Lisa Ameera Azman

28th June 2023 - 5 min read

During a time when technology is rapidly transforming our daily lives, service providers work tirelessly to come up with new and innovative ways to best serve their customers. From property and automotive, to F&B and banking, businesses across all industries and the globe continuously seek solutions that can solve the problems faced by everyday people.

Earlier this year, Alliance Bank unveiled their latest credit card, the Alliance Bank Visa Virtual Credit Card. As the digital landscape continues to evolve, the Alliance Bank Visa Virtual Credit Card offers customers an advanced level of security and convenience. But how exactly does it work?

Alliance Bank Visa Virtual Credit Card In A Nutshell

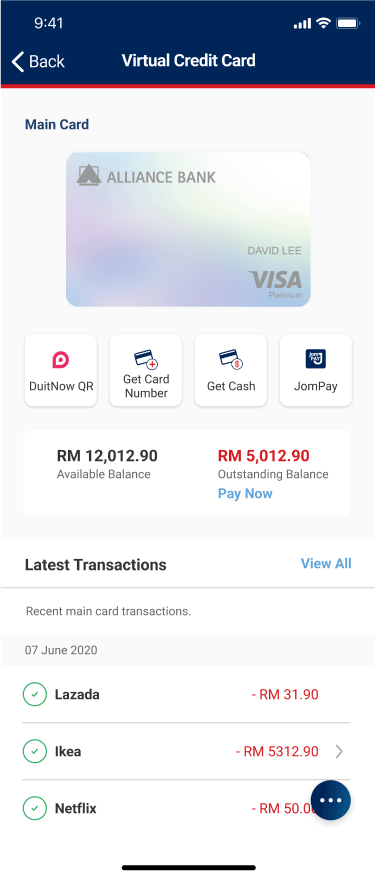

Unlike your traditional credit cards, the Alliance Bank Visa Virtual Credit Card isn’t something that you need to carry around in your wallet. As the name suggests, it is a virtual card that exists on your phone within the allianceonline mobile app.

Along with its convenience, the Alliance Bank Visa Virtual Credit Card also allows users to make cashless transactions, freeze the card in just a few taps, collect Timeless Bonus Points (TBP), and create cards for specific recurring payments.

However, the one thing that sets the Alliance Bank Visa Virtual Credit Card apart from the rest is its unique Dynamic Card Number (DCN) feature.

The Dynamic Card Number Feature – How Does It Work?

With technology advancing at its current pace, fraudsters and identity thieves have also gotten more advanced. We’ve always been advised to keep our card numbers hidden, clear caches on our devices, and so forth, but even so, the upward trend of financial scams indicates that it won’t be slowing down anytime soon.

At a time like this, having a virtual card might make all the difference between your personal information being protected or otherwise.

Instead of having your card number physically embossed on the front of your card, the Alliance Bank Visa Virtual Credit Card is kept secure within the allianceonline mobile app, as mentioned earlier.

