Alex Cheong Pui Yin

7th June 2024 - 9 min read

Malaysians now have as many as three digital banks to choose from, following the official launch of Boost Bank that took place just yesterday. In the only digital bank launch where the Prime Minister attended as a guest of honour (so far), let’s look at the features and benefits that Malaysia’s latest digital bank is bringing to the table.

Boost Bank’s offering is mirrored a lot in its experience of running the Boost e-wallet, one of the pioneer digital wallets in Malaysia that launched back in 2017. In this article, we’ll look at the different aspects of its banking product, including the new membership tiers, savings products and their interest rates, the Boost Bank debit card, and some synergies with the Boost e-wallet and how it unlocks more for the user.

Boost Bank Membership Tiers

Like GXBank and AEON Bank before it, Boost Bank is also offering deposit products to kick things off, namely a savings account and a goal-based savings feature called Savings Jar that offers boosted (heh) interest rates. And, like GXBank and AEON Bank before it, Boost Bank also taps into its existing loyalty programme – in this case, BoostUP.

The Boost Bank membership tier essentially “governs” the user’s banking experience as a whole, which will be made clearer as we elaborate on all of them in this article. The introduction of membership tiers unlock various perks, such as higher deposit interest rates and so on. There are three tiers in total: Boost Basic, Platinum President, and a special Platinum President with Partner Benefits tier.

The biggest perk of unlocking Platinum President tier is the increased interest rates that can be earned on the two savings products on Boost Bank: Savings Account & Savings Jar. The full breakdown of the interest rates will be shared in the next section.

As mentioned earlier, Boost Bank has tight integration with the Boost e-wallet’s BoostUP loyalty programe. In line with this, once a Boost Bank member achieves Platinum President tier, he/she will also automatically unlock Gold General rank on Boost e-wallet, which rewards 3x Boost Stars for every RM1 spent on Boost e-wallet.

Now, let’s look at the requirements to achieve these tiers:

| Boost Bank membership tiers | Requirements |

| Basic | Sign up for a savings account with Boost Bank |

| Platinum President | – Sign up for a savings account with Boost Bank – Deposit minimum RM2,000 to your savings account and/or Savings Jar. Upon doing so for the first time, you will be automatically ranked up to Platinum President. – Maintain a minimum daily balance of RM2,000 for at least 25 days within a calendar month to keep your rank for the next month. |

| Platinum President with Partner Benefits | – Sign up for a savings account with Boost Bank – Deposit minimum RM2,000 to your savings account and/or Savings Jar. Upon doing so for the first time, you will be automatically ranked up to Platinum President. – Maintain a minimum daily balance of RM2,000 for at least 25 days within a calendar month to keep your rank. – Shop with selected partners via Boost e-wallet each month to maintain your interest rate (for additional partner benefits where you can unlock higher interest rates via promos). |

Boost Bank Savings Account & Savings Jars

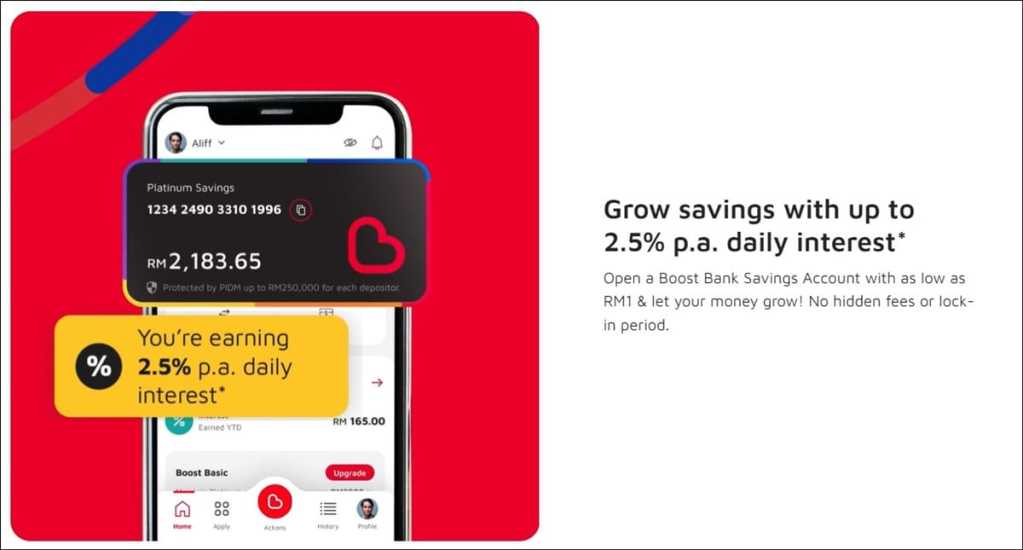

As mentioned earlier, Boost Bank’s current offering consists of the savings account and the Savings Jar. Both products offer returns at a fixed interest rate, with deposits kept in Savings Jar earning a higher rate.

The Savings Jar is a feature that lets you save towards a specific goal with a higher interest rate as compared to the savings account. For Boost Bank, you can create up to eight Savings Jars, with each having its unique target savings goal (from RM1 to RM1 million) as well as the target date. You can even make things more convenient by automating the savings process via auto debit, so that you make recurring deposits at regular intervals to your Savings Jar.

