RinggitPlus

1st November 2019 - 4 min read

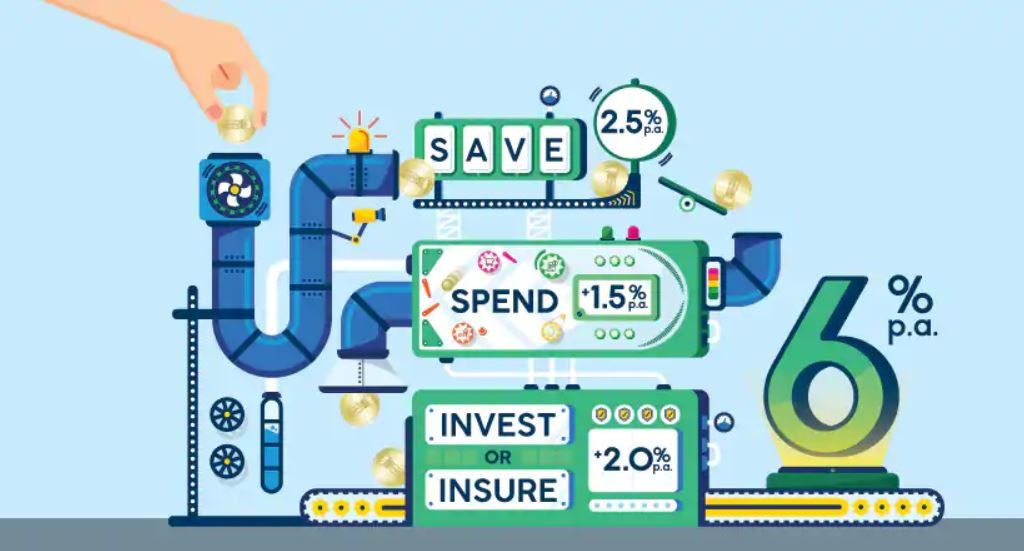

Saving can be a pain sometimes – which is why you should grab at any opportunities to make it easier. Standard Chartered Bank’s Privilege$aver is designed to help you make saving an automated process, offering returns of up to 6% per annum.

The Privilege$aver starts you off with a base interest/profit rate of 0.5% p.a. and lets you earn bonus interest/ hibah if you fulfil certain criteria.

- You get an extra 2.0% p.a. by making a single deposit of at least RM3,000 fresh funds during the month.

- Spend a minimum of RM1,000 using any Standard Chartered credit card and get an additional 1.5% p.a. bonus interest.

- Invest/Insure/Cover – Purchase a minimum of RM1,000 on regular investment or insurance/ takaful products through Standard Chartered/ Standard Chartered Saadiq and receive an extra 2.0% p.a. bonus interes/ hibah.

As you’ll soon see, it actually takes few steps to hit the three criteria of spending, saving, and investing or insuring/covering so that you can get the full 6% p.a. offered by Privilege$aver. We share some of the easiest ways to automate your savings through Standard Chartered Privilege$aver.

1) Make Privilege Savings Account / Super Salary-i your salary account

Privilege Savings Account/ Super Salary-i rewards you with an extra 2.0% p.a. bonus interest/ hibah if you make a single deposit of at least RM3,000 fresh funds during the month. The easiest way to fulfil this requirement is to make Privilege Savings Account/ Super Salary-i your salary account as it will ensure you get fresh funds in your account each month. Clearly, this is a no-brainer way to automatically increase your savings every month.

2) Create standing instructions from your current salary account

If your are unable to select Privilege Savings Account/ Super Salary-i as a salary account for whatever reason, you can still easily deposit at least RM3,000 every month for free via instant transfer. If you want to make things even easier, you can set up a standing instruction to automatically transfer at least RM3,000 from your current salary account to Privilege Savings Account/ Super Salary-i after your salary comes in each month.

3) Get a Standard Chartered credit card and use it

Once you start using your Standard Chartered Bank Malaysia Berhad credit card, you can easily earn yourself another 1.5% p.a. bonus interest on your Privilege$aver. A minimum spend of RM1,000 is possible if you compile all your usage in one main credit card, including daily necessities and bill payments. Moreover, don’t forget about all the cashback and rewards benefits you will gain from using your Standard Chartered credit card too!

4) Pay your bills automatically each month

If you want to make using your credit card to hit that RM1,000 a month even more easy and effortless, you can set up a standing instruction to make automatic payment to your recurring bills and insurance premiums or takaful contributions each month. That way, your monthly commitments get paid and you hit the spending requirement without even having to think about it.

5) Let your investments and insurance/ takaful boost your savings

Have you been thinking about getting additional insurance/ takaful or perhaps starting on a new investment plan? If you sign up for one of Standard Chartered/ Standard Chartered Saadiq eligible investment or insurance/ takaful product with a minimum monthly payment of RM1,000, you can earn an additional 2% p.a. bonus interest/ hibah on your Privilege$aver – yet another way to automate your savings just by making your monthly payments.

Automatic savings with Privilege$aver

Hopefully, you can see for yourself just how easy it is to get that 6% p.a. returns on your Privilege$aver. After all, we all have salaries to collect and bills to pay each month – it requires little extra effort for you to get those additional bonus interest/ hibah on Privilege$aver.So, make the smart move and switch to Privilege$aver today – find out more on the Standard Chartered website.

Comments (0)