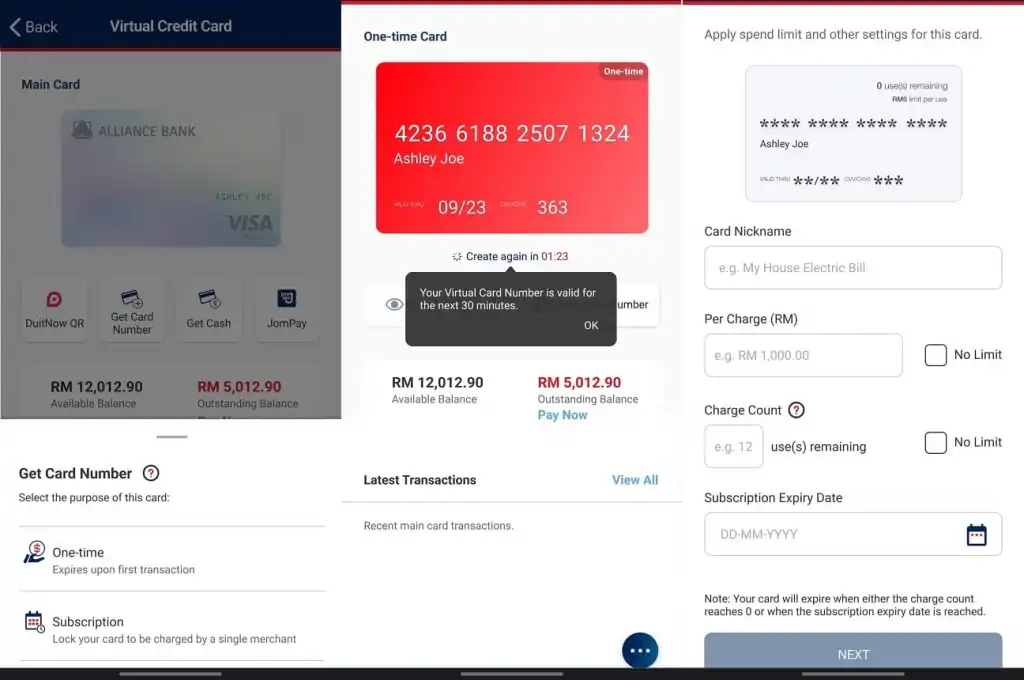

With the Alliance Bank Visa Virtual Credit Card, each transaction is safeguarded by randomly generated card numbers that remain valid for just 30 minutes. This security measure not only makes it incredibly challenging for thieves to steal your information but also adds an extra layer of protection with its limited window of validity.

Let’s say the one-time card number you used for an online transaction was compromised due to a data breach from a third party payment gateway. The 30-minute validity period mitigates the risk of that number being used for unauthorised transactions in the event it was created but not used.

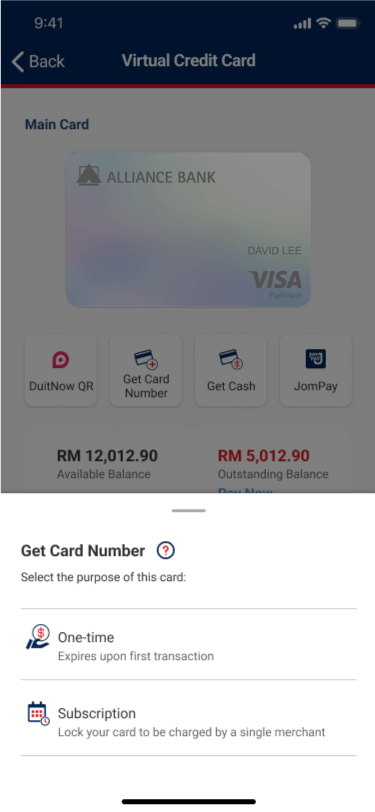

Virtual Cards For One-Time Payments & Recurring Payments

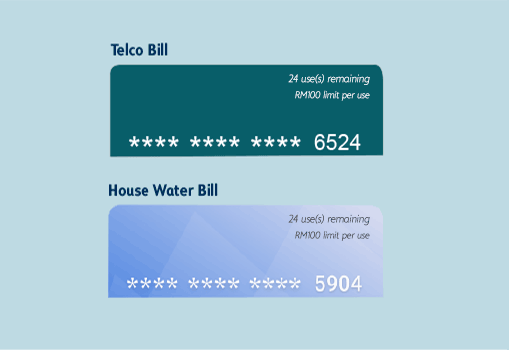

Besides one-time payments, you can also set up additional virtual cards for each recurring payment. Every virtual card that you generate for recurring payments is free. The best part is you could personalise the validity period and credit limit for each one.

For example, you pay RM15 for your monthly subscription to a music streaming service. You could create a new virtual card specifically for this service and set a credit limit of RM15 so there is little risk of you being overcharged beyond the limit that you have already set.

You could also customise the virtual card face via the allianceonline mobile app for a more personalised experience.

The Ability To Instantly Freeze Or Unfreeze Your Card

In the event you’ve noticed irregular or suspicious activity with your virtual credit card, there is no need to call the bank. Open the allianceonline mobile app and swipe the freeze/unfreeze option to halt its activities.

Not only is this faster than searching for the bank’s number and giving them a call, but it’s also more convenient.

***

There’s evidently plenty to benefit from with the all-new Alliance Bank Visa Virtual Credit Card. This card offers cardholders various nifty features that not only makes their banking experience more enjoyable, but also safer and more personalised.

On top of that, there are zero annual fees and each dynamic card generated is free. You will only be charged RM25 SST on a yearly basis for your virtual credit card static card.

Sign up for the Alliance Bank Visa Virtual Credit Card and RM1,000 Touch ‘n Go eWallet Credit on top of a guaranteed gift of RM200 Touch ‘n Go eWallet Credit could be yours! Apply using the code “RPVCC”, get approved, and activate your Virtual Credit Card to be among the lucky winners!

Elevate your banking journey with the enhanced security features and personalised features offered by Alliance Bank Visa Virtual Credit Card. Take the first step towards a safer and more secure banking experience, and you may just win yourself a double cashback reward.

Download the app via the Google PlayStore or Apple AppStore.

Terms & Conditions apply.

Comments (0)