As for the interest rates offered for Boost Bank’s savings account and the Savings Jar, they are different depending on the customer’s membership tier, and here’s the full breakdown:

| Membership tiers | Interest rate for Boost Bank savings account | Interest rate for Boost Bank Savings Jar |

| Basic | 0.5% p.a. | 1.5% p.a. |

| Platinum President | 2.5% p.a. | 3.2% p.a. |

| Platinum President with Partner Benefits | 2.5% p.a. | 3.6% p.a. |

In conjunction with the Boost Bank launch, it has announced a deposit campaign from now until 31 August 2024, where you’ll be able to enjoy 3.6% p.a. interest on your Savings Jars once you hit Platinum President, instead of the default 3.2% p.a.. Note, though, that this campaign has a RM200 million cap on the deposit accepted; once this cap is hit, your Savings Jar deposits will only earn the default 3.2% p.a. daily interest.

We’ve also been told that there will be another, separate Savings Jar deposit campaign that will soon be launched exclusively for those on the Platinum President with Partner Benefits tier. This particular campaign is slated to run from 13 June to 30 September.

Boost Bank & Boost E-Wallet Integration

Beyond the savings account and Savings Jar with upsized interest rates, Boost Bank is also tapping into its consortium ecosystem, mainly on the Boost e-wallet where it has integrated certain functions and features into the e-wallet app, with a goal to convert its e-wallet users into banking customers.

The bank highlighted its “pioneering embedded onboarding journey”, where existing Premium Wallet users on Boost e-wallet can easily open a Boost Bank Basic account from the e-wallet app itself. During the launch event, we were told that this “embedded banking” doesn’t just mean Boost e-wallet users are not required to download a new app and go through another round of eKYC verification, but it also allows access to Boost Bank’s deposit products directly via the Boost e-wallet app.

Furthermore, this integration allows Boost Bank customers to link their Boost Bank account to their Boost e-wallet, after which the funds in their savings account can be transferred to the e-wallet via DuitNow transfer. From there, you can then conduct QR code payments and online transactions nationwide.

Equally important is the integration of Boost Bank’s rewards programme with Boost e-wallet’s BoostUP loyalty programme which we briefly covered in the first section. If you’ve been a regular Boost e-wallet user, you’ll know that the BoostUP programme features three ranks, namely Red Recruit, Silver Sergeant, and Gold General with the following benefits:

As a Platinum President-tier customer on Boost Bank, you’ll be instantly upgraded to Gold General rank on Boost e-wallet, which is normally unlocked by spending RM4,500 over a three-month period.

This is in addition to an upcoming perk where you can enjoy weekly discounts on selected goods if you shop with Boost Bank’s grocery partners and pay using your Boost e-wallet. These include brands like MYDIN, CKS RETAIL Sdn Bhd, FARLEY (KCH) Sdn Bhd, Servay Hypermarket (Sabah) Sdn Bhd, and Boulevard Hypermarket and Departmental Store Sdn Bhd. On top of that, shopping at these partners will also unlock the Platinum President with Partner Benefits tier (though it is not yet known if there’s a minimum spend requirement here).

For your convenience, here’s a visual from Boost Bank to show you the full Boost Bank perks that you can earn according to your tiers:

Serving The Underserved

Boost Bank is one of the few banks in Malaysia that still allow users who do not have an existing bank account to create an account via its digitally onboarding process – in line with its mandate to reach out to the underserved and unserved communities. This is reflected in its account activation process, where:

- Individuals with existing bank accounts can activate their new Boost Bank savings account by initiating a transfer from another bank.

- Individuals without existing bank accounts can declare that they are unable to perform a bank transfer and get a Boost Bank savings account with account balance limitations.

Here are all the limitations that apply for both types of accounts:

Boost Debit Card, PIDM Insurance, And Other Info

As a bank approved by Bank Negara Malaysia (BNM), your deposits with Boost Bank will be protected by the Perbadanan Insurans Deposit Malaysia (PIDM) for up to RM250,000 – the same as all other banks operating in Malaysia.

In terms of security, Boost Bank also adopts several precautionary measures recommended by BNM, including requiring users to bind their accounts to their devices for access control, as well as to have a cooling period for new device logins. The app also offers you the ability to freeze your account in the event of suspected fraud or emergency situations. As an added layer of protection, the digital bank is also supported by a 24/7 fraud hotline that you can contact at +6016 299 9831.

More importantly, a debit card is on its way! Boost Bank has shared that it is looking to roll out its debit card in collaboration with Mastercard in July 2024. In the meantime, Malaysians are invited to help decide on the final design of the card by voting on their preferred card face here; you’ll get to choose between a striking red card and a sleek black card.

That said, there are no immediate plans to enable support for Apple Pay or Google Wallet as of now, as Boost Bank is looking to focus on offerings for micro SMEs, such as lending and financing.

Last but not least, just as Boost has worked on deep integration with the Boost e-wallet as part of its ecosystem play, let’s not forget that Axiata also has CelcomDigi in its portfolio. When Boost e-wallet first rolled out the Beyond prepaid card last year, it was available exclusively to users who were Celcom and Digi subscribers first – it won’t be a surprise to see more exclusive perks between Boost Bank and CelcomDigi in the future.

***

Chief executive officer of Boost Bank, Fozia Amanulla said that as Malaysia’s first homegrown bank, it hopes to continue tapping into Boost’s technological expertise and RHB Banking Group’s legacy to offer more than just banking services, but a financial journey that is seamlessly integrated and accessible. “For us, keeping our users in mind has been the cornerstone that guided every aspect of our user journey design when developing the Boost Bank app,” she stressed.

Boost Bank is backed by the Boost-RHB Digital Bank Consortium, where Boost and RHB hold 60% and 40% equity, respectively. It received official regulatory approval from BNM and the Ministry of Finance to commence operations in January 2024.

Comments (1)

Too many rules on Boost Bank, consumer needs something clear and easy to understand. Look like they have own agenda.