RinggitPlus

10th November 2020 - 2 min read

The year 2020 has been quite a journey with COVID-19 affecting people’s lives and causing a global recession as a result of movement restrictions and lockdowns to contain the spread of the virus. The Malaysian economy contracted by 17.1% in Q2 2020 as a result of the Movement Control Order (MCO) which took effect in March 2020.

Initially, global stock markets plunged as COVID-19 spread globally. Malaysia was not spared with the Kuala Lumpur Composite Index sinking to a low of 1219.72. However, global markets rebounded positively due to unprecedented fiscal and monetary policies undertaken by various governments.

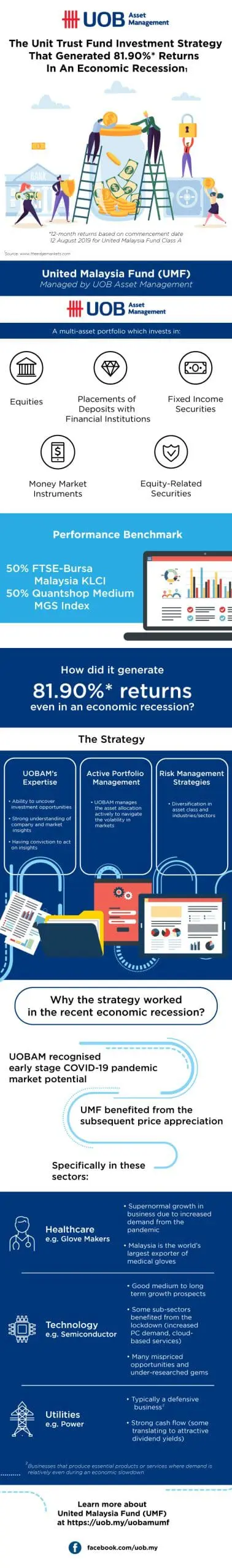

Some unit trust funds have managed to rally alongside the swift recovery in the stock markets. In particular, the United Malaysia Fund (UMF) managed by UOB Asset Management (UOBAM) Malaysia, saw outstanding returns of 81.90%* for the past 12 months. In this article, we take a look at what made it possible for UMF to deliver in the current global pandemic.

*12-month returns based on commencement date 12 August 2019 for United Malaysia Fund Class A

The United Malaysia Fund is just one of several unit trust funds managed by UOBAM. Visit UOBAM Malaysia’s website to learn more about UOBAM Malaysia and its high-performing United Malaysia Fund (UMF). The UMF’s prospectus and disclosure sheets can be accessed here.

You can also listen to Francis Eng, CIO of UOBAM (Malaysia) himself, explaining about UMF in Episode 11 of One Minute Insight, a regular bite-size informative shows by UOBAM.

Alternatively, this episode is also available in 3 other languages; Bahasa Malaysia, Cantonese, and Mandarin in UOBAM’s One Minute Insight website.

Disclaimer: Past performance is not necessarily indicative of the future or likely performance of the fund. Investors are advised to read the fund’s prospectus before making any investment decision.

Comments (0)