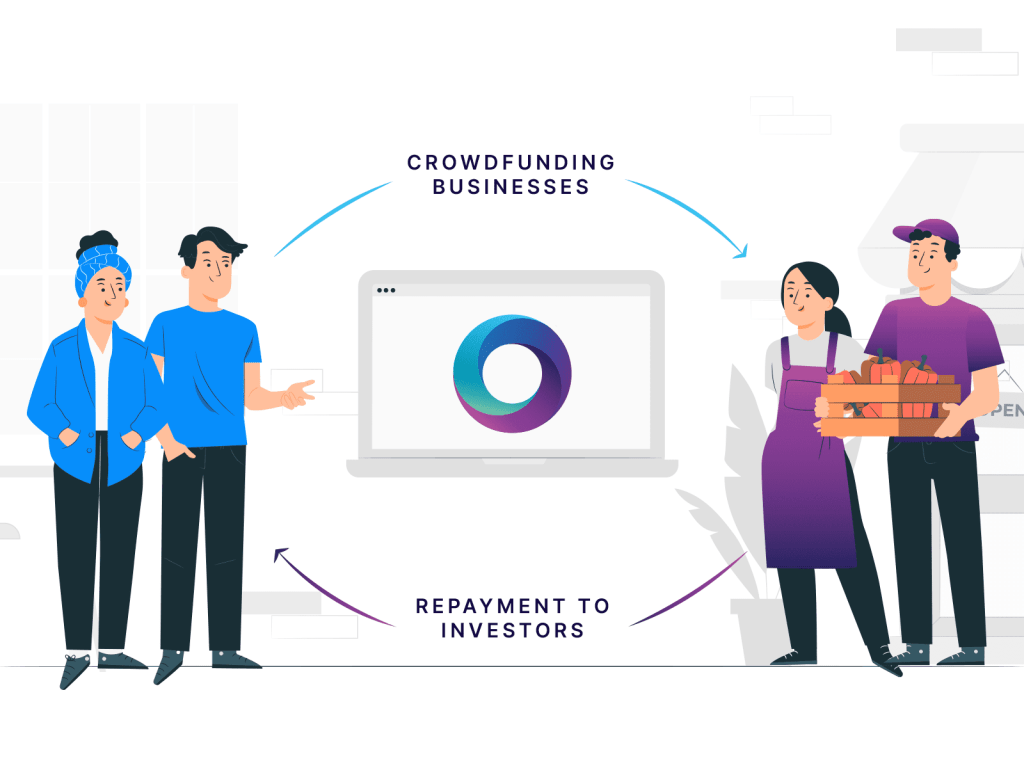

How P2P Financing Works

In P2P financing, a borrower lists their financing request on a P2P platform, detailing the amount needed, the purpose of the loan, and the interest rate offered for the amount requested. Investors can then browse these listings and choose which ones to fund based on their preferences and risk tolerance. The P2P platform then facilitates the transaction, handling loan agreements, repayments, and any necessary collections.

Benefits of Investing in P2P Financing

One of the primary advantages of P2P investing is the lower barrier to entry, with initial investments starting as low as RM50. This makes P2P financing accessible to a broader range of investors who might not have large amounts of capital to invest. Additionally, P2P investments may offer potentially higher returns generally ranging from 6% to 18% p.a. which can significantly outperform traditional investment options.

Another appealing aspect of P2P investing is the level of control it affords investors. They have the autonomy to choose which businesses they want to invest in, enabling them to support ventures that align with their values, such as those adhering to Environmental, Social, and Governance (ESG) principles or Shariah-compliant businesses.

Risks of P2P Investing

As with all forms of investments, P2P investing does come with certain risks. Most P2P financing options are unsecured, meaning there are no assets or collateral to fall back on in the event of a default, which increases the risk of potential loss of capital. Consequently, this makes P2P investments riskier compared to traditional investment avenues. To mitigate these risks, P2P investors are encouraged to diversify their P2P portfolios by investing in multiple businesses across different industries and risk ratings.

Another crucial aspect is the regulatory backing of the P2P platform. In Malaysia, P2P platforms are required to obtain a license from the Securities Commission of Malaysia, which ensures that the platform is compliant with the strict regulatory requirements to protect investors.

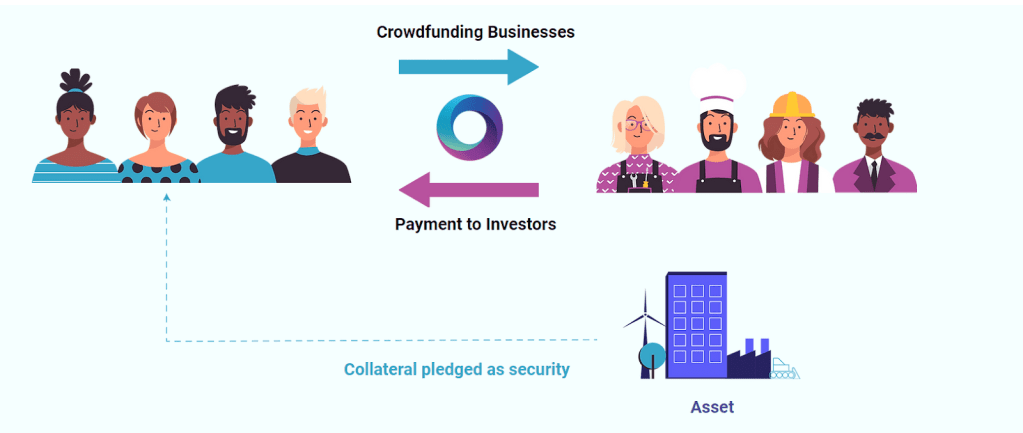

Introducing Capsphere – Malaysia’s First Asset-Backed P2P Platform

Founded in June 2016, Capsphere stands out as Malaysia’s first asset-based P2P financing company. Registered with the Securities Commission Malaysia, Capsphere aims to support SMEs by providing an alternative financing solution that guarantees each loan is backed by an asset.

What this means is companies can hedge their assets as collateral, including property, medical equipment, automotive equipment, manufacturing equipment, sports equipment, digital assets, specialist vehicles, solar panels, and most assets with secondary market value. This added measure enables Capsphere to provide relatively low-interest financing to SMEs and empowers investors to back businesses with peace of mind.

The advantages of investing in the Capsphere platform include:

Facilitate Resource Sharing: Capsphere links investors to SMEs in need of financing, promoting sustainable resource utilisation and encouraging community involvement by optimising the deployment of surplus capital from investors.

Trust and Safety: Capsphere implements top-notch safety measures, including thorough testing, to ensure security before users access the platform.

Seamless Accessibility: With a streamlined interface and tools such as an investor simulator and automated investment options, Capsphere facilitates convenient access across multiple devices.

Easy & Prompt: Issuers can submit their applications via the platform and start financing within two weeks. Capsphere is always ready to assist both businesses and investors, ensuring the process caters to each business’s unique financing needs.

Socially Responsible Investment: Capsphere’s platform promotes sustainability by encouraging issuers to adhere to ESG principles, allowing both issuers and investors to actively contribute to sustainable development.

Shariah Compliant: Capsphere offers Shariah-compliant financial products, including Shariah financing for issuers and Shariah-compliant notes for investors.

Guaranteed Investment Notes**: Capsphere Safevesting are Guaranteed Notes offering expected and stable returns up to 6%*p.a over a specified term. This enables investors to have a clearer understanding of their expected returns.

**Do note that Capsphere has 2 types of investment notes – Conventional notes for Term Financing (working capital), Invoice Financing, and Islamic Financing (with an average return rate of 8% – 12% p.a.), as well as Guaranteed Notes (with returns up to 6%).

***

Capsphere provides a safer and more reliable way to engage in P2P investing by backing loans with assets. With its unique approach and robust safety measures, Capsphere not only offers potentially higher returns and greater control but also promotes sustainability and community involvement.

Ready to start your investment journey with Capsphere? Download the Capsphere app on the app store and Google Play or visit the website for more information.

This article is brought to you by Capsphere Services Sdn Bhd.

Disclaimer:

This is an advertisement.

The information provided herein is not intended for general circulation but for discussion purposes only. It does not take into account the specific investment objectives, financial situations or particular needs of any particular person. This does not constitute an offer, solicitation or recommendation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Information contained herein should not be relied upon when making investment decisions. You should seek independent legal or tax advice before making any investment decisions. Investments are subject to investment risks, including the possible loss of the principal amount invested. Value of the investments and the income, if any, may fall or rise.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by Capsphere Services Sdn Bhd and it should not be relied upon as such. Capsphere Services Sdn Bhd does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. Capsphere Services Sdn Bhd shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. The information provided herein is based on certain assumptions, information and conditions available as at the date of this advertisement and may be subject to change at any time without notice.

Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Capsphere Services Sdn Bhd does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. The contents hereof may not be reproduced or disseminated in whole or in part without Capsphere Services Sdn Bhd’s written consent.

The distribution of this advertisement may be restricted in certain other jurisdictions. The above information is for general guidance only and it is the responsibility of any persons in possession of this advertisement to observe all applicable laws and regulations of any relevant jurisdictions.

The Investor acknowledges the risks associated with the use of the Platform and Services, the issue of Subscription Offers and the Investment Notes, including without limitation, the risk that Investors will not be paid in full the Principal Subscription Amount together with any interest and/or profit payable under the Investment Notes and the risk of the Platform discontinuation.

This advertisement has not been reviewed by the Securities Commission Malaysia.

For more information, please visit https://www.capsphere.com.my/ .

Comments (0)